Preferred Citation: Gerlach, Michael L. Alliance Capitalism: The Social Organization of Japanese Business. Berkeley: University of California Press, c1992 1992. http://ark.cdlib.org/ark:/13030/ft5s2007g8/

| Alliance CapitalismThe Social Organization of Japanese BusinessMichael L. GerlachUNIVERSITY OF CALIFORNIA PRESSBerkeley · Los Angeles · Oxford© 1997 The Regents of the University of California |

To my parents

Preferred Citation: Gerlach, Michael L. Alliance Capitalism: The Social Organization of Japanese Business. Berkeley: University of California Press, c1992 1992. http://ark.cdlib.org/ark:/13030/ft5s2007g8/

To my parents

Introduction

Despite their far-reaching consequences-economic and political, domestic and international-surprisingly little is understood about the patterns of interaction that link Japanese companies. Situated between the internal managerial practices of the Japanese firm and the national and international forces that define Japan's macroeconomy and industrial policies, intercorporate relations in the contemporary Japanese economy are marked by an elaborate structure of institutional arrangements that enmesh its primary decision-making units in complex networks of cooperation and competition. Included here are trade associations among firms in the same industries, large-scale business associations that cut across industries, special public corporations jointly invested in and staffed by private companies and state agencies, and overlapping sets of industrial, commercial, and financial alliances. These mediating institutions have in turn shaped and defined the basic characteristics of Japanese market structure and corporate enterprise.

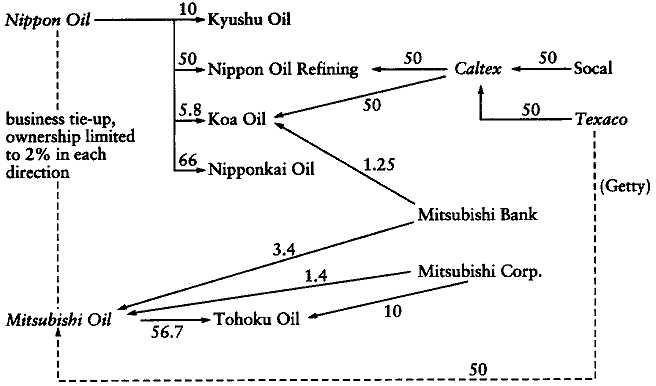

This is a study of perhaps the most distinctive of these institutions, the intercorporate alliance. There is a strong predilection for firms in Japan to cluster themselves into coherent groupings of affiliated companies extending across a broad spectrum of markets: with banks and insurance firms in the capital market, with sogo shosha (general trading companies) in primary goods markets, with subcontractors in component parts markets, and with competitors in new technology development. This pattern is dearest when the dusters have been institutionalized into identifiable keiretsu, or enterprise groups, which include both

the modern descendants of the prewar zaibatsu (family-centered holding companies, such as Mitsubishi and Sumitomo) and elaborate chains of suppliers and distributors dependent on large manufacturing concerns (such as the Toyota and Hitachi groups). As is demonstrated at various points throughout this study, however, intercorporate alliances extend far beyond the most formalized groupings and, in fact, pervade much of the Japanese economy.

Understanding how these networks of cooperation operate and the functions they serve has become increasingly important as discussions have moved beyond the realm of academic debates to those of public policy. The keiretsu and other patterns of intercorporate relationships are now at the center of both criticism and admiration by foreign observers. On the one hand, they are attacked as a significant structural barrier for newcomers in the Japanese market. With the continuation of bilateral trade imbalances even after the dramatic rise in the value of the yen beginning in 1985, preferential trading among Japanese firms is seen by U.S. negotiators as a source of market exclusion that continues to operate even after formal barriers imposed by the Japanese government have been torn down. This perception has been heightened by dramatic but unsuccessful attempts by overseas investors, such as T. Boone Pickens, to gain a significant voice in the internal affairs of several Japanese corporations through the same mechanisms of stock acquisition and takeovers that they have used in the United States. A related concern is that as Japanese firms in the automobile and other industries invest increasingly in the United States, they are bringing over their own affiliated firms as suppliers of parts and capital and thereby excluding American competitors.

On the other hand, and with quite different implications, dose relationships among banks, shareholders, and business partners are also seen as a potential source of Japanese competitive advantage, particularly in channeling the activities of corporate managers in the direction of long-term growth, profitability, and innovation. A number of observers ask whether the traditional public corporation, with large numbers of dispersed shareholders, has not outlived its usefulness. Taking Japan's banking groups as his model, Michael Jensen (1989) writes of "the eclipse of the public corporation" in the West and advocates the increasing privatization of corporate ownership and the replacement of open stock markets with large-block investments by financial institutions that serve as both equity and debt holders in highly leveraged firms. Similarly, in a special supplement on contemporary market capital-

ism, The Economist (May 5, 1990) suggests that Japan's intercorporate shareholding structure may have done a better job than most Western economies of filling the "vacuum at the heart of capitalism" that resulted from the fragmentation of ownership accompanying the rise of the modern corporation. Approaching the issue from a different direction, Charles Ferguson (1990) advocates the creation of "U.S. keiretsu" in the American computer industry as a means of bringing together financial and technological resources now fragmented among venture capitalists, start-up specialist firms, and integrated computer manufacturers in order to compete more effectively with the intercorporate "complexes" that dominate this industry in Japan. Perhaps, then, Japan has created a set of institutional arrangements that improve on the functioning of such basic institutions as corporations and the stock market, and on the ways they work together to promote economic growth?

These issues strike at the basic structure and character of Japanese market capitalism. Indeed, they raise important questions regarding the optimal organization of exchange in any economy. Is discipline through independent capital markets, notably through hostile takeovers and other forms of shareholder control, the most appropriate means of channeling corporate activities to ensure overall economic efficiency? Or are other, less disruptive, mechanisms for disciplining corporate managements more effective? And are impersonal, atomized markets among competitive traders inevitably the best way of coordinating business relationships, especially in a world of increasing scale, complexity, and technological change? Or is cooperation among companies equally important?

There is, of course, no reason why economic systems need to converge to a single form. Even within advanced industrialized societies, significant differences exist in the nature of the corporation and its role in the economy. Addressing these differences requires a detailed analysis of the specifics of market capitalism-notably in the patterns of trade, banking, ownership, and informal communications among firms themselves.

One of the advantages to studying Japan is the precise data, both academic and popular, available for the study of intercorporate relationships. Despite the abundance of materials, however, research is complicated by the variety of alliances that exist and the terminologies employed, by difficulties in defining membership, and by misconceptions concerning their nature and purposes. The assumption is often made that keiretsu and other alliance forms are uniquely endowed institutions with dearly defined boundaries, when the reality more often is blurred

boundaries and overlapping affiliations. For this reason, analysis of specific enterprise groupings must be supplemented by an understanding of the overall intercorporate networks in which they are embedded.

Taking this approach, this study relies on a large-scale new database on important business relationships among large Japanese and large American corporations, described in Appendix A. This database includes information on firms' top-ten shareholders, the amounts of these holdings, and the identity and company affiliations of all outside directors. Data have been systematically coded for a series of key years for the two hundred largest industrial firms and fifty largest financial institutions in both the United States and Japan (see Appendix B for a complete listing). For Japan, information on these companies' top-ten creditors, the amounts of their borrowings, and the identity of their leading trading partners is also coded; this information is not available from published sources for U.S. firms. In the following chapters, these data are used to map the underlying structural characteristics of industrial organization and intercorporate relationships in Japan and compare them with their American counterparts.

The database has several distinctive features worth noting. First, by cutting across major business groupings and including all large, publicly traded Japanese corporations, the database gets away from a problem common in earlier research on enterprise groupings-that of prespecifying membership in groups. Relying instead on overall network data, it becomes possible to derive group patterns empirically, as well as to show patterns that are common among all large Japanese firms. Second, the database is explicitly comparative. Since identical measures are taken from Japan and the United States, it allows for direct comparisons of network structures between the two countries along several variables. Third, the database is longitudinal, facilitating the mapping of the evolution of intercorporate relationships over time and showing patterns of continuity and change. A fourth feature of the database is the broad range of relationships studied, highlighting similarities and differences in structures by market type.

Later chapters utilize this network database to derive a wide variety of original findings and conclusions, among them:

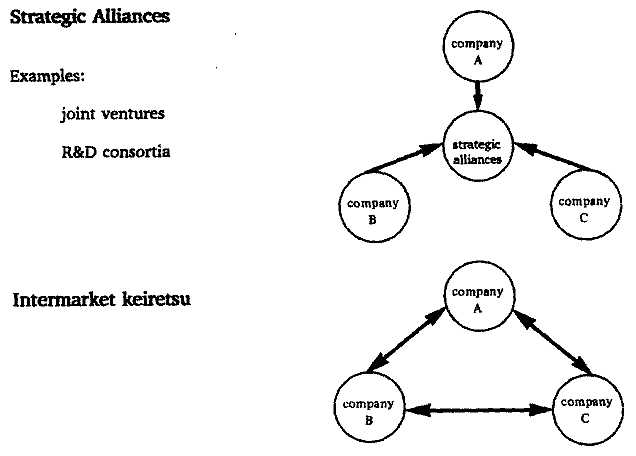

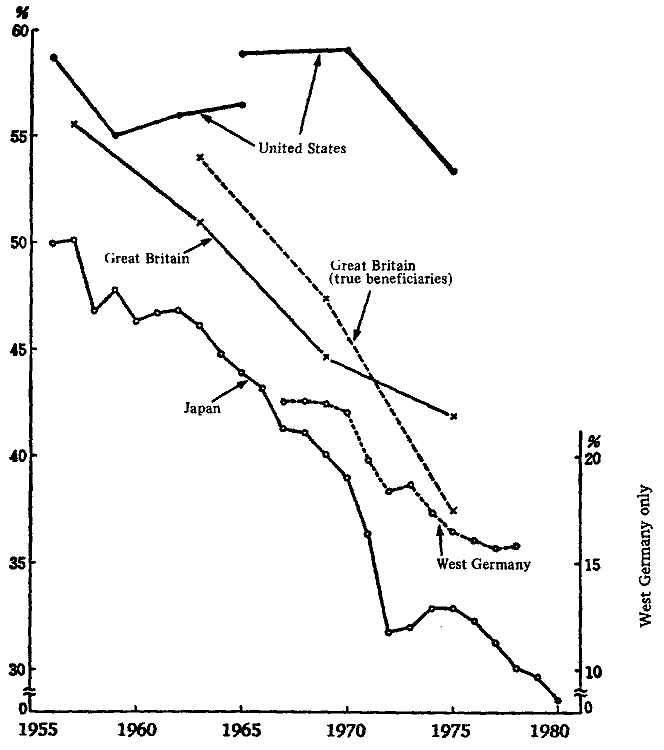

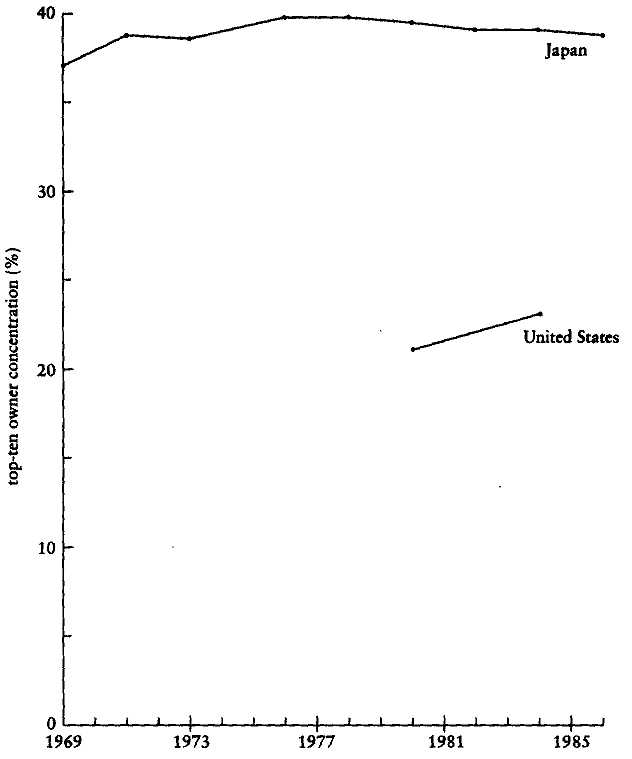

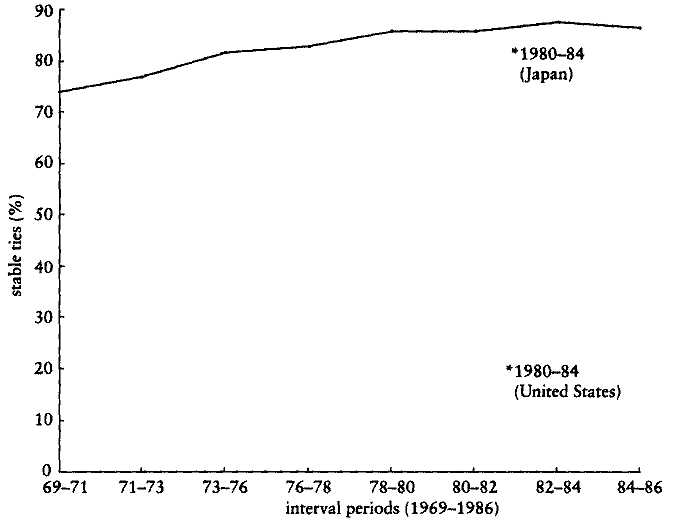

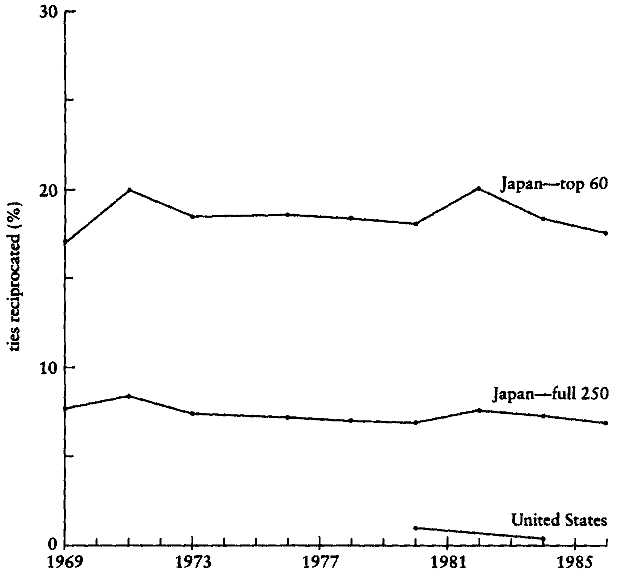

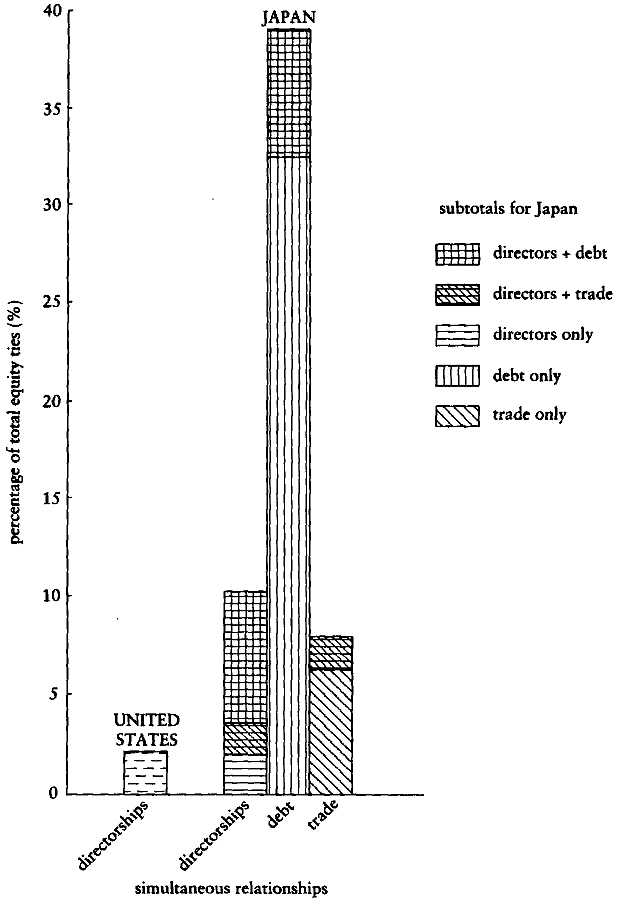

1. Demonstrating that patterns of corporate ownership in Japan differ substantially from those in the United States. Evidence in Chapter 3 shows that corporate shareholding for large Japanese firms is about (a) twice as concentrated as in the United States; (b) four times more

stable; (c) five times more likely to involve simultaneous board positions among the same companies; and (d) seven times more likely to be reciprocated. The significance of these differences in the basic ownership of the firm is covered in detail at many points in this study.

2. Measuring in detail the importance of alliance structures in Japan across a range of relationships and market types. Japanese business networks are shown to be strongly organized by keiretsu across three types of ties (dispatched directors, equity shareholding, and bank borrowing) and more weakly organized in a fourth (intermediate product trade). In all cases but product trade, as Chapter 4 indicates, the proportion of transactions taking place with firms in the same group is over ten times higher than the average with firms in other groups, indicating an extremely strong pattern of preferential trading that clearly has important implications for how we understand the nature of Japanese markets.

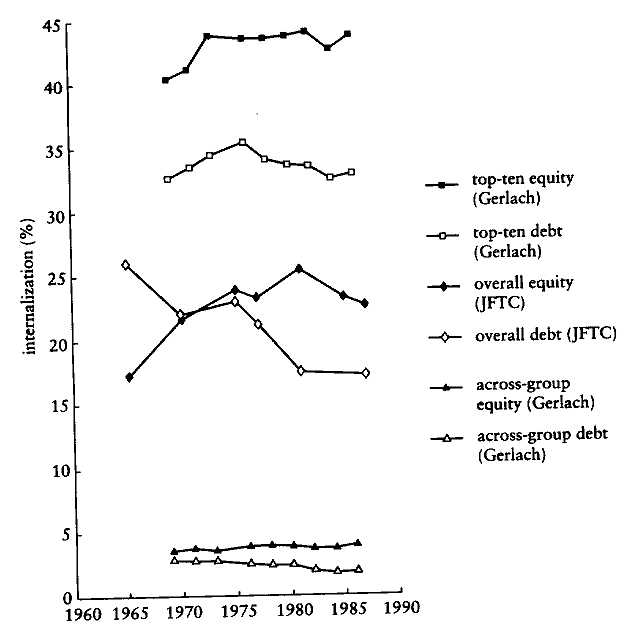

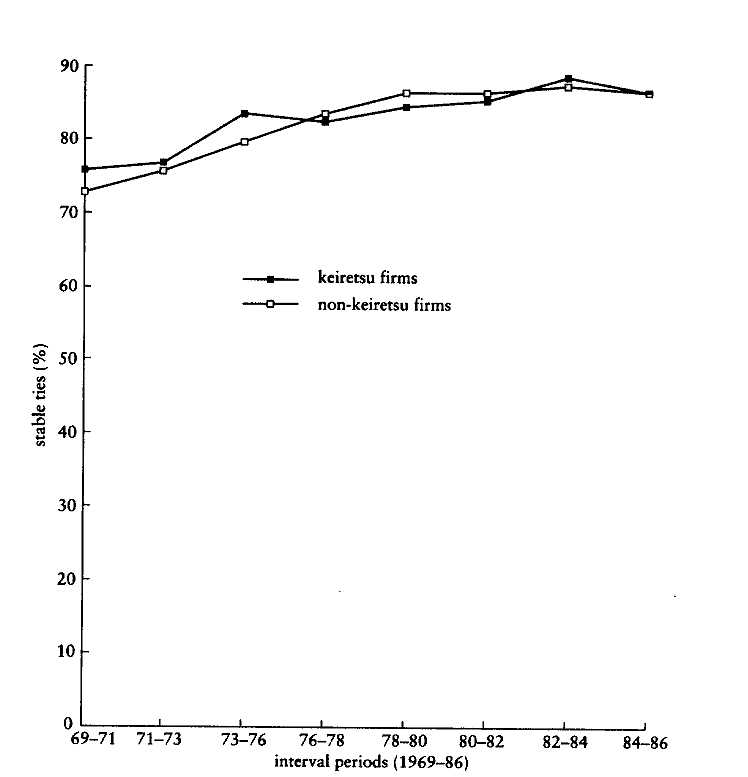

3. Showing how these patterns of preferential trading have persisted over time. Because the database used here extends from the late 1960s into the 1980s, analyses are able to map the evolution of relationships. Contrary to prevailing wisdom, results in Chapter 4 suggest that alliance structures in debt and equity markets have remained largely enduring even with ongoing financial liberalization and other changes in the political and economic environment of Japanese industry.

4. Demonstrating that certain important features of Japanese industrial organization are common to intercorporate relationships among all large Japanese firms. These include stable and reciprocal shareholdings, as well as the linking of transactions across different market types, as indicated in Chapter 5. Alliance forms, therefore, are far more pervasive in the Japanese economy than is commonly recognized.

Overall, these results confirm the existence of alliance structures as a distinctive feature of the Japanese economy and one that continues to thrive into the present day. They also indicate the need for a subtle understanding of these structures, as their importance varies considerably by the type of relationship in question.

Although a variety of alliance forms are discussed in the study, it is the diversified groupings linking major banks and industrial enterprises that receive special attention. The large corporation occupies a central position in industrialized economies, especially in strategic sectors such as finance, basic manufacturing, and international trade. Even in Japan, where the medium-and-small-firm sector constitutes a substantial per-

centage of total employment, it is the large-firm sector that has been the primary source of Japan's finance capital, its imports and exports, and its major technological and organizational innovations (Okimoto and Saxonhouse, 1987; Patrick and Rohlen, 1987). While representing only 10 percent of the industrial firms listed on the Tokyo Stock Exchange, firms formally affiliated with one of the six largest groups constitute over 40 percent of total banking capital and over half of total sales in certain manufacturing sectors (e.g., steel and nonferrous metals). In addition, the fact that the general trading companies affiliated with these groups handle over two-thirds of Japan's imports places these groups in a special role vis-à-vis foreign traders interested in penetrating the Japanese market.

The significance of these firms extends far beyond even these percentages, however. Many large companies that are nominally "independent" maintain looser affiliations with one or more major groups that do not show up in these figures. Moreover, most large companies maintain vast networks of satellite and subsidiary companies that greatly increase their overall influence in the economy. Over half of Japan's medium-and-small-firm manufacturing businesses serve as subcontractors to larger companies, a fraction that has been increasing over time (Aoki, 1987). Toshiba alone has about two hundred related companies (kankei gaisha ) in Japan and below those another six hundred "grandchild companies" (mago gaisha ). Success of the parent firm brings with it increased business for other firms in the parent's network of affiliates, while the failure of a Toshiba, Toyota, or Hitachi would bring down an entire network of dependent enterprises.

Japan's large-scale, diversified groupings also introduce important conceptual issues that prove instructive in understanding distinctive features of Japanese capitalism. Whereas the vertical groups that comprise upstream supplier firms and downstream distributors introduce at the interfirm level some of the characteristics one associates with standard hierarchical organization (notably a degree of centralization of product-related decision making, which is managed by the parent firm), the intermarket groups are less easy to classify. They represent informally and loosely structured "network organizations" among relatively equally sized firms located across diverse economic sectors. Although the financial role of these groupings is most often emphasized, this function coexists with the commercial and industrial activities of member companies in an elaborate structure of relationships across multiple markets. When reinforced through cross ownership, these patterns define strategic control of the overall "core" of the Japanese economy.

Somewhat confusingly, Japanese terminology is vague on the distinctions among different types of groupings. The direct Japanese translation for "enterprise group" (kigyo gurupu or kigyo shudan ), is oftentimes used to refer to the major intermarket groupings centered on large commercial banks, but it is also sometimes used by companies in discussing their own family of satellite operations. Toyota Motor Corp., for example, defines the Toyota Group as fourteen key companies, most of which were spun off of the parent company at some point in the past (e.g., Nippondenso and Toyota Autobody). Perhaps as a result of this terminological variation, some academic writers in Japan have taken to coining their own words to describe these forms, among them "intermediate organizations" (chukan soshiki ), following a markets and hierarchies formulation, and "networks" (nettowaaku ) (see, for example, Imai, 1989a).

In recognition of the increasing familiarity of the term, I shall refer to both the vertical and diversified groups as "keiretsu." Although not all observers agree with this usage, the fact is that the term is broadly used in Japan (e.g., in the standard datasource, Keiretsu no kenky u ). I have added the modifier "intermarket" where necessary in order to differentiate the diversified groupings that are the main focus of the discussion from their vertical counterpart. Others have referred to these groups as "horizontal" keiretsu because of the similar size and status of their members. This terminology follows directly from the Japanese (yoko keiretsu ), but it introduces a degree of confusion in English, where "horizontal" typically refers to relationships among competitors in the same industry. These groups have also been termed "financial" keiretsu because of the important role played by commercial banks. However, as suggested above, and again in later chapters, this term defines affiliations rather narrowly and ignores the role played by trading companies and direct business transactions among industrial participants.

These particular groupings fall under the larger category of intercorporate alliances. The variety that alliance forms exhibit and their interaction are introduced in Chapter 1 and discussed at various points in later chapters. Whatever terminology is chosen, it is important to recognize that individual keiretsu groupings represent stylized portrayals of what are actually intricate and overlapping patterns of ties among Japanese companies.

Quantitative analyses of large-firm networks are reinforced at many points by historical and archival works, interviews, and other ethnographic materials. In order to protect the identity of the executives interviewed, individual names have generally been omitted. Where pos-

sible, company names have been kept. These interviews were carried out primarily in the mid- and late-1980s. While the executives were often quite frank about what they perceived as the advantages and disadvantages to their companies of different kinds of external alliances, it was sometimes in the interstices surrounding the formal interviews that the most interesting discoveries were made. Perhaps the following example best illustrates this.

I observed in my company rounds an ongoing competition that I took to calling "the beer wars." When I was invited to the company lounge for an after-hours beer at one of the companies where I was interviewing, the brand was invariably that of the group brewery-Asahi at Sumitomo, Kirin at Mitsubishi, or Sapporo at Fuji. Several managers commented that they always ordered their group brand when they were out in public and drank their personal favorite only at home. Thus did intergroup rivalries filter down to the day-to-day level of Japan's corporate managers, making evident the intensely localized way in which these rivalries are sometimes manifest.

This competition has a history going back decades. The first group affiliate was Kirin Brewery, which had been a prewar member of the Mitsubishi zaibatsu. (Even today, one can only find Kirin beer at one's local Meiji-ya, a supermarket chain with a long history of relationships with Kirin and the Mitsubishi group.) In the 1960s, Sapporo began cultivating closer relationships with the Fuji group, so when Sapporo held its ninetieth anniversary in 1966 it used the Fuji Bank headquarters. All core Fuji group companies at the time were invited and the Fuji Bank president opened the ceremonies with a toast, saying, "From now on let's celebrate the end of the year with Sapporo Beer" (quoted in Kameoka, 1969, p. 97). Sapporo the following year became a charter member of the Fuji group's newly formed presidents' council, the Fuyo-kai. Similarly, Asahi Breweries began moving toward the Sumitomo group in the 1960s, and these relationships became considerably closer in the 1970s as a result of Sumitomo's rescue of Asahi from various financial troubles. In response to these shifts, Japan's fourth and last-place brewery, Suntory, has been over the past decade in the process of developing closer ties with the Sanwa group. The comments by the president of Sanwa Bank a number of years ago are worth quoting, as they make evident the importance of business reciprocity in alliance relationships:

As part of our good partnership policy, our bank has initiated a highly successful campaign to promote sales of Suntory beer and whiskeys among Sanwa group member companies. Suntory's shares of the market have increased significantly in the areas where our bank's offices are located. My

favorite restaurants also have come to always stock Suntory beer and whiskeys. Many of Sanwa group companies, moreover, have switched to Suntory beer and whiskeys as a result of our "Drink Suntory" campaigns. The rise in Suntory's share of the domestic beer market in spite of the exceptionally unfavorable weather conditions this summer can largely be accounted for by our campaigns. Suntory, on its part, urged its employees to deposit their summer allowances with Sanwa Bank and the campaign also proved to be a big success. This type of mutually beneficial accommodation and exchange of territories, managerial know-how and clients is what we call good partnership, a true way of attaining maximum co-prosperity. [Quoted in the Oriental Economist, September 1982.]

ACKNOWLEDGMENTS

Over the years in which this project evolved, I have benefited From perhaps even more than the usually broad set of supports-financial, logistical, intellectual, and moral-that any author requires. It is impossible to acknowledge everyone who had some kind of impact on the final outcome, but I would like to mention at least a Few of these people and institutions.

Financial support for field research was made possible through the Henry Luce Foundation, the Japan Foundation, and the Japan Society For the Promotion of Sciences. Data collection and analyses used in the quantitative portions of the study were provided through Funding From the University of California Pacific Rim Program and the National Science Foundation. Creation of the basic database was greatly facilitated by the skillful research assistance of Christina Ahmadjian, Joan Boothe, Frank Freitas, Peggy Takahashi, and a team of data coders at Berkeley. Joseph Chytry and Patricia Murphy were instrumental in completing figures and tables. In addition, congenial environments for writing and additional Forms of support were provided by the Center for Japanese Studies in Berkeley and the Institute of Business Research at Hitotsubashi University in Tokyo. Finally, the Haas School of Business at the University of California has been unusually generous in allowing me time away From campus to complete the project.

Tangible and intangible intellectual stimulation has come From many colleagues and Friends. While some must remain anonymous, others do not. Special thanks in Japan are owed to Arai Yoshitami, Goto Akira, Imai Ken-ichi, Kojima Hiroshi, Matsui Kazuo, Nonaka Jiro, Nakamoto Satoru, Nakano Mutsuji, Okumura Akihiro, Okumura Hiroshi, and Ueda Yoshiaki. Among the many people who provided critical comments on earlier drafts of the book and various papers related to it were Paul DiMaggio, Mark Fruin, Mark Granovetter, Robert Harris, Takeo

Hoshi, David Mowery, Charles Perrow, Woody Powell, Vladimir Pucik, Mark Ramseyer, Tom Roehl, Michael Schwartz, David Teece, David Vogel, and Oliver Williamson. Two other individuals merit special mention for carefully reading the entire manuscript in earlier forms-Hugh Patrick and Kozo Yamamura. In addition, my colleague Jim Lincoln has been a great source of intellectual stimulation at Berkeley over the past several years as we have collaborated in developing these ideas and expanding the database in new directions.

No study would be completed without the support of friends and family. Among the many who deserve credit, Mary Dean Lee, Rumi Kanesaka, and especially Laurie Freeman were instrumental in instilling and maintaining my interest in Japan and in the project. Finally, my family, and most specially my parents, have been a continual source of support, even during those long stretches when I was in hibernation with my word processor and a nonexistent correspondent.

NOTE ON JAPANESE USAGE

An attempt has been made to conform as closely as possible to usage in the original source. Japanese personal names are given in the customary Japanese order, family name first, where the work is published in Japanese and in the Western name order where it is written in English. Macrons are used only for Japanese-language works. Company and place names are written without macrons.

Words that appear frequently in the text (keiretsu, zaibatsu, sogo shosha) are only italicized the first time they appear. Some of these, of course, have already entered the Western lexicon.

Chapter I

Overview

We make our destinies by our choice of gods.

Virgil

The postwar global economy has witnessed what by any standard is an extraordinary reordering. That this has involved competition not only among companies and countries, but also among economic systems, was long apparent when considering the centrally planned economies of Eastern Europe. Ironically, with the dramatic decline of these economies has come an increasing recognition more recently that "market capitalism" is itself no monolithic system. Important institutional characteristics of its contemporary American variant-for example, hostile takeovers, leveraged-buyouts, and other aggressive mechanisms for transferring corporate control-are largely unknown in most European or Asian economies. The patterns of relationships among corporations and other key external actors (financial institutions, government organizations, industrial associations, labor groups) need not be and often are not identical across these economies.

Nowhere are the distinctive characteristics of market capitalism more directly challenged than in the economies of East Asia. With the emergence of Japan and its more recent successors has come the realization that economic development is not the prerogative of countries with a European ancestry. More controversial has been the viewpoint that these economies reflect underlying institutional arrangements to deal with the problems of economic growth that are both different in focus and, in certain respects, more effective in results than their counterparts in other industrial societies. The dynamism now observable in this region was not always so obvious, of course: when President Lincoln's secretary of

state, William Henry Seward-perhaps the U.S.'s first great partisan of the Pacific Rim-tried to build a bridge between the United States and Asia by purchasing Alaska from Russia, there was widespread doubt about Asia's capabilities; an article in the San Francisco Chronicle at the time said that Alaska would be the place where "Young America brisk and spry, shakes hands with Asia withered and dry."[1] But this earlier backwardness only makes the transformation since then much more striking.

Among this select group of aggressively expanding economies, Japan's economic success has been the most extensive and sustained. Japan now serves as a major trading partner in the global economy, as a model of economic development (especially for the NICs, or Newly Industrializing Countries), as a competitive challenger in frontier industries, and, more recently, as the world's largest net creditor nation and active investor in overseas markets. Moreover, it has accomplished this while successfully overcoming three major hurdles during the postwar period: first, the devastation of the war; second, the oil shocks of the 1970s; and third, the doubling of the value of the yen against the dollar since 1985.

This remarkable growth and resiliency raises fundamental questions concerning the nature of Japan's own form of market capitalist economy. Put starkly: is Japan's performance primarily the result of the effective harnessing of fundamental economic forces within the same market capitalist institutions as exist in other advanced economies, as some writers have suggested (e.g., Patrick and Rosovsky, 1976; Abegglen and Stalk, 1985)? Or has Japan crafted new institutions or transformed preexisting institutions in ways so basic that they bring into question the belief in the inevitable convergence toward a single, universally rational form of economic organization, as others have suggested (e.g., Dore, 1986; Johnson, 1987)?

These questions are extraordinarily important not only to our understanding of Japan but to more general models of successful economic organization, development, and growth. The answers have proved elusive partly because Japan continues even now to be a country that is only vaguely familiar to most Westerners. Perhaps more important, however, has been the theory gap between our conceptual understanding of economic organization and the application of this understanding to real-world economies. As Murakami and Patrick (1987, p. xxii) point out in their introduction to the first volume of the Political Economy of Japan trilogy:

In the short run it may be possible m isolate and analyze certain phenomena on the assumption that nothing else changes, but in the longer run one must take into account an intricate web of complex interactions between economic, political, social, and cultural forces and structures. However, social science has yet to develop generally accepted, comprehensive analytical frameworks that are operational.

How best, then, to understand this "intricate web of complex interactions"?

JAPANESE BUSINESS NETWORKS AND THE KEIRETSU

This study tackles this issue by focusing on the network of alliances among the major corporations that make up the Japanese economy. Intercorporate alliances, as defined here, are institutionalized relation. ships among firms based on localized networks of dense transactions, a stable framework for exchange, and patterns of periodic collective action. As a form of economic organization, they are distinct from both ideal-type bureaucratic organizations, on the one hand, and ideal-type market organizations, on the other. The organizational model is neither that of Alfred Chandler's "visible hand" nor that of Adam Smith's "invisible hand"-neither the solid structures of formal administration nor the autonomously self-regulating processes of impersonal markets- but of hands interlocked in complex networks of formal and informal interfirm relationships.

In the traditional model of formal organization, actors are linked under a common, unified hierarchy. This command structure is designed to ensure high degrees of control over a limited set of exchanges among a prespecified set of actors. Actors within this structure subject themselves to the restrictions imposed by an authority relation (Simon, 1937) and the organization's internal decision-making machinery (William-son, 1975, 1983). No such unity of command exists in alliance forms. Whether operating through specific institutional arrangements, such as joint ventures, or through more loosely coupled structures, such as informal business groupings, alliances preserve a relatively large degree of formal decision-making independence for their initiating organizations. At the same time, relationships among alliance partners differ from the impersonal, arm's-length markets of textbook theory in that the identity of actors and the history of their relationships are important

considerations in actual patterns of trade. Whereas perfect competition implies "social atomization" (Granovetter, 1985) among economic actors-temporary exchanges of convenience among faceless traders- alliances represent coherent dusters of preferential exchange among traders often linked together over the course of decades. In summarizing the distinctive features of Japanese industrial organization, we may point to five general tendencies. Although none of these is unique to Japan, what distinguishes Japan from the United States (which perhaps lies at the other extreme of the transactional continuum) is their pervasiveness and continuing visibility. These defining tendencies are:

1. Affiliational ties. Transactions often take place through alliances among affiliated enterprises, creating a vast sphere of economic life intermediate between anonymous markets and vertically integrated firms.

2. Long-term relationships. Intercorporate relationships in their ideal form are stable and long-term, relying on diffuse sets of obligations extending over time.

3. Multiplexity. Transactions tend to be overlapping, with equity investment and personnel interlocks used to consolidate financial, commercial, and other business ties.

4. Extended networks. Bilateral relationships are set in the context of a broader family of related companies.

5. Symbolic signification. Active efforts are made to infuse intercorporate relationships with symbolic importance, even in the absence of formal, legal arrangements or contracts.

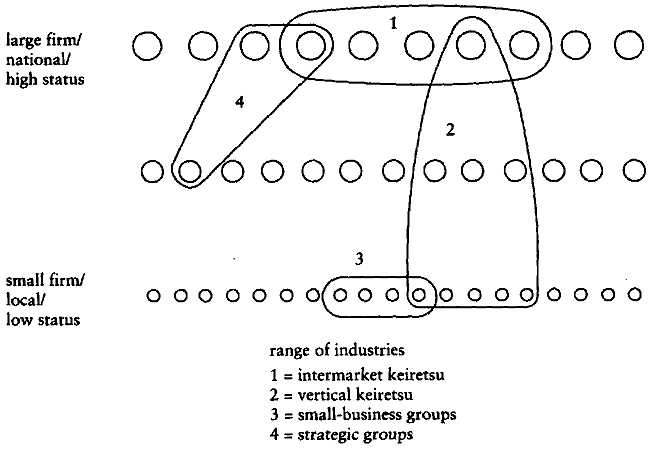

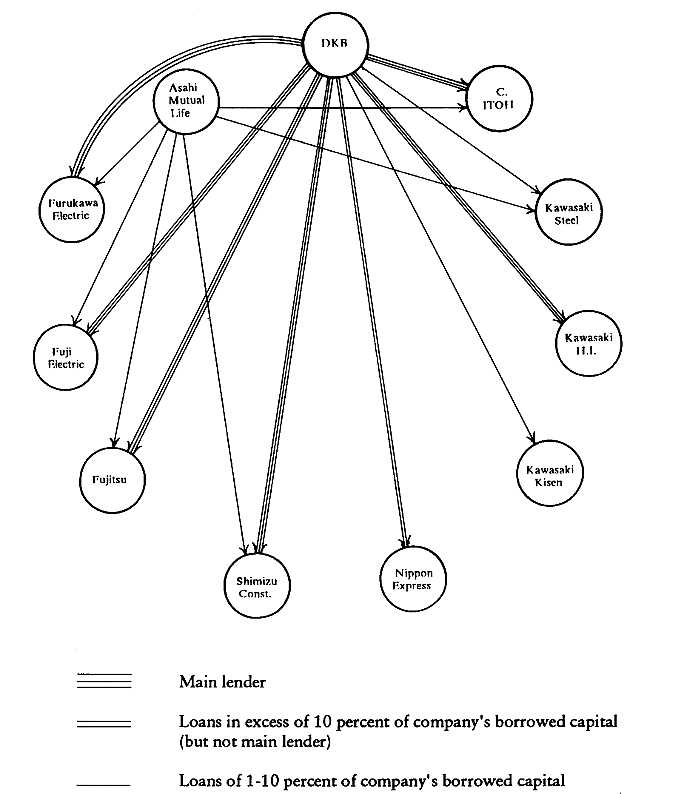

Networks of business relationships in Japan are most evident when they become institutionalized into identifiable keiretsu. The keiretsu are of two distinct, though overlapping, types. The vertical keiretsu organize suppliers and distribution outlets hierarchically beneath a large, industry-specific manufacturing concern. Toyota Motor Corp.'s chain of upstream component suppliers is a well-known example of this form of vertical interfirm organization. These large manufacturers are themselves often clustered within groupings involving trading companies and large banks and insurance companies. The six major groups in Japan comprise three historical alliances directly linked to the former zaibatsu of Mitsui, Mitsubishi, and Sumitomo, and three banking groups centered on Fuji, Sanwa, and Dai-Ichi Kangyo. These large clusterings, the intermarket keiretsu, provide for their members reliable sources of loan

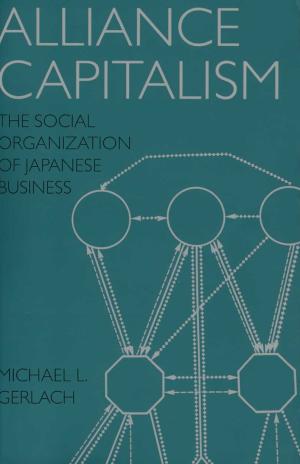

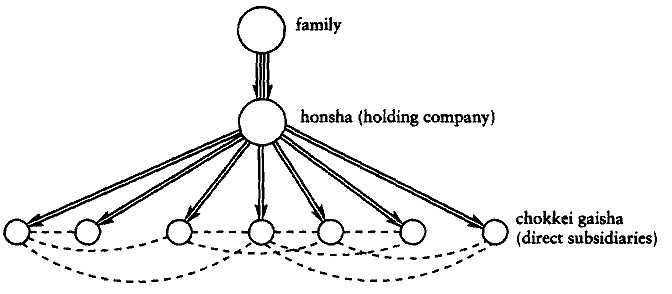

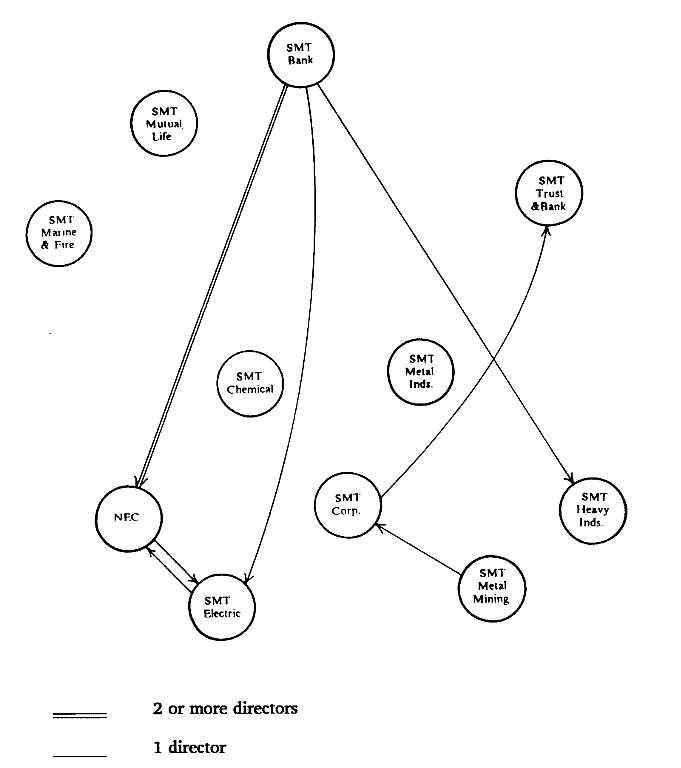

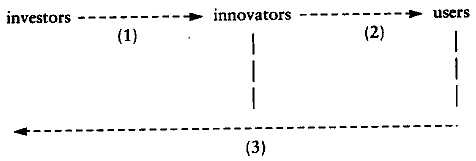

Fig. 1.1. Debt, Equity, and Trade Linkages in the Keiretsu.

capital and a stable core of long-term shareholders. Moreover, like the vertical keiretsu, they establish a partially internalized market in intermediate products. A basic schematic of linkages within and between the vertical and the intermarket keiretsu is shown in Figure 1.1.

However, it is important to recognize that these are only the most formalized of a wide variety of different cooperative groupings that dominate the Japanese industrial landscape. The keiretsu should be seen as a metaphor for general patterns of interfirm organization in Japan-

as an ideal type in interfirm networks marked by the five characteristics outlined above. As we see in the core empirical chapters, these characteristics are pervasive throughout Japanese industrial organizations (although often varying in precise form). Intercorporate relationships within the most formalized keiretsu therefore share many characteristics with those among ostensibly more independent firms. The alliance terminology captures more flexibly the overlapping richness of these relationships than terminologies based in bounded notions of enterprise groups. For the sake of convenience and consistency with other studies, "keiretsu," "enterprise group," and related terminologies will continue to be used at various points in the chapters that follow; but the loosely coupled sense in which they are interpreted here should be kept in mind.

ARE ALLIANCE FORMS A GLOBAL TREND?

The proliferation of complex new forms of strategic alliances in the United States, the European Community, and elsewhere raises the issue of just how different Japanese patterns of intercorporate relations really are, and whether we are not seeing an international movement toward convergence in organizational practice. The popular and business media have been noting this trend since at least the early 1980s, as suggested in the following reports:

1. In the United States, according to Business Week, Silicon Valley has taken the lead in crafting the new rules of competition: "Putting the customer in charge of product design is forging new, tighter relationships between chip suppliers and users. No longer will a sale be just a pact between peddler and purchasing agent; instead, it will require the involvement of engineering staffs and, often, of managements" (May 23, 1983). As part of this "new spirit of cooperation" (January 10, 1983), "Even if they do not acquire each other outright, the various computer, communications, and semiconductor companies may end up aligning themselves through joint ventures, investments, and cooperative deals" (July 11, 1983).

2. In response to international competition, new forms of cooperation have emerged in Europe as well. The New York Times (August 21, 1989) reports, "Governments and companies across Europe are teaming up on a large and fast-growing number of projects aimed at making Europe a more formidable competitor for the United States and Japan."

The scale of these projects is increasingly grand: "France, West Germany, Britain and 10 other nations are building a space shuttle at a cost of $4.8 billion. Airbus Industrie, a four-nation consortium, has become the world's No. 2 passenger aircraft manufacturer, behind Boeing. And Europe's three leading semiconductor companies, Philips of the Netherlands, Siemens of West Germany and SGS-Thomson, a French-Italian joint venture-have teamed up on a $5 billion program that aims to build the world's most advanced computer chips."

3. Similarly, as the Japanese economy moves toward global operations, complex new international alliances are being formed, reshaping the nature of competition in entire industries. A Japan Times article on automobile alliances stated a number of years ago (April 4, 1983): "Trends toward the development of a truly global auto industry demonstrate that Japanese car firms and their U.S. and European counterparts are beginning to recognize that the very survival of the world auto industry depends on cooperative integration of limited resources and technical skills. Faced with meeting energy conservation standards and shifting consumer demands, the auto industry is expected to become streamlined and increasingly interdependent, characterized by shifting alliances and intensified cooperation."

Is Japan, then, at the forefront of a global movement toward complex new forms of cooperation and alliance? A variety of researchers have argued that such a movement is indeed under way, as companies search for solutions to the problems of economic organization that simultaneously avoid the shortcomings of the traditional corporate hierarchy, which introduces a host of different costs related to bureaucratic distortions and inertia, and of arm's-length markets, which fail to adequately protect parties in the kind of complex, information-based exchanges that characterize many contemporary business activities. (See, for example, Piore and Sabel, 1984; Miles and Snow, 1987; Powell, 1987; Johan-son and Mattsson, 1987; Eccles and Crane, 1987; Jorde and Teece, 1990.) If so, this represents a significant trend in the evolution of the industrial structure of advanced societies.

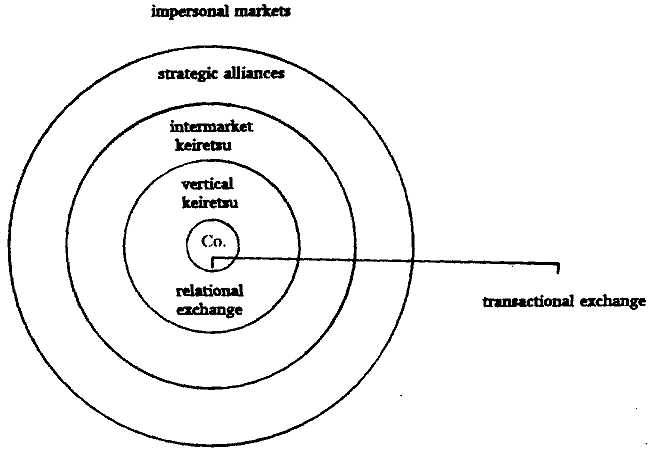

Nevertheless, important differences remain among forms of intercorporate alliance, especially when comparing the strategic alliances characteristic of emergent industries in Silicon Valley and elsewhere with keiretsu relationships among large Japanese enterprises. Strategic alliances create a framework within which companies are able to cooperate in a set of specific business activities, such as the developing of new

technologies. With rare exceptions, however, they do not alter greatly the relationships those companies have directly with each other, their own shareholding structure, or the basic strategic constraints under which they operate.

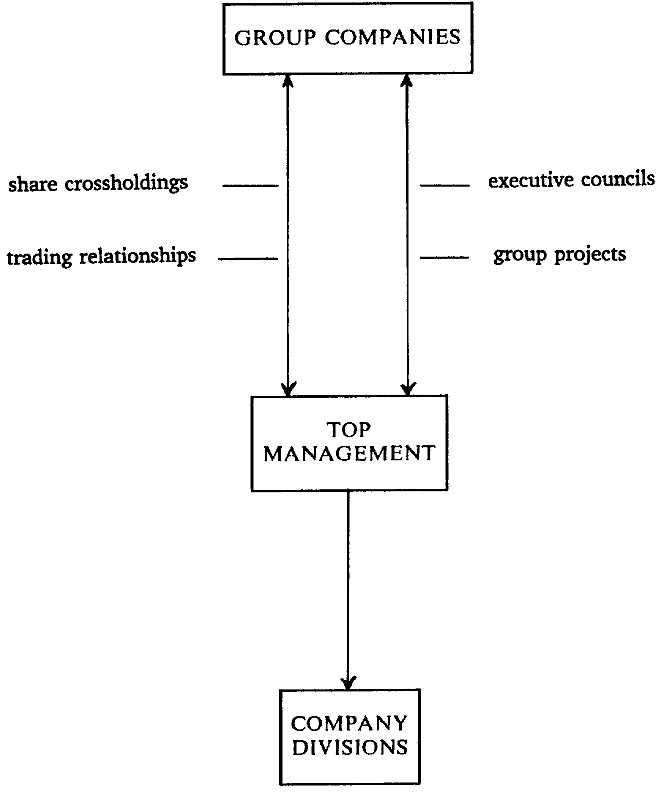

Japan's major business groups, in contrast, comprise direct and indirect linkages among banks, industrial firms, and commercial enterprises that shape a complex web of interests affecting the company as a whole. They engage a wide variety of activities by opening up sources of capital flows between banks and corporate borrowers, setting a framework for the exchange of raw materials and intermediate product trade, and providing a forum for the informal exchange of information. Most important, they define, through patterns of share crossholding and business-linked equity investment, the underlying ownership structures of their participants-those actors who are assigned ultimate control over the basic decision-making apparatus of the company through the formal mechanisms of corporate control.

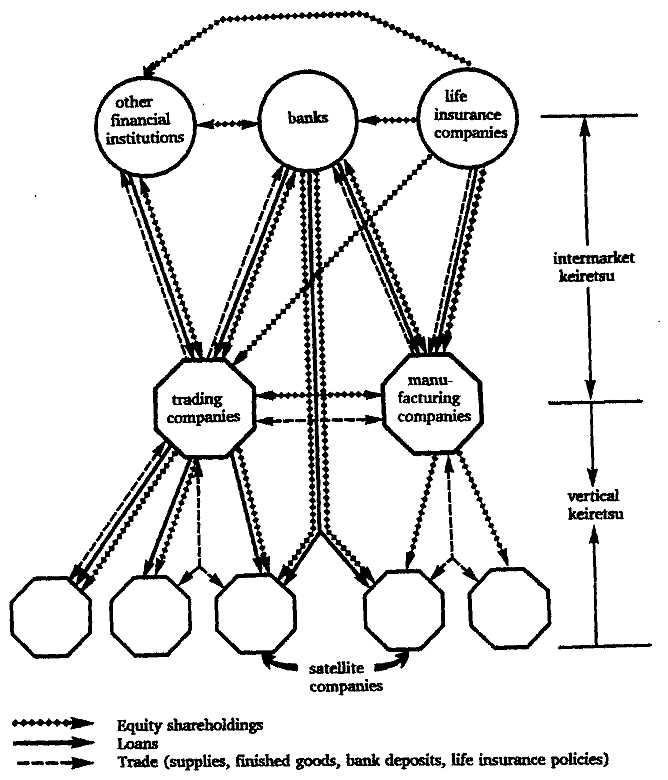

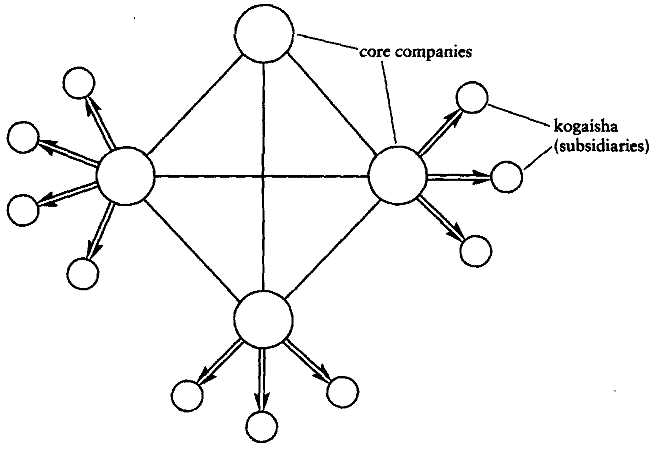

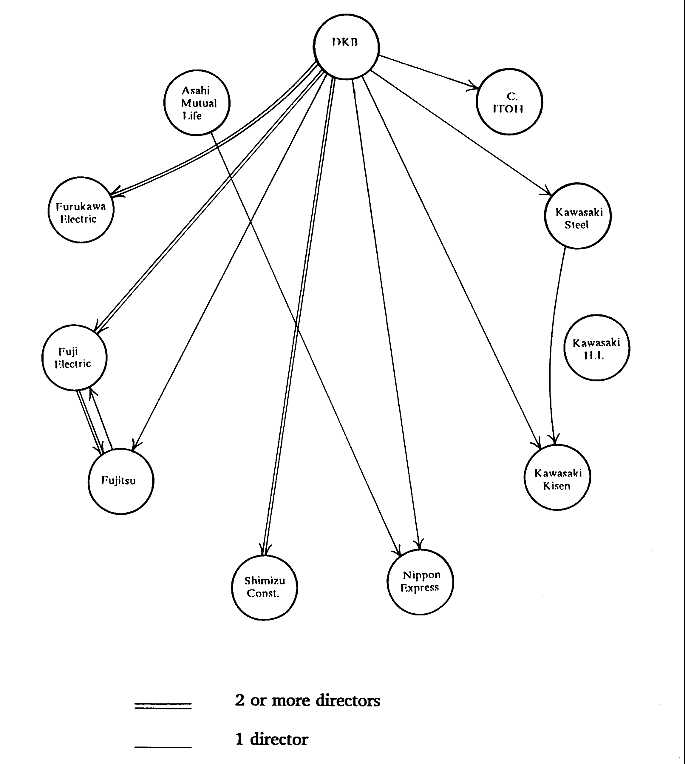

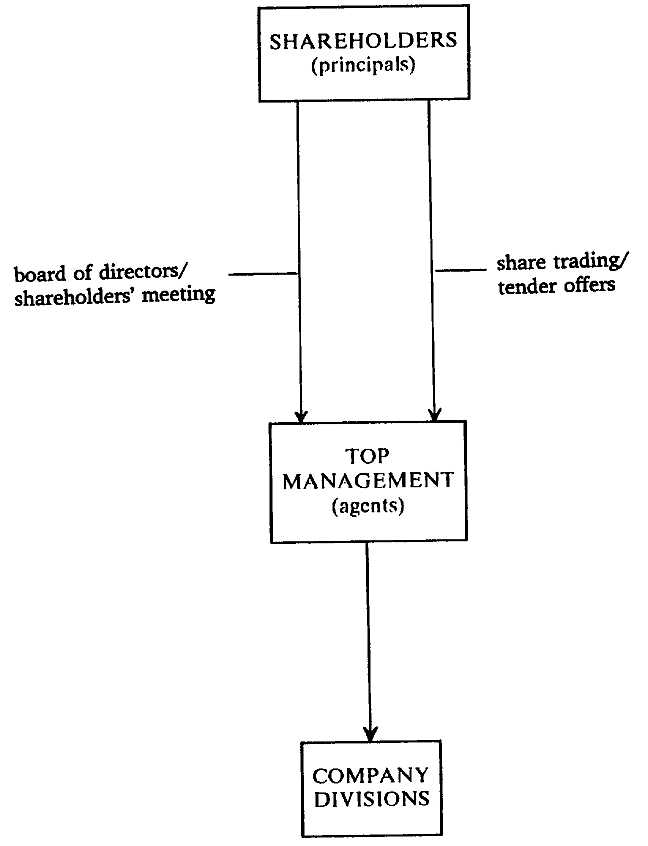

This distinction is depicted schematically in Figure 1.2. The strategic alliances that companies craft with competitors and other firms represent a set of focused activities that, while possibly important in the aggregate, do not affect the core integrity of the companies themselves because they are primarily outward-directed and limited in scope. They may be used to help develop new products, exchange technologies, or open up promising markets, but other ongoing business activities among the companies are generally circumscribed and overall corporate strategies are unlikely to be significantly altered.

Not so when a Japanese company's network of ties with its own intermarket keiretsu affiliates is disrupted. Ties to other large manufacturing, trading, and financial firms define basic constraints on the entire corporation: the access it has to capital, the kind of industries it is likely to move into, and the locus of ultimate control over their formal and informal decision-making processes. Should these affiliated enterprises choose, they are able to exercise substantial clout in constraining the management of their members, for they represent a complex nexus of reciprocal interests.

This distinction, of course, is not absolute. Large Japanese companies frequently engage in strategic alliances for technological or market development with the same companies that are their core intermarket affiliates. In this case, their core affiliations help to predetermine the extent of interaction likely to take place among these firms, and this in turn shapes the patterns of cooperation that emerge in the areas of

Fig. 1.2. A Schematic Representation of Strategic Alliances and Intermarket Keiretsu.

business-specific technological and market development. In addition, these firms often take partial equity positions in vertically linked suppliers and distributors that serve business-specific interests for the parent company but represent, in conjunction with high levels of trading dependency, the corporate-wide interests of the supplier or distributor firm.

For this reason, even relatively straightforward distinctions, such as those between vertical and intermarket keiretsu, are rarely this clearly differentiated in practice. Many of the firms constituting the major postwar groupings were themselves at one time vertically linked spin-offs from the zaibatsu. In addition, vertically related firms are often brought into the banking and other relationships that their parent companies maintain with the intermarket groups, indicating that bilateral relationships must be viewed in the context of broader families of relationships.

EARLIER STUDIES OF JAPAN'S ALLIANCE STRUCTURES

The study of enterprise groupings and intercorporate relationships in Japan has evolved in a number of important ways since the 1970s.

Eleanor Hadley's milestone Antitrust in Japan (1970) provides what remains among the most complete analyses of Japan's postwar bank-centered groupings and the impact of the dissolution of the prewar zaibatsu. Hadley writes as someone with long knowledge of her subject, having been involved in early postwar Occupation economic reforms. This background also shapes her perspective, for the main question addressed is whether Japan has recreated in modified form the institutions that the Occupation forces had set out to abolish. Hadley concludes that Japan's postwar groupings are dearly of a different type than the zaibatsu, though loose affiliations remain as a result of Japan's historical legacy.

Also viewing Japan's contemporary business groupings through the lens of industrial organization and its antitrust implications are Richard Caves and Masu Uekusa in their study Industrial Organization in Japan (1976). Although addressing a broader range of topics than Hadley, Caves and Uekusa reach similar conclusions regarding the lack of apparent cohesion in the postwar groupings and the difficulty of unified coordination of the kind evident in the prewar period. Their careful empirical analyses do not provide much support for their preferred interpretation of business groups, which is based on market power: the groups do not appear to produce increased concentration, to suppress competition, or to create monopoly profits for group members. Like Hadley before them, Caves and Uekusa are somewhat baffled by just why these groupings exist, although they point to the possibility that the groups might be serving the interests of their constituent banks at the expense of other group firms.

A number of the most finely detailed empirical studies of enterprise groups have been carried out by researchers in Japan. Futatsugi (1976) and Miyazaki (1976) both include systematic quantitative treatments of groups using extensive databases on patterns of share crossholding and other relationships among several hundred major Japanese corporations. A more institutionally oriented perspective is provided in Okumura's (1983) analysis of Japan's six largest bank-centered groups. Okumura presents a wide range of interesting examples of how group processes work in practice and compiles evidence from a variety of sources on the impact of these groupings on the Japanese economy. Both Okumura and Futatsugi emphasize in these and other works (e.g., Okumura, 1975; Futatsugi, 1982) that business reciprocity and intercorporate shareholding are common features throughout Japanese industrial organization and not simply limited to the most visible groupings. This

important observation captures a fundamental feature of Japanese capitalism, discussed at greater length in the following chapter and reinforced empirically in various portions of this study-the difficulty of separating capital markets from other business interests that firms have in one another.

As the Japanese economy continued to outperform those of its industrial competitors, the 1980s saw an increasing shift in emphasis toward economic efficiency as an explanation for a wide range of business practices. Just as Japanese personnel practices, such as permanent employment and seniority-based pay and promotion systems, came to be viewed less as legacies of Japan's cultural past and more in terms of conscious rationality in an economy where labor stability and human capital investments are highly valued (e.g., Koike, 1983; Aoki, 1988), so too has economic efficiency, in a variety of guises, emerged as a leading explanation for Japan's enterprise groupings. This shift in thinking has been facilitated by the simultaneous emergence of new approaches to the economic study of organization, discussed in the following chapter.

Among the first writers to take a transactions costs approach to economic exchange and apply it to enterprise groups was Akira Goto (1982). Goto argues that, by organizing collectively, companies are able to avoid the scale diseconomies and the control losses likely in full-scale vertical integration, and at the same time to provide benefits not available in unprotected market exchange. The market mechanism, he notes, "might not be an effective device to trade information because of the characteristics of information as a good, such as strong externalities and the difficulty of appropriation, and because of the ineffectiveness of such institutions as the patent system and the resale prohibition of information" (pp. 61-62). As an alternative to market exchange, business groups serve as a kind of "information dub" designed to improve information-sharing among member firms. Close cooperation can in this way be "secured by a set of tacit, informal rules that emerge through a long history of exchange of information and recognition of interdependence, substantiated by financial linkages and interlocking directorates" (p. 61).

Further developing the perspective that enterprise groups represent an efficient hybrid between impersonal markets and internal organization are Ken-ichi Imai and his colleagues (see, e.g., Imai, 1982, 1989; Imai et al., 1982; Imai and Itami, 1984). Viewing markets and organizations as alternative modes of exchange, Imai argues that these modes can coexist within a single organizational form, with enterprise groupings a representative example. In the process of "interpenetration," these groupings

simultaneously introduce organizationlike properties in markets (creating a degree of coordination of otherwise-independent companies) and marketlike properties in organization (through a higher level of competition than is common within firms). In explaining the origins of these groupings, Imai adds the useful insight that transactions costs need not be fixed or common; instead, they reflect the relative costs of markets and organizations in any economy. Among the constellation of distinctive factors that exist in Japan is the prevalence of internalized labor markets, which puts pressures on firms to minimize their own size and rely instead on external sourcing through reliable intercorporate relationships in order to ensure stable employment for their core workers (Imai and Itami, 1984).

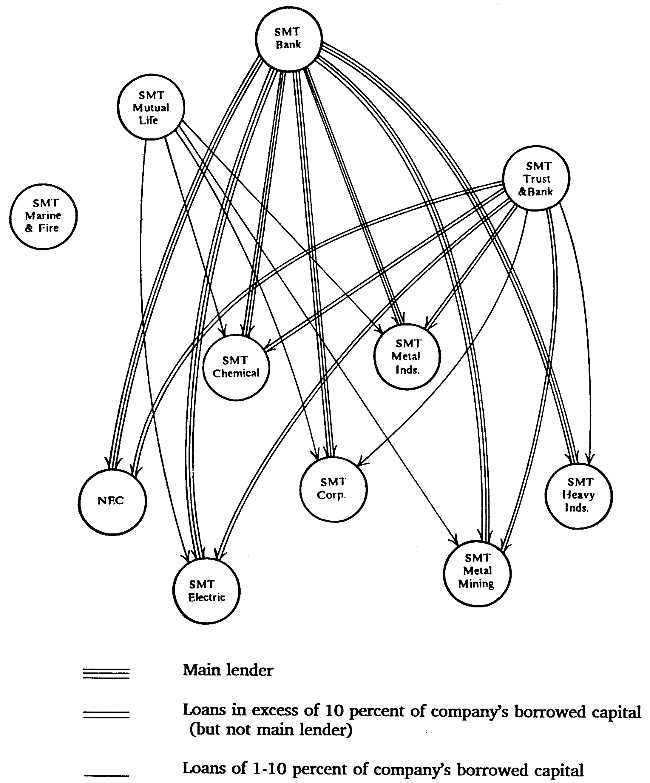

Efficiency-oriented explanations of Japan's distinctive industrial organization have been applied as well to the study of specific sets of exchanges common within enterprise groups, including those between general trading companies and industrial firms (Roehl, 1983) and those between financial and nonfinancial firms. Special attention has been paid recently to the distinctive role of commercial banks in Japan's capital markets. Using theoretical developments in the economics of financial intermediation, Horiuchi, Packer, and Fukuda (1988) suggest that banks' primary function comes from the creation and integration of costly information on borrowers that is not available to the stock market. Long-term transactions between banks and corporate borrowers improve this information, they argue, resulting in the emergence of "main bank" relationships in Japan in which a lead bank uses its inside information both to provide loans directly to companies and to send signals to other banks on a company's soundness.

Additional evidence for the view that bank-oriented financing creates effective channels of capital allocation in Japan has been provided in a series of empirical studies by Takeo Hoshi and his colleagues (Hoshi, Kashyap, and Scharfstein, 1990a, 1990b, 1990c). Observing that banking relationships are central to the intermarket groups, these researchers explore the possibility that companies with well-defined keiretsu relationships have better access to capital because of the quality of the information obtained by banks. They find that firms with close group affiliations do indeed improve their access to capital.[2] They also find that these banking ties are a better explanation of whether cash flow predicts investment than several standard stock-market indicators.[3] They con-dude from this that the intertwined nexus of information and capital flows marking enterprise groupings has created an institutional structure in which Japanese firms can take on higher levels of debt financing with

lower levels of attendant risk than their counterparts in America, where debt is relatively diffusely held and bond financing is more prominent (Hoshi, Kashyap, and Scharfstein, 1990c).

A different perspective on the efficiency properties of enterprise groups has also received considerable recent attention. Studies by Nakatani (1984), Aoki (1988) and Sheard (1991) argue that the primary function of bank-centered enterprise groups is to spread risk among their members. This hypothesis points to the distinctive features of Japanese labor markets, notably the high levels of firm-specific capital that are associated with internal labor markets and the resulting absence of markets for managers and skilled workers. These conditions expose Japanese workers to severe risks and encourages managers to stabilize their external business relationships and to create implicit insurance arrangements with other companies should their companies face financial difficulties.

An influential source of empirical support for the risk-sharing hypothesis is Nakatani's study of several hundred large firms listed on the Tokyo Stock Exchange. In a series of regression analyses, Nakatani finds that rates of profitability and sales growth tend to be somewhat lower for firms classified as keiretsu companies, but so too is the variability in these rates. Nakatani interprets these findings as a confirmation of the view that enterprise groupings represent "an implicit mutual insurance scheme, in which member firms are insurers and insured at the same time" (p. 243). More recent studies have extended risk-sharing models theoretically and empirically from the study of enterprise groups as a whole to their various component linkages, including those between creditors and clients (Osano and Tsutsui, 1986; Sheard, 1986), manufacturing firms and subcontractors (Kawasaki and McMillan, 1987), and trading companies and industrial firms (Sheard, 1989).

Unlike the transactions costs explanation, the risk-sharing hypothesis makes no prediction of enhanced performance for Japanese firms that are clearly identified with one of the major keiretsu, since the main rationale is seen to be the buffering of companies' internal labor markets. This is not necessarily inefficient, however. To the extent that workers and managers have large stakes in the firms for which they work, it may be desirable to offer them protection for forms of human capital (e.g., knowledge of how to get things done in a particular factory) that are not transferable elsewhere. In addition, as Nakatani suggests, there may be benefits from the increased stability in company performance that are captured in the form of increased macroeconomic stability, even if not measurable in improved firm-level profitability.

Although most of the research on alliance structures in the Japanese

economy has been carried out by economists, one notable exception has been the work of sociologist Ronald Dore. In his well-known article "Goodwill and the Spirit of Market Capitalism" (1983) and in several books that followed (1986, 1987), Dore points out that transactions costs in market exchange can vary with the patterns of social and economic relationships characterizing different countries. For Dore, it is the durability of Japanese intercorporate relations and their quasi-moral character that is most striking. The basic principles of relational contracting in Japan, as he sees them, are the sharing of losses in bad times and gains in good times, the recognition of each partner's role in the relationship, and the avoidance of using one's positional superiority to gain advantage.

Unlike the writers discussed above, Dore emphasizes that distinctive cultural features may be important in explaining Japanese industrial organization,' seeing these patterns as modern-day manifestations of traditional Japanese notions of social obligation manifested through the ritual reenactment of well-established relationships. Thus, whereas specific patterns of who may trade with whom may be recent, "what are entirely traditional . . . are, first, the basic pattern of treating trading relations as particularistic personal relations; second, the values and sentiments which sustain the obligations involved; and third, such things as the pattern of mid-summer and year-end gift exchange which symbolizes recognition of those obligations" (1983, pp. 464-65).

Dore acknowledges the possibility that short-term allocative efficiency is sometimes lost in the course of maintaining these relationships. Nevertheless, like other proponents of risk-sharing models, he believes that these costs have been offset overall by long-term advantages flowing from the Japanese economy's adaptability to the ongoing processes of restructuring inevitable in industrial evolution: "[r]elational contracts, in this interpretation, are just a way of trading off the short-term loss involved in sacrificing a price advantage, against the insurance that one day you can 'call off' the same type of help from your trading partner if you are in trouble yourself" (1983, p. 470).

STRUCTURES, STRATEGIES, AND INSTITUTIONS: AN INTERDISCIPLINARY APPROACH

This study builds on this prior research, as well as taking it in a variety of new directions, both empirically and theoretically. In the chapters that follow, an approach to the understanding of Japan's business networks and enterprise groupings is developed that is broadly interdisciplinary.

This is the product of a belief that the institutions of modern market capitalism-the intercorporate alliance no less than the corporation or the stock exchange-are the result of a continuing unfolding of overlapping economic, political, and social forces. No single explanation is sufficient, therefore, to cover the wide range of forms or specific patterns of alliance now found in the Japanese economy. The structure of intercorporate relations as it actually exists in Japan is far too intricate, precisely conceived, enduring, and pervasive to be understood solely in terms of single-factor explanations (be they market power, economic efficiency, or cultural determinism). To ignore the interaction among diverse forces, therefore, is to lose important elements in our understanding of the nature and consequences of Japanese industrial organization.

Although interdisciplinary, several strong preferences in the explanation of economic organization will nevertheless become apparent. The first is an orientation toward structural (or network) analysis. This reflects a shift in attention toward complex relationships among actors not wholly derivable either from the aggregation of individual actors (as often assumed in microanalytic economic models) or fully internalized attitudes, norms, and values (common in many culturalist explanations of Japanese economic organization). Methodologically, special attention is placed on the study of concrete structures of relationships that actors forge to facilitate exchange relationships, and especially on intercorporate (as opposed to corporate-level) data. The second, related to the first, is that economic actors view their relationships in essentially strategic terms. This implies that rational action is an intended goal of Japanese corporations. But rationality for any given company-hence, the ultimate criterion by which its actions must be evaluated-is defined not by optimization within a single market or industrial sector (e.g., maximization of profit, sales growth, or employment stability) but across a nexus of interests in the different markets (capital, industrial, and labor) on which it is dependent. Third, intercorporate relationships are set in an institutional context that, on the one hand, shapes the range of options that Japanese firms face when making strategic decisions and, on the other, leads to path-dependent business activities that transcend immediate rationality to include the distinctive histories that the partners bring to their relationships.

The Structural Analysis of Intercorporate Relationships

Ina structural approach, concrete networks of exchange become the main unit of analysis, and the focus shifts toward the way specific

patterns of interaction emerge and the implication of those patterns for social and economic behavior and performance.[4] Insofar as corporations are the key decision-making bodies in contemporary industrial economies, understanding the patterns of their relationships to other companies becomes an important source of information about their behavior. A "fully structural view," as Mizruchi and Schwartz (1987, p. 3) point out, is one in which "an organization is viewed as interacting with its environment-molding as well as being molded by it-and in which the structure of relations-rather than individual organizations-is the unit of analysis."

This is based in two assumptions. The first is that, in contrast to earlier managerialist theories, in which the modern corporation is seen as largely self-contained and immune from external influence, corporations are instead understood to be strongly affected by other actors in their environment. Managers are constrained, in varying degrees, from acting solely on their own or their organization's interests by their banks and shareholders, trading partners, regulatory agencies, and other external constituencies. Second, and more recently, the organizational environment itself becomes an important phenomenon for study through the analysis of concrete structures of relationships making up the intercorporate network. Associated with this perspective is the belief that economic transactions are not simply decomposable into bilateral transactions, but are organized into complex relationships in which the characteristics of actors' strategies cannot be fully derived from their actions vis-à-vis each dyadic (transactional) linkage.[5]

The recognition that the corporation is subject to external constraint is consistent with the emerging view of the Japanese firm as a constellation of multiple internal and external interests, developed most completely in the theoretical work of Aoki (1984c, 1988). But a structural perspective shifts attention to the level of intercorporate relationships themselves as a major focus of interest in explaining the behavior of firms and their economic performance.

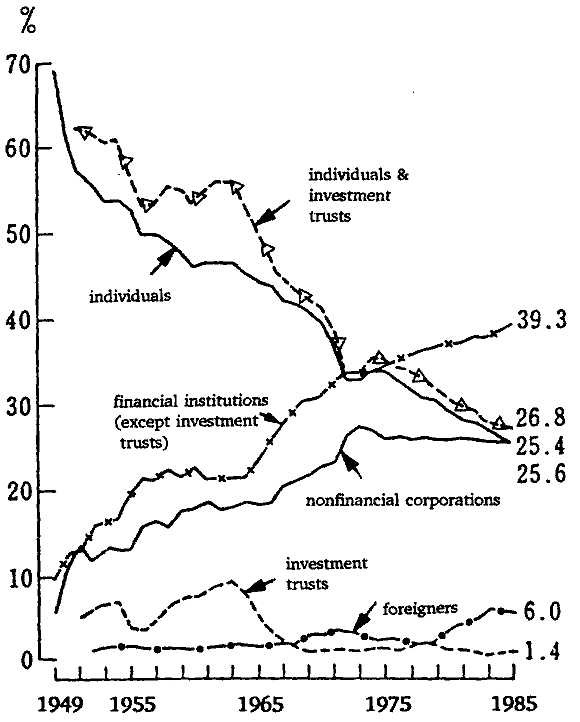

This difference at times becomes important, as when considering issues such as the changing relationships among financial and nonfinancial corporations in Japan, a subject taken up in Chapter 4. A number of writers have suggested that there has been a decline in the role of bank-centered groups during the period from the 1970s to the late 1980s, based on firm-level data showing a shift among large firms from debt- to equity-based financing (e.g., Aoki, 1988; Hoshi, Kashyap, and Scharfstein, 1990a). If we focus instead on the intercorporate flow of capital

and the structure of relationships between capital investors and capital users, the impact of this shift becomes far less dear. Equity-based financing continues to be provided largely by the same financial institutions as the debt capital that it is replacing. In contrast to the assumption, based on traditional definitions, that this represents a movement from "indirect" to "direct" financing, an analysis of the actual flow of funds suggests instead that this is essentially a shift from one form of mediated financing to another. The financial institutions that had earlier channeled capital between household savers and corporations through the loan market continue to serve the same function, only now by buying those companies' new securities issues.[6]

This gradual change in financing methods might have great significance if the financial institutions behaved quite differently as purchasers of securities than they do as financial lenders-for example, by becoming unstable stock market investors rather than stable lead banks. However, the analyses in later chapters indicate that equity ties among financial and nonfinancial companies, much like debt ties, continue to be structured in long-term relationships that reflect a complex set of strategic interests among the parties involved-not a movement from administered to impersonal market transactions. As a result, the effects of this shift in the form of financing on the nature of keiretsu-based relationships remains unclear without further substantiation based on the analysis of the concrete patterns of relationships among the firms involved.

This suggests the limitations of studying intercorporate structures from the point of view of data at another (e.g., firm or macroeconomic) level, and reflects the need to improve the empirical record on which the discussion of alliance forms is based. Important comparisons have been left implicit in most previous studies-among them, the differences between patterns of relationships in Japan and those in other countries; between types of relationships (e.g., equity ownership vs. intermediate product trade); between patterns in contemporary Japan relative to those several decades earlier; and between firms with strong group affiliations and those without.

The database used in this study shows that preferential product market trading among affiliated companies in Japan remains very high between general trading firms and some intermediate producers, but is generally much lower when consumer-oriented manufacturers are involved-a fact of importance in assessing the significance of the keiretsu for market access in Japan. The consequence of alliance structures for interlocking directorate positions is mixed, with the density of linkages

among companies quite low, as a result of the small number of outside directors on the boards of large Japanese firms, but the likelihood extremely high that the linkages that do exist are with other companies in the same intermarket group.

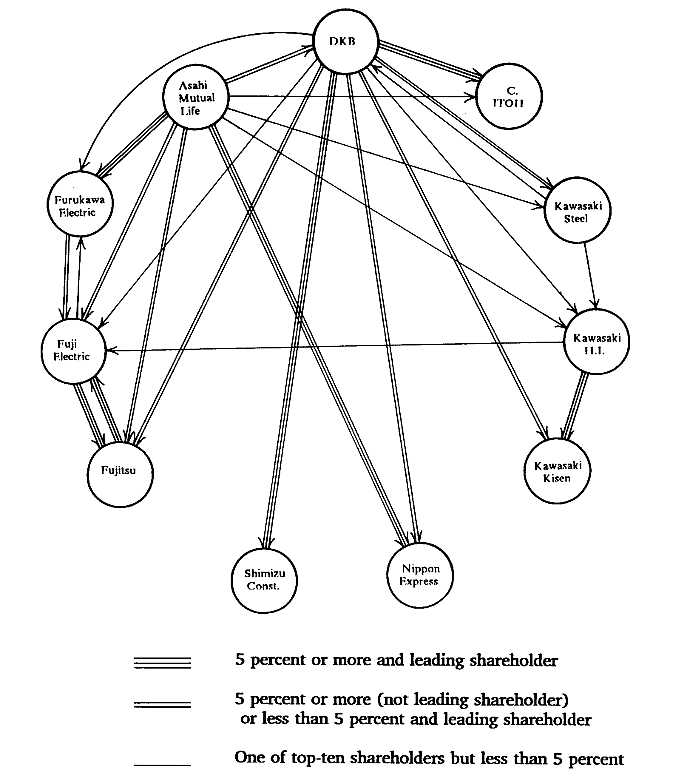

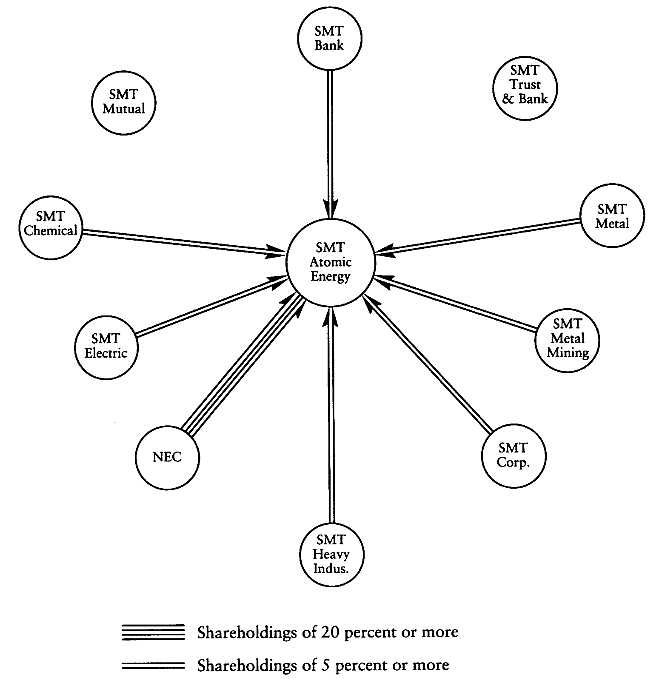

The pattern of interlocking shareholding, on the other hand, proves to be, if anything, far more important than is generally recognized, a fact that takes on added significance given the increased role for equity-based financing in recent years. Although it is true that the total equity held by affiliated group companies in a typical firm averages "only" 15-30 percent, this ignores two important facts. The first is that many of the shareholders not included in these figures are linked structurally through reciprocal and strategic shareholding positions with the firm, although not formally identified in the same keiretsu. Most large Japanese firms have well over half of their total equity controlled by stable shareholders with a variety of business interests in the company, and in the case of some firms, such as commercial banks and other financial institutions, this figure is over 90 percent. The second is that both affiliated and unaffiliated intercorporate investors are disproportionately represented among firms' leading shareholders. When we look only at the top-ten shareholders, the share of total stocks controlled by companies in the same group rises to over 25 percent in all major intermarket keiretsu and over 50 percent in the older, zaibatsu-based groups. Since these strategic shareholders are the ones best able to create voting coalitions if needed to influence management policy, their influence extends substantially beyond what the raw percentages would indicate.[7]

This factor relates to another of the conclusions of this study: that alliance patterns based on strategic and stable equity crossholdings, as well as reciprocity in trade and financial relationships, are prevalent throughout Japanese industrial organizations and are not limited to the most formal intermarket groupings. The high degree of institutionalization of these network structures points to the need for understanding the contextual and historical forces that have promoted their development in Japan, and also argues against the viewpoint that Japanese industrial organization is rapidly converging toward a "Western" model, as some have suggested.

The similarity in certain important network patterns also helps to explain why empirical studies of the impact of these relationships based on their classification into discretely dichotomized groups (e.g., as keiretsu or non-keiretsu firms) have generally provided mixed results.[8] To the extent that large Japanese firms and the networks of intercorporate

relationships they maintain share many characteristics-the product of long histories going back to the prewar period for the great majority of these companies-it is not surprising that performance outcomes flowing from these structures also tend to converge on common patterns.

Chapter 5 reviews these studies and provides new analyses of the sources of Japanese company profitability. In keeping with the findings in several other studies, these results demonstrate small but statistically significant differences in profitability, with firms in clearly defined keiretsu relationships showing lower returns than firms with more loosely defined affiliations. However, these differences are also shown to relate to a number of other characteristics of the companies, most notably to a firm's overall pattern of ownership and banking relationships. These results indicate that corporate performance results from a complex set of considerations beyond keiretsu affiliation itself, and indicate the need to refine analyses of the relationship between network structure and economic outcomes.

The Strategic Linking of Complex and Overlapping Interests

A second characteristic of the approach taken here reflects the belief that economic actors view their relationships from what is fundamentally a strategic vantage point. The alliance terminology conveys the seemingly paradoxical combination of intensive, instrumental maneuvering among corporations for economic advantage and the reality that long-term cooperation is often the best way to pursue those interests. It has a well-established position in the vernacular of political science and anthropology in a way that closely approximates its characteristics in contemporary Japanese industrial organization: an important function of alliances (whether among countries, kinship units, or business corporations) is to serve as a means of creating reliable sources of critical resources and long-term external linkages through which their members are able to carry out their day-to-day activities.[9]

A strategic orientation recognizes that actors consciously seek to improve their own economic and social positions. The emergence of cooperative groupings of firms in Japan is not simply a reflection of culturally determined patterns, for this misses the importance of conscious institutional design in the process and the belief by actors themselves, however well justified, that their interests are being served. Culturally preexisting forms may provide useful "tools" from which to craft new arrangements (Swiddler, 1986), but these tools are utilized by actors

to further their own interests and are not simply digested in whole. As Granovetter (1985, p. 486) points out, culture "not only shapes its members but also is shaped by them, in part for their own strategic reasons."

A strategic orientation also implies a second consideration, underappreciated in single-factor explanations of Japan's enterprise groupings. The complexity of the contemporary corporation, the diverse resources on which it is dependent for its survival, and the varied markets it serves have resulted in an equally elaborate structure of networks in which it must maneuver in order to operate successfully. Rational action in this context is defined by optimization not within individual markets but in the company's overall position across a set of interrelated markets.

Theories of intercorporate risk sharing and managerial protection rightly point to the vulnerability of Japanese managers and workers resulting from the prevalence of permanent employment systems in large firms and the lack of an effective midcareer market for managers and skilled workers should their companies fail. In this context, close ties among banks and other companies with implicit agreements for mutual assistance provide important risk-sharing advantages for employees. Share crossholdings offer further protections by creating a stable coalition of shareholders that will vote with management in the event of a dissident shareholder movement or hostile takeover attempt and by providing a reservoir of buffer capital that can be disposed of if necessary in emergencies.

Capital-monitoring models capture a different part of this reality by emphasizing imperfections in the market for investment capital and their resolution through the use of financial intermediaries. Japanese household savers face special problems, including generally poor public-domain accounting information and weak protection by boards of directors that are dominated by inside management. This has led them to rely on banks as investment specialists. Bank-company alliances help to overcome these problems by improving both the quality of information available to investors and the ability of those investors to discipline company managements effectively.

However, it is important not only that alliance structures provide a form of implicit insurance against company failure, protect Japanese managers from hostile outsiders, or facilitate access to capital through improved information flows and governance capabilities, but also that each of these benefits is offered by business partners and financial institutions with which the company is linked in long-term, strategic relation-

ships. Consider the diverse interests involved in two key components of the intermarket groups:

1. Japanese commercial banks' relationships with their corporate clients include not only receiving substantial loans from the bank, reinforced by equity positions as well as special assistance during times of financial distress, but also (a) managing loan consortia involving other banks; (b) handling a variety of fee businesses from the client, such as foreign exchange transactions; (c) negotiating and financing mergers and acquisitions involving the client; (d) helping the client to find business partners; (e) providing loans to the client's affiliated suppliers and distributors; and (f) managing the savings accounts of the client's employees, whose wages are automatically transferred to the bank.

2. Trading companies provide a broad range of services for their clients in addition to directly handling domestic and international transactions, including (a) negotiating and writing trade contracts; (b) extending trade credit; (c) hedging exchange rate risks; (d) transporting and storing materials; (e) integrating complex projects; and (f) providing a variety of consulting services related to political, economic, and social conditions in host-country markets.

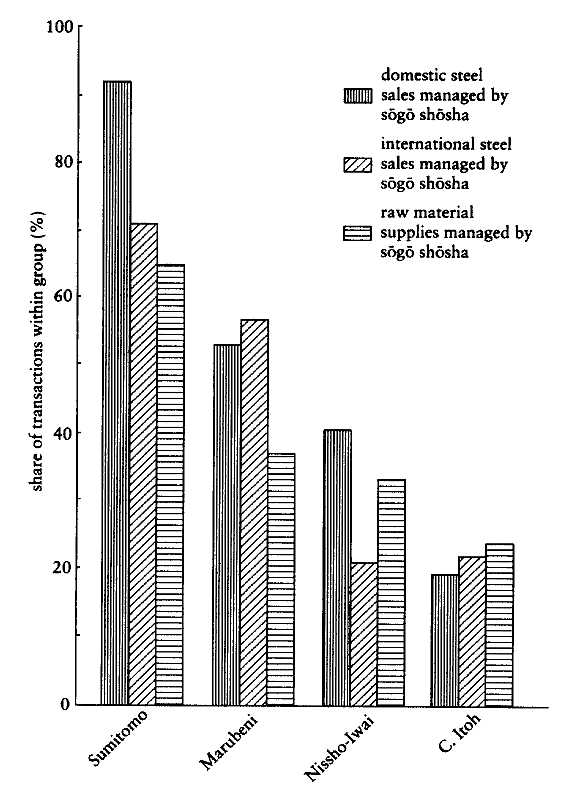

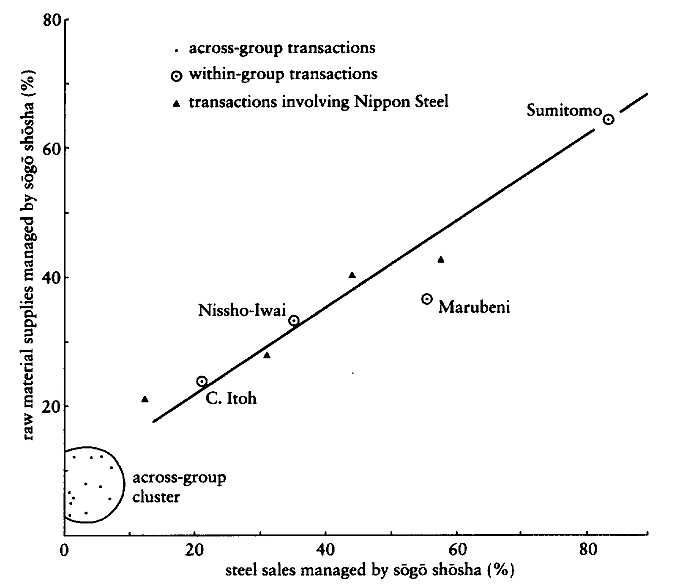

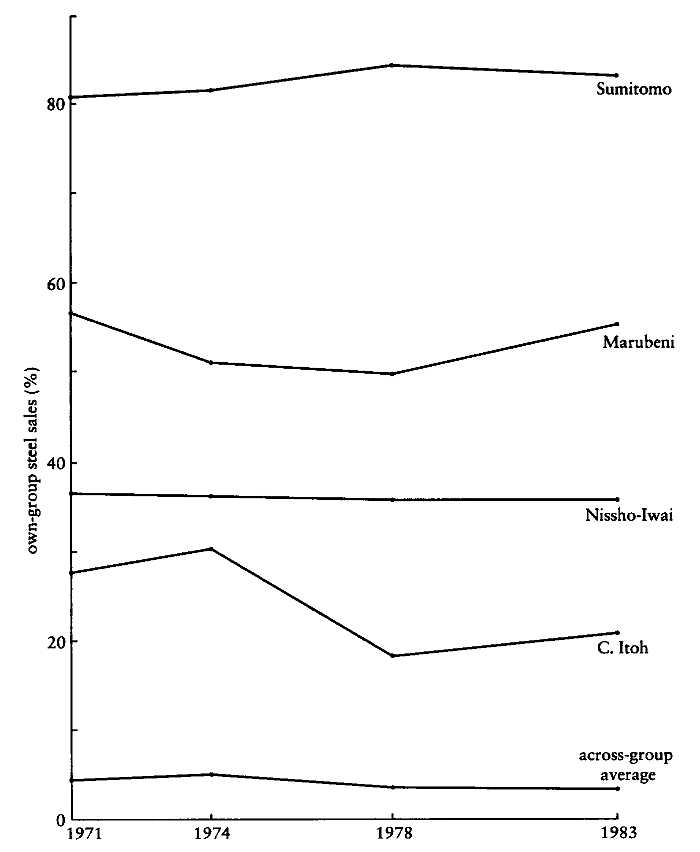

Firms consciously craft these strategic alignments through intricate and precisely conceived structural and symbolic arrangements. The amount of equity that a commercial bank holds in its corporate clients tends to be directly proportional to the loan, fee, and other business it carries out with the client firm. Similarly, steel companies buy raw materials from general trading companies in direct proportion to the amount of finished steel those trading companies sell.[10] The large corporate clients of these firms also maintain equity crossholding positions, place their own deposits in the bank, and participate in a variety of personnel transfers and joint projects, creating a complex and reciprocal pattern of resource, influence, and information flows.

In this way, banking, trading company, and other intercorporate ties represent multifaceted relationships oriented toward a wide variety of interests companies have in one another and in an extended network of other affiliated companies. The purpose of these relationships is not limited to any single set of considerations (e.g., risk-sharing or improved capital monitoring), for companies do not segment their business activities this easily. Indeed, it is precisely the intermarket character of these groupings-in which a broad range of banking, industrial, and

commercial interests are brought together in a community of interest- that is important to understanding their origins and functions in the Japanese economy.

This points to the need for an affirmative theory of alliance structures, recognizing that they serve not simply defensive purposes (important as those interests may be) but also as a proactive source of strategically crafted "credible commitments" across a range of complementary business activities.[11] It is the largest firms that are most closely involved in the intermarket keiretsu, not because of an unusually high need for implicit insurance arrangements-indeed, these companies are better able to diffuse risks across a diverse range of business lines than are smaller and more focused firms. Rather, large companies have the broadest scale and scope of activities, and the resulting benefits of complementary coordination among these firms, their banks, trading companies, and other large industrial companies are greatest.

The Institutional Origins of Economic Organization

A strategic orientation to economic organization recognizes that actors are self-interested. Equally important, however, are the ways that those interests are shaped by the institutional context within which they take place. As Simon (1961, p. xxiv) points out, behavior is " intendedly rational, but only limitedly so." In part, the limits to rational action are due to the structural complexity and interdependency of contemporary economies, resulting in the need for a broad (i.e., strategic) interpretation of how rationality and efficiency are defined, as discussed above. But economic organization is also constrained by legal and normative restrictions on acceptable behavior, by a priori models of how the world works, and by patterns of relationships that develop a taken-for-granted character independent of the interests of the parties involved.[12]