Chapter 7

The American Challenge

Dollars and Multinationals

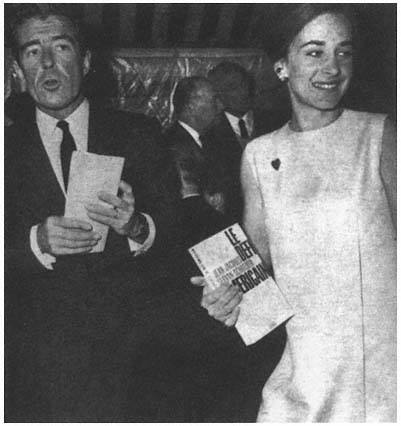

Le Défi américain (The American challenge) appeared in bookstores in the fall of 1967. By Christmas Jean-Jacques Servan-Schreiber's book had sold 400,000 copies and went on to become the best-selling title in France during the 1960s (fig. 18). Le Défi 's author became an instant celebrity whose lectures attracted full houses; some observers were shocked that Servan-Schreiber outsold literary giants like André Malraux, whose Anti-Anti-mémoires appeared at the same time.

The message of this American challenge was simple. Next to the United States and the Soviet Union, the emerging economic power was not Europe—it was American business in Europe. American managers knew better than Europeans how to exploit Europe's resources and markets. If nothing changed, Europeans would soon become subcontractors for American subsidiaries. the author was no Gaullist, but he exposed and expressed a national anxiety—one that the Gaullist regime tried to address.

Among Western European nations France was unique in trying to control American investment during the 1960s. There may have been grumbling elsewhere about the flood of dollars that poured into the continent, but the Fifth Republic alone actively tried to channel and even discourage this influx of capital. And nowhere else did public opinion become so disturbed by the issue. American investment even figured in a minor way in the presidential election of 1965.

The defensive reaction of France to American investment parallels the offensive that de Gaulle launched against Washington's political-

18. Servan-Schreiber, with his wife, at a party honoring his best-seller.

(Courtesy New York Times Pictures)

strategic hegemony. And, like his effort at upending American political domination, de Gaulle's resistance to the inflow of dollars resulted, unintentionally to be sure, in bringing France and America closer together. For by the end of his presidency the Fifth Republic and the French reached the conclusion that a certain measure of borrowing from the New World was necessary to meet le défi .

The Fifth Republic's response to American money seems puzzling, since the level of American investment in France was below average within the European Common Market. Gaullist resistance was not commensurate with the volume of dollars. Why was France under de Gaulle so different from other Western European nations who eagerly

welcomed American dollars and firms? Why did France respond to American investment as a challenge rather than as a boon?

Answers to these questions start, but do not end, with de Gaulle. The attempt at control may have been the president's decision, but he commanded considerable support both within and outside his government. He may have led the way in combating American investment, persuading some to adopt a harsher stance than they would have done otherwise, and he certainly dramatized and politicized the issue. Yet there was also a broad consensus based on ambivalence about American capital that supported a policy of monitoring incoming dollars.

Agreement existed that American capital constituted a challenge that had to be met. If dollars were a source of growth and modernization, they also bore certain undesirable consequences. Thus foreign investment, it seemed, should be screened or channeled. De Gaulle's government, many experts, those economic interests most directly affected, even prominent left-wing politicians, as well as ordinary private citizens, agreed on the need to guide the flow of dollars. Explaining government policy and this consensus of ambivalence are the subjects of this chapter.

In the summer of 1962 the Frigidaire plant of General Motors near Paris laid off almost seven hundred workers without prior notice. Ten days later Remington Rand-France discharged eight hundred workers at its typewriter factory near Lyons. Local trade unions complained that the massive dismissals at Remington were teletyped from the United States. Small businesses perceived the American multinationals as "a threat to the economic and social order." One newspaper denounced the "dollar's magic spell" and concluded, "The American, if not the enemy, is the accused." The minister of industry, Michel Maurice-Bokanowski, denounced the multinationals' "casual policy" that ignored the French "social contract," according to which employers, not employees, bore the costs of such layoffs; he announced that future investments, particularly from American firms, would be closely examined.[1] The reproach to Remington Rand was especially sharp since the company had built its plant with capital loaned by a government fund. These events announced the coming storm.

On 18 January 1963 came the news that Chrysler had purchased a controlling interest in Simca, the country's third largest automobile manufacturer. With eighteen thousand employees, Chrysler became the largest American company in France. the Simca takeover irritated and alarmed the government. Chrysler had informed authorities only two

days before of its purchase of Simca shares on the Swiss stock exchange. De Gaulle, shortly thereafter, upon meeting the head of Simca at an Elysée reception, supposedly rebuked him by saying, "You could have anticipated it."[2]

It was this series of events that brought the American challenge to the attention of the Fifth Republic and the French people. For some time the government, behind the scenes, had been concerned about the problem. Other incursions, such as the project of Libby McNeill in the Languedoc, were pending. But the Chrysler purchase galvanized officials into action. Recall that only days before the news about Chrysler-Simca, de Gaulle had announced his opposition to the entry of Great Britain into the Common Market. A principal reason for his veto was to protect the European community from losing its identity and coherence in a vast Atlantic free-trade area dominated by the Anglo-Americans.

Two weeks after the Chrysler takeover, the Fifth Republic decided to get tough with American investments. The minister of finance, Valéry Giscard d'Estaing, announced, "It was undesirable that important economic sectors of the Common Market should depend on outside decisions."[3] Any attempt to curb foreign investment, however, had to take into consideration the Treaty of Rome, which obligated the six member states (France, West Germany, Italy, Luxembourg, the Netherlands, and Belgium) to eliminate any discrimination against foreign capital. Accordingly, the first step was for Giscard to raise the issue with his fellow finance ministers from the Common Market.

As we shall see, Gaullist attempts at channeling foreign investment through a national policy were to clash with Gaullist commitments to the Common Market. At one level de Gaulle's twin goals of disengaging France from Washington's hegemony and of building a European Europe seem complementary. The first goal sought to liberate the French and the second to protect all Western Europeans from the American colossus. Both efforts would move Western Europe away from an Atlantic community subservient to Anglo-American, rather than European, interests. Yet in practice these seemingly parallel aims proved to be contradictory—at least with respect to meeting the American economic challenge posed by the flood of investments. De Gaulle's attempt at controlling American investment conflicted with his parallel effort at constructing European unity through the community of the Six. The goals proved incompatible.

De Gaulle's dilemma in the 1960s occurred because in 1958 he had made two important decisions. The first was to join the new European

Economic Community, which was going to reduce the republic's room for maneuver in fending off the surge in American dollars, and the second was to invite American investment. With respect to these issues, as well as the main lines of economic policy, President de Gaulle made the decisions.[4]

The next-to-last ministry of the Fourth Republic, which immediately preceded de Gaulle's, had notified Brussels that France would not be able to meet its treaty obligations on 1 January 1959, the day the first round of tariff reductions was to go into effect. But de Gaulle's government, in the fall of 1958, officially confirmed an earlier promise to apply the Rome treaty on schedule. Why did de Gaulle decide against following his predecessor's use of the treaty's escape clauses?

The historian is seldom on sure ground when assessing de Gaulle's motives, yet on this matter evidence points to endorsing the general's account, which says he elected to abide by the treaty in order to stimulate the French economy by plunging it into the cold waters of European competition. There were other reasons for this choice, such as honoring commitments and strengthening the new continental community at the expense of a rival British-sponsored trade scheme, but they seem less important.[5]

His principal reason for entering the community was that it would serve to renovate the economic and financial structure of France. In 1958 the new government faced large deficits in its budget and in the balance of payments, high inflation, a substantial debt owed to the United States, and an impending rendezvous with the Common Market and the Organization for European Economic Cooperation over reducing controls on trade. Externally, France had lagged far behind the rest of the Six in shedding protectionism. Internally, the market was still encumbered with so many obstacles that there were doubts about its future growth and competitiveness. De Gaulle was determined, in his words, to terminate "the mess, the inflation, the begging," and the policies that over the years had brought a dozen devaluations and an indebtedness that reduced the nation's rank in world affairs.[6]

He opted for a bold program of economic and financial reform to ready France for economic leadership in European and world markets. Central to this program was renovation through competition. He later explained: "Expansion, productivity, competition, concentration—such, clearly, were the rules that the French economy, traditionally cautious, conservative, protected, and scattered, must henceforth adopt." In this program the Common Market was instrumental:

I was concerned with international competition, for this was the lever which could activate our business world, compel it to increase productivity, encourage it to merge, persuade it to do battle abroad; hence my determination to promote the Common Market, which as yet existed only on paper, to support the abolition of tariffs between the Six, to liberalize appreciably our overseas trade.[7]

Accordingly in December 1958 de Gaulle's government introduced a complex program of economic and financial reforms, two of whose "levers" were entry into the Common Market and convertibility of the franc. These measures aimed at relieving the deficits in trade and balance of payments and at attracting foreign, especially American, investment. Thus de Gaulle made the second fateful decision to seek American capital as a remedy to France's economic and financial weaknesses.

Given subsequent events it is ironic that in 1959, as part of the program of economic and financial reforms, France actively began courting American investment. Prime Minister Michel Debré expressed his desire that American firms set up shop in France rather than elsewhere in the Common Market.[8] A new Franco-American Convention of Establishment encouraged mutual investment and accorded nationals and companies of both countries equal treatment. Whereas the Fourth Republic because of its internal political and financial difficulties had discouraged investors with onerous procedures for capital exchange, the Fifth Republic reduced these regulations to a formality. Antoine Pinay, the minister of finance, went to New York in May 1959 to reassure Wall Street that its capital would be safe in France. And his ministry set up a welcome center to encourage investors. Attracting dollars to offset the deficit in the balance of payments was the overriding need.

In 1963, however, following the Chrysler takeover and the layoffs by General Motors and Remington Rand, the republic did. an about-face. For the next three years the government adopted a hard line toward American investment. Why was American capital perceived as a danger whereas four years earlier it was being solicited?

First of all France was running a surplus in its payments and no longer needed help. But that alone does not account for the new resistance. In 1963 President de Gaulle with his veto of British entry into the Common Market launched the most active phase of his effort at asserting French independence from the United States. Independence and status in world political affairs depended on economic autonomy—a calculation that had prompted his reforms in 1958. But American capital threatened that autonomy. A host of arguments emerged against the American challenge, including charges that dollars went into buy-outs of profitable firms

without bringing any advantages; that American firms were too big and would overwhelm French competitors; that excess capacity was being built; and that American companies violated French rules of the game. Behind this smoke screen, at least from the government's perspective, lay the real danger: American control of key economic sectors. If unregulated, it was feared, vital branches of industry—some critical to national defense—would fall into the hands of American subsidiaries who were controlled from corporate headquarters across the Atlantic. The fact (still unknown to the French public in 1963) that Washington had blocked the sale of a special computer deemed vital for the French nuclear program demonstrated the consequences of such technological dependence. Moreover, the Fifth Republic had awarded priority to national economic planning and outside capital might upset the designs of the planners and the ministries.

American capital came in a rush after 1958. Its biggest surge arrived in 1961 and the peak occurred in 1962–65. To assess the magnitude and type of foreign investment is difficult in this instance.[9] Rarely do studies agree on precise quantities of investment, but at least we can chart its general flow. Quantitative analyses suggest why the French perceived a problem. Of the total stock of foreign investment, which reached about five billion dollars as of 1965, over half came from the United States.[10] Over three-quarters of this took the form of "direct" rather than portfolio investment, meaning that it carried some form of continuing control by the investor such as a substantial share of equity ownership or transfer of patents, technology, machinery, or management. If by almost every measurement the volume of American investment in France was no more than average for Common Market countries, most of it had arrived recently and the number of transactions was relatively large. Most important, it was concentrated almost entirely in manufacturing and much of this was in the most dynamic industrial sectors. Whether the target for American capital was a leading sector like computers or a traditional activity like food processing, it was among the growth industries of the day. One source estimates that 84 percent of foreign investment between 1960 and 1964 saturated four sectors: chemicals, mechanical-electrical, oil, and farm machinery-food processing.[11] Some industries where Americans acquired a dominant role during this period or several decades earlier were synthetic rubber, petroleum, office machines, tractors, photographic supplies, sewing machines, elevators, telegraph and telephone equipment, and computers.[12] From the perspective of national inter-

est, some of these sectors were strategic; others, such as razor blades, were not.

First to expand their holdings were the big corporations, many of which had been doing business in France for years: IBM, Standard Oil-Esso, and General Motors. A second wave of medium-sized firms, many in the food and service sectors, then entered the French market. Much of this new investment transgressed the so-called traditional boundaries of American presence. For subsidiaries of Standard Oil or IBM to raise their capital stock was acceptable. But for new entries to expand outside traditional areas, as Chrysler did by entering automobile manufacture or as Libby did with food processing, made it appear as if the Americans had cast off all restraint. In addition American subsidiaries, especially in the later 1960s, borrowed capital from European banks that held increasingly large stocks of dollars. In this way corporate America induced Europeans to finance American business expansion. Although the rate of private capital inflow slowed after 1964, dollars continued to arrive.

The reasons for this capital outflow are numerous, but in the last analysis it was attracted by the opportunities offered in the rich new European market. American companies wanted to take advantage of a market of 170 million people who were entering consumer society. Corporate America could, for the first time, export the mass production and marketing techniques it had developed at home. Establishing operations within the European community avoided the common external tariff and allowed free movement of capital and goods across the borders of the Six. A host of related reasons such as earning higher returns on investment, raising market shares over a competitor, or acquiring raw materials contributed to the outflow. In France a stable government, a convertible currency, low inflation, and a balanced budget heightened the appeal.

If the magnitude of American investment in France was significant, though not extraordinary when compared to that in other European nations, it was, nevertheless, widely perceived as a challenge. This reception marked the French as unique among Western Europeans. A consensus of ambivalence, at least initially, supported de Gaulle's restrictive policy. It derived from three deeply held popular aspirations or fears.

As we have seen, postwar France displayed an irrepressible national assertiveness toward the United States. This sentiment had occasionally become strident during the Fourth Republic, and the Fifth Republic both nurtured and excited it. In this instance national assertiveness

translated into a refusal of American domination via investment. A second element of this consensus was a fear of Yankee capitalism. American business had a mixed reputation. The interwar years left a caricature of American gigantism, impersonality, regimentation, and ruthlessness that lingered despite the French pilgrimages to the paradise of human relations during the Marshall Plan era. American capitalism was antithetical to an assumedly more humane French way of economic behavior. The French left added an ideological gloss that stressed the exploitive, expansive, and "colonizing" aspects of the American system. A final ingredient of this consensus was a fear of economic decline. In the race for international competitiveness, the postwar generation worried about falling further behind the leaders. The United States was both an agent and a reminder of this relative retardation. In the midst of unprecedented economic growth there occurred doubts that France was abreast of its rivals and fears that Americans would like to keep France in a subordinate position by controlling its dynamic sectors. This consensus dampened enthusiasm for the capital boon from the New World and provided de Gaulle with support for his intervention against the dollar.

The government's opening move to curb the American challenge was to appeal to the European community. In late January 1963 Giscard d'Estaing announced that he would raise the issue of foreign investment at the next meeting of the community's finance ministers. Giscard stated that unless a European solution were found, the autonomy of certain sectors in the community was at risk.[13] But before June, when the ministers gathered in Belgium, Vice-Chancellor Ludwig Erhard of West Germany and André Dequae, finance minister of Belgium, had already declared their opposition to regulating American capital.[14] France's partners were displeased with de Gaulle's veto of the British membership in the Common Market and disinclined to side with Paris on the investment issue. When the finance ministers met at Spa, Giscard tried to soften his tone and proposed drawing up a sectoral inventory of foreign investments with an eye to limiting them should they appear dominating. But his partners' reactions effectively killed any hope for instituting a common policy. They agreed only to study the problem. The Italian minister, Guiseppe Trabucchi, said the Six were committed to a policy of free capital movement.[15] The Commission of the European community was not eager to become involved in a problem that seemed

to worry only the French.[16] France would have to act alone and against the policies of its partners, all of whom welcomed American capital. De Gaulle found no help in Brussels.

Following this setback the French government tightened up existing regulations and procrastinated. Rather than rewrite the rules, which risked an open clash with the European community and the United States over existing treaties, the government of Georges Pompidou (which had succeeded that of Michel Debré in 1962) simply stalled. Requests to the Ministry of Finance for authorization gathered dust. Prime Minister Pompidou told the American Chamber of Commerce in Paris in early 1963 that the spread of American investments needed further study in order to prevent surprises in the future.[17] A few months later Pompidou stated:

France is not hostile to foreign investments; however, a limitation appears desirable in practice. France does not wish that the industry ora particular region or a particular branch of industry be dominated by foreign capital, for example, American.[18]

Heads of American banks in Paris were told the government wanted primarily to discourage French firms from seeking American bailouts.[19]

While the government discouraged unwanted investors through bureaucratic delay rather than outright refusal, Giscard and his colleagues groped for a policy. The finance minister first tried to distinguish investments that were "productive" from those that were "exclusively financial," but this made little sense.[20] Over a year passed before the Pompidou government produced criteria for selecting investments. According to the minister of industry, Maurice-Bokanowski, "good" investments improved employment and the balance of payments, raised national income and. tax revenues, and aided economic modernization and competitive capacity. "Bad" investments compromised healthy domestic competition, concentrated on the most profitable sectors where they created excess capacity, laid off French staff, ignored national interests, endangered the trade balance, and discouraged French research.[21] Such a list only demonstrated that multiple criteria needed to be employed on a case-by-case approach.

Within the government the partisans of rigor, such as the Elysée and the ministères de tutelle (guardian or supervisory ministries), especially the Ministry of Industry, were more strict in their judgment of applications than were the Finance Ministry and DATAR (Délégation à l'aménagement du territoire); disagreements were common. The latter

agency championed regional development and eagerly sought foreign investment. But its stance was exceptional. The Commissariat général du plan stood between the extremes, advocating a liberal policy in principle but endorsing restrictions for strategic sectors like electronics.[22] Ultimately selection was in the hands of Pompidou, Giscard, and de Gaulle; this trio often vetoed recommendations from below for authorization.

Many applications after 1963 faced endless administrative obstruction, and some were rejected outright. Weyerhauser offered to buy a box company that was on the verge of bankruptcy. The government tried without success to find a French purchaser yet eventually rejected Weyerhauser's bid because Americans were considered already too powerful in this sector. This rejection was also intended to be a signal to other French firms in distress not to look abroad as an easy way out.[23] The United States Treasury Department only fueled the fires when it pressured the Fruehauf trailer company to make its French subsidiary cancel a contract with Automobiles Berliet. The latter had ordered trailers from Fruehauf-France for sale in the People's Republic of China. This contract raised a jurisdictional issue over which country controlled Fruehauf-France. A court action by Berliet eventually forced the sale. In the first nine months of 1965, out of 164 requests 40 were turned down.[24] The most controversial cases involved two American multinationals, Libby McNeill and General Electric.

Libby became interested in establishing a food-processing plant in the Bas-Rhone-Bas-Rhône-Languedoc in 1961 when it learned of the development of this area. The government was sponsoring a massive irrigation project and also trying, without much success, to build a major canning industry by regrouping the fragmented local food-processors. France had nearly a thousand canning companies, of which most were tiny and none was large enough either to compete in the Common Market or to stimulate change in local agriculture. By January 1963 the Ministry of Agriculture and Libby McNeill had drafted a tentative agreement: Libby would build a large plant in the Bas-Rhone-Bas-Rhône-Languedoc for processing local fruits and vegetables and would export 85 percent of its output. Part of the package included contracts with French farmers, who would grow crops according to Libby's rules and receive guaranteed prices.

In the midst of the outcry over Chrysler-Simca, news of the Libaron (the name of Libby's subsidiary) project leaked to the press. Opposition came from a wide range of political groups, especially on the left, as well as farm associations. Farmers objected to being disciplined by American experts. Local canneries protested against unfair competition from the

American giant. And the fact that an American firm would benefit from an irrigation project built with public funds aroused protests.[25]Le Monde suggested that because Libby said it might at the outset need to import some fruits and vegetables from the United States, Libaron might well become a "Trojan horse" the Americans could use to flood the Common Market with their commodities.[26] This was especially galling considering France's own large agricultural surpluses. Defenders of Libaron, however, argued that since Libby entertained Italy as an alternative site, it was better that Libby's cans should contain beans from the Languedoc than from the mezzogiorno . And the Fifth Republic needed the cannery to implement its plans for the region. The government suspended action on Libby's proposal and asked the Chicago firm to yield part ownership to a French bank and to modify the growers' contracts. Libby executives complied and authorization was granted.

Of less notoriety than Libaron were projects by American companies to penetrate the French market for animal feed. In 1964 Duquesne-Purina, a subsidiary of Ralston Purina, opened a large slaughterhouse for poultry in Brittany and incurred a storm of opposition. The poultry market suffered from a glut and the contracts let by Duquesne-Purina endangered the local cooperatives. A Breton farm leader complained of the "underhanded American attempt to seize the French poultry market and put our farmers in servitude" and threatened to dynamite the slaughterhouse.[27] Ralston Purina agreed to curtail its output and the affair subsided, as Libaron had. A similar project submitted to the government by the giant feed-wholesaler Cargill was discovered by farm associations before a decision had been rendered. Farmers sent a delegation to the minister of agriculture; the government, already under fire from farmers for its approval of the Common Market's new agricultural policy and worried about Breton votes in the 1965 presidential elections, tabled Cargill's request.

The affair that captured most attention, however, occurred in the computer industry.[28] Machines Bull was the only serious competitor for IBM-France, which had long dominated the industry. Bull was owned by the Callies family and had specialized in office calculators. In the early 1960s it embarked on an expensive expansion program absorbing subcontractors, developing new product lines, and building an international service and distribution network. Only belatedly, however, had it begun to shift to all electronic computers. For some time Bull had been manufacturing electronic machines under license or importing them from the United States; its own research and development could not

provide the designs. And the new electronic computers were leased rather than sold, adding further strain on the firm's financial health. By 1963 the company was in need of capital and a technological infusion. General Electric stepped in late that year and offered to buy a 20 percent interest at above market price and to provide technological and managerial assistance as a way of getting into the European market. GE offered Bull not only $28 million in cash but product designs and technicians to help it develop new computers.

The Ministry of Finance, however, in February 1964 refused to authorize the joint venture and called for a "French solution." De Gaulle took a personal role in settling this affair.[29] After much prodding a group of French investors that included two banks and two major electronics firms offered to buy shares in Bull for $7 million, and the government promised public contracts to the company. But there was no technical aid.

In April the government reversed itself and allowed Bull to reopen negotiations with GE. Advice coming from the two electronic firms that formed the French alternative and from the Ministry of Industry was negative. Without the technical and managerial skills and more cash, the "French solution" would break down in the long run. De Gaulle himself judged the scheme designed by the finance ministry unworkable.[30] And, even though the Callies family accepted the ministry's proposal, many of the shareholders and some of the family did not; the situation might have led to a formal vote against the venture and either bankruptcy or nationalization—alternatives the government wanted to avoid. GE knew it had the upper hand and tendered a new, complicated offer that strengthened its position in the merger.[31] In July the government capitulated and allowed the GE-Bull joint venture.

Looking outside the offices of the ministries in Paris, we cannot generalize about how major interest groups—much less the French people—viewed American investment. Reactions were immensely varied, sometimes derived from personal experience with an American firm. But there was no important opposition to Gaullist screening policy, at least at first. Criticism grew only as monitoring and stalling turned into a de facto freeze.

Peak employers' associations like the Conseil national du patronat français (CNPF) and the Confédération générale des petites et moyennes entreprises (CGPME) adopted no official stance. Given their diverse constituencies, this is no surprise. The closest approximations to a position

were the declarations of Georges Villiers, the head of the CNPF. If at one time this confederation had encouraged American investors, by 1964–65 Villiers tactfully asked Americans to respect certain limits. Speaking at a reception for the United States ambassador, Villiers first praised the benefits of this capital influx, then warned that it was in the interest of neither country that this movement develop in "an excessive manner." French industry, he declared, needed to adapt by itself to international competition; it would be harmful if the centers of technical progress or decision-making were to be concentrated in the United States. "We should be aiming for an exchange of industrial experience—toward stimulation rather than substitution." Sounding a political note, the president of the CNPF remarked that the magnitude of this financial and technical movement "risks producing economic, social, and, as an indirect consequence, political effects . . . that we should try to forestall."[32]

Similarly when top managers of French firms and American subsidiaries, like Ford-France, met in 1964, the Americans pointed out the Europeans' need for capital and warned that if France closed the door, the dollars would go elsewhere within the European community. French executives spoke of an unequal struggle. General Electric, they pointed out, produced two hundred thousand different products; General Foods, should it choose to, could merely cut its prices l0 percent and force out every French candy manufacturer. Outside capital was wanted, but Americans must respect certain limits. They should, for example, invest in existing companies without demanding control and make full use of French middle management, French techniques, and French subcontractors. Otherwise, the French industrialists warned, a nationalist reaction could take place.[33]

Other French business leaders disapproved of the way American firms violated the Gallic code of behavior—especially with respect to competition and personnel practices. Instead of accepting the status quo, Goodyear and Firestone, for example, tried to win a foothold in the original-equipment tire market by offering unparalleled discounts to French automakers.[34] Some American affiliates ruthlessly replaced managers and laid off workers without helping them relocate. Gallic anxiety about the "savage" aspects of American business, which had been repressed in the 1950s, emerged a decade later when American subsidiaries "misbehaved"—allegedly showing their true colors.

Business and financial journals stressed the several advantages of American investment, warned against xenophobia, yet accepted the need for vigilance.[35] This press, like business itself, complained that American

capital targeted certain sectors—of which some were vital to national independence. It also reported the "brutal" layoffs at Remington, the contracts at Libby that made farmers work "à l'américaine," and American penetration into the food industry that threatened artisanal manufacture. What raised anxiety in these observers was the colossal size of American enterprise. The press reported that while the sales of the entire French electronics industry were 5.5 billion francs, those of General Electric alone were 27 billion. With respect to business turnover in 1965, General Motors was nineteen times bigger than Renault, U.S. Steel five times bigger than Schneider, Goodyear four times larger than Michelin, and Du Pont three times the size of Rhone-Rhône-Poulenc. And profit margins for big business were estimated to be on the average double that of their French counterparts. One of the most common comparisons was that General Motors' annual business exceeded the Dutch gross national product by 10 percent.

These business reviews disapproved of the melodramatic way the government presented the problem and the political and anti-American overtones of its policy, yet they urged the Americans to avoid seeking controlling interest. They opposed a strict protectionist policy, recalling how opposition to General Electric's initial offer to Bull had backfired, and looked to Europe, either at the level of European-wide mergers or European Economic Community regulation, for a solution. But as many experts advised and as one business paper declared, "France has a duty to protect itself against inordinate American investment."[36]

The weather vane of the intelligentsia, Le Monde, at first displayed Gaullist alarm about American investment and then became more forgiving. Days before de Gaulle's rejection of Great Britain's bid for entry into the Common Market, Maurice Duverger called attention to the other dimensions of the American design on Europe besides the British "Trojan horse."[37] Europe, according to this columnist, faced a "neocolonialism" that threatened to transform an emerging independent Europe into Washington's dream of an open, capitalist Atlantic community. The "true Trojan horses," following this logic, were American companies that had already been welcomed, mistakenly, into the Common Market. These corporations transferred decision-making across the Atlantic to "economic groups" that formed part of the inner circle that ran Washington. Duverger reminded his readers that the American mentality combined extreme generosity in charitable matters with "utmost severity" in business. The way out for Duverger was a planned, autonomous European community.

Two weeks after Duverger's "Trojan horse" column, Le Monde divulged the Libaron scheme. But as the investment issue gained attention, the newspaper began to present a more nuanced position, mildly praising the behavior of American subsidiaries, blaming the capital inflows on French weaknesses, criticizing the government for "ambushing" investors, and looking to Europe for a solution.[38] By 1967 Le Monde was cheering on American companies for their market-guided behavior and their constructive influence on French firms while continuing to worry about growing outside control. "At a time when capital is increasingly without a homeland, French industry must be sufficiently effective so that foreigners continue 'to invest in France without investing France.'"[39]

In the mid-1960s the American challenge attracted popular attention. Foreign investment was no longer dull reading in economic journals. General-interest periodicals carried the story, and the topic assumed national stature with reports on affairs like the General Electric takeover of Bull. One report said that if the average consumer had learned to accept Mobil Oil, Coca-Cola, Gillette, and O'Cedar, American acquisition of companies making automobiles, snacks, and other foods evoked "a certain mistrust."[40] Public opinion surveys from the mid-1960s do little more than verify a substantial degree of reserve about foreign investment among the French—more so than among other Europeans.[41]

Except for discussion of the nation's long-range economic plan (the fifth since the war), the issue never became the subject of a major debate in the National Assembly. But the left tried, halfheartedly, to use it against de Gaulle by demanding even stiffer measures against the Americans.[42] The Communists attacked the government for selling out French industry to the Americans; the Socialists asserted that the Gaullist regime favored class interests over national ones. François Mitterrand reproached the Pompidou government for authorizing "the colonization of France by foreign capital."[43] Socialist intellectuals like Serge Mallet argued that if European integration was not accomplished, then Europeans would end up working in factories whose manager's and technicians were Americans.[44] Gaston Defferre, who made a bid to be the left's candidate for the presidency in 1965, denounced the government's handling of the Simca and Bull affairs and accused it of accepting colonization by the United States. He called the Bull affair "the most striking event of 1964 by virtue of both its symbolic value and its practical consequences . . . it marks in fact the abandonment of a sector that controls the future of all our key activities."[45] Defferre blamed the

Gaullists for mistakenly seeking a French solution to a problem that could be resolved only at the European level. Gaullist errors, the Socialist candidate declared, were leading not to independence but to economic and political "enslavement."[46]

But trying to outbid the Gaullists by playing the nationalist-protectionist card did not work, because the aims of the Gaullists and the left converged. The government was already doing what almost everyone wanted, that is, it was monitoring foreign investment; the left had no real alternative to offer at the European level because Europe had refused to cooperate with de Gaulle. The Gaullists allowed the left little space for its outflanking maneuver. All that could be requested was a more effective screening policy. In the end foreign investment was only a minor issue in a campaign that earned de Gaulle his reelection.[47]

The way the Fifth Republic chose to restrict foreign investment from 1963 to 1966 proved defective. In the cases of Machines Bull-GE and Libby McNeill, the Pompidou government, failing to find an alternative, succumbed to American offers. This was not unusual. In fact, in most cases the ministères de tutelle were unable to find French substitutes for American investors.[48] Weaknesses in French industrial structure and capital markets undermined Gaullist policy. Equally important, without a common policy among the Six, American capital found havens elsewhere within the Common Market. In this way France lost jobs, tax revenue, technology, exports, and research facilities—and the products arrived across its borders anyway. Faced with interminable bureaucratic delays, Phillips Petroleum and Rhone-Rhône-Poulenc, for example, chose Antwerp as the site of their new plastics plant rather than Bordeaux. Ford shifted its proposed new factory from Metz to the Saar. Giscard supposedly made the president of General Motors wait for twenty-four hours, leaving the American executive so angry that he swore he would never invest in France; in fact, General Motors abandoned its plan for a plant in Strasbourg to build one in Antwerp. American executives complained that they could not understand what government policy was other than deference to the pressure of special interests.[49] Discouraged in advance by ministerial arbitrariness and delay, companies ceased even to apply for authorization. This tack deprived the government of its option of screening applications and approving "good" investments.[50]

Official fumbling now prompted press and political criticism because France was losing out in the competition for American capital. Screening, to the critics, was desirable but the way the republic implemented it

forfeited advantage to other Europeans. An official report concluded that foreign investment had actually fallen in 1965, that it represented at most 10 percent of domestic capital investment, and that within the European community Germany, Italy, and the Netherlands had received more American capital than France had.[51] Most critics, many of whom were economists, advocated a European rather than a French solution.[52] But that option, at least at the level of a common European community policy, was not available to Paris.

Another report, this one commissioned by the Ministry of Industry in the summer of 1965, noted that foreign investment was not excessive and, in fact, was declining. The report, which expressed views of a select group of officials, bankers, and industrialists, argued that in international markets, in which only a few multinationals could compete, to force an enterprise to depend on French capital alone was unsound.[53] Better to have a French company triumph in such markets, even if it was under American control, rather than have it disappear waving the tricolore . The issue was not resisting foreign investment, according to the report, but meeting a lag in technology and management. Foreign investment would help close the technological gap in the race against the real rival from across the Rhine. The report recommended against "uniform ostracism" of foreign investment that would, in addition, be legally and diplomatically impossible and invite reprisals. In June the minister of industry began to bend. He praised American subsidiaries for obeying the French social contract in contrast to their behavior in 1962–63, but he also announced new guidelines, which included French control over a firm's decision-making and industrial research.[54] By mid-1965 the restrictive policy pursued since 1963 had miscarried and was in need of overhaul.

While the administration struggled to define a policy for selecting investments, President de Gaulle pursued a different, but parallel, strategy. The head of state chose to strike at the alleged source of American investment by opening the issue of international monetary reform at his press conference in February 1965. In fact the interconnections between American payments deficits, American overseas investments, and European inflation had been discussed within the highest governmental circles for years and had also been raised at the international level.[55] In July 1963 de Gaulle first spoke in public of "the dollar problem."[56] The following year Giscard addressed the International Monetary Fund (IMF) about the problem of excess international

liquidity and recommended the creation of a new reserve unit linked to gold. But it was the dramatic 1965 presidential press conference that triggered a new Gaullist offensive against the dollar.

On this occasion the president sharply attacked the status of the dollar as a reserve currency. The operation of the Gold Exchange Standard, de Gaulle argued, permitted the free financing of foreign investment that led, for some countries, to "a kind of expropriation" of their enterprises.[57] The president recommended overhauling the international monetary system by substituting the gold standard as a means of imposing discipline.

As a reserve currency, the Gaullists contended, the dollar escaped the discipline of international payments. Under the Gold Exchange Standard the dollar was a privileged currency; its use permitted the United States to dispense with the rule of regulating payments deficits by reducing its stock of gold. The Gold Exchange Standard allowed the United States simultaneously to spend lavishly on foreign aid and defense (including Vietnam), imports, and foreign investment without experiencing unbearable repercussions on its balance of payments. For years, according to the Gaullist critique, the United States refused to face its growing payments deficit while corporate America took advantage of the dollar's special status to send capital abroad, further amplifying the deficit. Americans also borrowed from the local stock of Eurodollars to finance their subsidiaries. Moreover, the Gaullists argued, this system allowed the United States to export inflation by printing dollars at will without having to pay in gold for its excesses. In short, the privileged status of its money served to reinforce America's industrial dominance in Europe. Such an arrangement was incompatible with an independent France and a European Europe. If after the war, given the shortage of dollars and America's hoard of gold, there was good reason for foreign banks to hold the currency, such was no longer the case because dollars were plentiful. Without reforms, the system was in such disequilibrium, according to de Gaulle, that if creditors ever began collectively to convert to gold, a global financial upheaval would follow.

Jacques Rueff, one of de Gaulle's principal financial advisers, explained the problem this way:

When a country with a key currency has a deficit in its balance of payments—that is to say the United States for example—it pays dollars to the creditor country, which end up with its central bank. But the dollars are of no use in Bonn, or in Tokyo or in Paris. The very same day, they are relent to the New York money market, so that they return to the place of origin. Thus the debtor country does

not lose what the creditor country has gained. So the key currency country never feels the effect of a deficit in its balance of payments. And the main consequence is that there is no reason whatever for the deficit to disappear, because it does not appear. Let me be more positive: if I had an agreement with my tailor that whatever I pay him he returns the money to me the very same day as a loan, I would have no objection at all to order more suits from him.[58]

Whatever the intrinsic merits of this argument—its deficiencies led some Americans to criticize it for being incomplete and self-serving—it formed the basis of policy. Moreover, de Gaulle's arguments evoked sympathy among the French business elite, as the policy of monitoring investment did.[59] The Bank of France in 1965 doubled the volume of surplus dollars it converted into gold and de Gaulle insisted that French gold reserves held by the United States Treasury be transferred to Paris.[60] In 1966 France withdrew from the "gold pool" (an international consortium whose function was to restrain speculation in gold). These words and actions further antagonized a United States that was already displeased with the head of the Fifth Republic. Americans asked if de Gaulle was contesting the hallowed proposition that the dollar was good as gold. Meanwhile the United States Treasury grumbled over the costly operation of repatriating gold across the Atlantic. In response to de Gaulle's press conference, the Treasury defended the existing international monetary order (though acknowledging the need for study), claimed that the gold standard would be too rigid and deflationary, and asserted that no other government would follow the French president.[61]

Before the quarrel over the dollar subsided, exasperated congressmen were demanding that France pay its war debts—from the First World War—before the Treasury changed more gold for dollars. American businesses threatened to boycott French imports. One bar owner in New York invited television cameras to film him "cleansing" his wine cellar by pouting bottles of Bordeaux down the drain. The humorist Art Buchwald advised those who could not afford expensive French products to join the boycott by refusing to eat "French Fries." And the cartoonist Herblock, parodying a James Bond film about a villain named Goldfinger who tried to rob Fort Knox, called the chief of state "Gaullefinger" (fig. 19). Even at the White House, where President Johnson had tried to stay aloof from the quarrel, French wines were no longer served at state dinners (though this practice had more to do with Johnson's "Buy America" campaign than it did with retaliation against de Gaulle). Stinging stories about the "anti-French" boycott filled the French press.[62]

19. De Gaulle attacks the dollar, according

to Herblock. (The Herblock Gallery [Simon and

Schuster, 1968])

For de Gaulle the gold standard was a means to an end. The end was elevating French rank in international affairs. His defenders argued that he proposed the gold standard not from some belief in its intrinsic worth but because he merely wanted to make all countries submit to the same rule, so that no one currency could create unlimited international liquidity. He told one of his financial advisers, "I proposed gold but I could have accepted something else provided it was a standard independent of the Anglo-Saxons' currencies."[63] In retrospect the campaign against the dollar seems to have been less a genuine debate about money than a Gaullist tactic to curtail American economic penetration of Europe and elevate France and Europe over the Anglo-Americans in running the international monetary system.[64]

For three years following his 1965 address, de Gaulle tried to force more discipline on the United States. International monetary reform involved both economic and political issues.[65] In the first case was the question of liquidity levels and their effects on inflation as well as the question of the proper means for creating liquidity. On these issues the Anglo-Americans sought only to modify the IMF mechanism, and the French wanted to impose strict rules on everyone and thus eliminate the fluctuations caused by the freedom of key currencies. In the second instance monetary reform expressed European, mainly French, determination to end Anglo-American domination of the IMF.

Washington seized the offensive on reform and offered its plan for adding to the world's monetary reserves through new Special Drawing Rights (SDRs) in the IMF. Michel Debré, as finance minister after 1965, struggled to line up his Common Market partners much as his predecessor had tried in 1963 over the issue of American investments. The most Debré could accomplish was a tentative and ambiguous agreement in 1967 over using SDRs as new instruments of credit. But crises in the pound and the dollar demonstrated that the French had been wrong in claiming an excess of reserves. In November 1967 de Gaulle again publicly attacked "an American seizure" of French enterprise that he attributed, in good part, to the export of dollars through the Gold Exchange Standard.[66]

When the central bankers and finance ministers of the principal industrial nations met at Stockholm in March 1968, the French delegation found itself isolated. Debré alone refused to sign the communiqué and told the press that the SDRs were a mere "expedient" and more like money than a form of supplementary credit; he complained that the basic problems had not been addressed since privileged currencies still existed.[67] In private, de Gaulle complained:

We must wait for the collapse of the dollar. The Americans spend too much on Vietnam, research, and space for their own good. We shall be forced to cover the American deficit. They will take up a collection and our partners will give in to American influence.[68]

Once again, France's European partners had deserted it on a question of meeting the American challenge. They refused French leadership because it was too risky. From their perspective the dollar, rather than gold, represented Europe's trade and capital needs.[69]

The controversy over the dollar quieted in 1968 once the franc itself was in danger. By the summer of 1969 the United States had won the

struggle over monetary reform. Modifications in the operation of the IMF had been made, but Washington did not comply with the French prerequisite that the United States end its payments deficit.[70] Three months after de Gaulle's resignation, the French government joined the others and accepted the scheme for SDRs.

At the same time that the French government was trying to curtail the source of American dollars, it continued its efforts to control their entry through selective authorization. By 1965, however, Giscard's restrictive policy had proved ineffective. His freeze discouraged desirable investors who simply found welcome elsewhere. Every member of the European Economic Community, except France, actively courted American capital. Thus the French share of direct American investment within the community fell after 1963 while it rose elsewhere—specially in Germany.[71] On 6 January 1966 Albin Chalandon, a former Gaullist party official, wrote in Le Monde: "Ford, which has been set up in the Saar on the other side of the French frontier, is going to manufacture German cars with French labor. Wouldn't the reverse be better for us?"[72] Three days later, when de Gaulle reorganized the Pompidou government, the two ministers most closely associated with protecting France from the dollar, Giscard d'Estaing and Maurice-Bokanowski, were left aside.

Michel Debré became the new finance minister in 1966 and received a free hand to deal with foreign investment. He immediately discarded the restrictive policy that had been in effect for three years. De Gaulle consented to the shift in policy rather than ordering it.[73]

Now the issue changed from a political problem of outside control of French industry: it became more a technological matter. France seemingly faced a "technological gap" that the Americans could help remedy. It was no coincidence that 1966 also marked the start-up year of the fifth plan. One of the plan's major goals, which de Gaulle fully shared, was to raise the economy's global competitive stature. Yet the planners faced declining total investment levels. The answer once again was to open France to those who could bring both cash and technology. Debré observed that "within the framework of the plan, which is the charter for government action . . . , it is better to have American investment than none at all. It is rather difficult to imagine how national investment could be a substitute."[74] When quizzed about American investments, Debré acknowledged that the government was not entirely free to respond

because of its commitment to competition and because of the warm reception given dollars within the Common Market. Moreover, Debré said, France lagged in technology and its financial market did not match the level of its industrial ambitions.[75] Debré also complained that if the government refused foreign investors, the political opposition would accuse it of "blind nationalism."[76] And, sotto voce within the government, the view was expressed that American companies were preferable to European firms because the Americans gave their subsidiaries more autonomy.[77]

Both the procedures and the atmosphere at the finance ministry changed. A new interministerial committee reviewed applications. Within a year new legislation governing all foreign exchange was in place.[78] Selectivity remained, but instead, of delay and uncertainty there was prompt action. New investors needed only to give the ministry prior notification and, if the government did not object within two months, authorization was automatic. This veto power was used sparingly from 1966 on. Foreign investment was once again encouraged. Only a loose form of monitoring remained, except for direct investments made by French corporations under foreign, that is, American, control that now fell under ministerial surveillance (prior law had regulated only original investment from abroad). Debré spoke of replacing a system of restriction with the principle of freedom. He told the American Chamber of Commerce in Paris that even if a review were indecisive, he would still approve the investment. In the first half of 1966 no investor was refused.[79]

The ministries applied multiple criteria to each potential investor and issued their decisions after careful deliberation.[80] High on the list of requirements was that research facilities be located on French territory. Investments that carried technological transfers or aided regional economic development or forced sectoral mergers, especially to raise French firms to the level of international competitiveness, also received priority.[81] When Motorola decided to build a semiconductor facility near Toulouse, a region in need of new industry, it received instant approval. Similarly Alcoa was welcomed at Châteauroux, where the American military base had been closed. General Mills, Nabisco, and Pillsbury received permission to buy into French companies in order to strengthen French shares of a market (cookies) run by European firms. When the perfume industry refused to use synthetic fragrances, Universal Oil Products was allowed to buy Chiris and introduce the innovation to France. Companies like Phillips Petroleum and General Motors that had

deserted France for more hospitable sites in the mid-1960s were welcomed back. General Motors decided to put its new $75 million automatic transmission plant near Strasbourg, and Henry Ford II, while attending the road car race at Le Mans, was invited to Pompidou's residence and told how pleased France would be with a new Ford plant.[82] Nevertheless, the new hospitality failed to raise the volume of American private capital in France.

Not all dollars were welcome under the new dispensation. Debré explained he favored closer collaboration between American and European firms but not under conditions that would constitute "economic colonization." Claiming that history would praise the French as "the best Europeans" for their efforts, he insisted that in joint ventures European firms must retain their freedom of action, their technological capacity, their freedom to export, and their control over personnel promotions.[83] And, he declared, there were key sectors that must remain French—especially when some foreign investors represented "an important power" that had "political objectives."[84] Thus in late 1969 Westinghouse was prevented from acquiring Jeumont-Schneider because the latter, as a producer of equipment for nuclear reactors, fell into Debré's reserved zone. Similarly IT&T was denied its bid to take control of France's largest manufacturer of industrial pumps. And when American businesses offered little advantage, as was the case when Revlon and others tried to purchase perfume companies, they were rejected.

As Debré struggled to find an effective way to attract "good" investments and discourage others, Servan-Schreiber caught almost everyone's attention with the publication of Le Défi americain[américain in the fall of 1967. What is at issue here is the popularity of this best-seller (its content will be discussed in the following chapter).

To explain why a book becomes a best-seller may be a difficult enterprise, but a major reason for the enthusiastic reception given Servan-Schreiber was the anxiety about the invasion of dollars and multinationals that made Gaullist policy French policy in the 1960s. To be sure, part of the book's success came from the glamour of its author: his courageous stance during the Algerian war, his success at remaking the glossy newsmagazine L'Express, his Kennedy-like physical appearance, and his associations with eminent politicians like Pierre Mendès France. Equally important was the book's novel marketing that used means similar to those perfected by American publishers to create publicity and excite and sustain interest.[85] But there was also the warning.

Le Défi américain sounded an alarm. It was the eleventh hour: unless the French, and the Europeans, launched an immediate counterattack, it would be too late—Europe would become a satellite of the United States. Europeans were on the verge of forfeiting their last chance at staying abreast of the technology and skills that accounted for America's dynamism. In a generation, if Europeans remained passive before the challenge, the United States and a few other countries like Canada and Japan would attain the rank of "postindustrial societies" while Europe would fall to the status of an underdeveloped region. European firms would become mere subcontractors and American subsidiaries would employ Europeans as clerks and workers. The decisions about how Europeans worked, lived, and even learned would be made in cities like New York and Chicago.

Following in the government's footsteps, Servan-Schreiber shifted attention from a preoccupation with American capital to technology and management. He noted that "putting an end. to American investment . . . will only weaken us further." The problem by 1967 was one of organization, of research and development, of innovation and creativity. The problem was human capital, not investment capital. Stealing yet another page from de Gaulle's list of complaints, Servan-Schreiber stressed that increasingly Americans financed their subsidiaries by borrowing on local markets, exploiting stocks of Eurodollars, winning subsidies, and reinvesting profits. "Thus, nine-tenths of American investment in Europe is financed from European sources. In other words, we pay them to buy us."[86]

The answer lay in imitating the Americans and building Europe. Much as the Gaullists did, he evoked the taste for independence—but within a European context. Thus Le Défi criticized Gaullist policy for being too timid and defensive in facing the challenge and for trying to meet it on the national, rather than the European, level. The best-seller attacked de Gaulle for his opposition to further European integration and antagonized the Gaullists by warning:

We can no longer sit back and wait for the renaissance. And it is not going to be evoked by patriotic rhetoric or clarion calls left over from the age of military battles. It can come only from subtle analysis, rigorous thought, and precise reasoning. It calls for a special breed of politicians, businessmen, and labor leaders.[87]

It should be no surprise then that when President de Gaulle was asked at his press conference for his opinion of Le Défi he answered, "Here, we don't advertise literature."[88]

Servan-Schreiber's warning touched a common Gallic fear—that the Americans were taking over France and Europe. Evidence had been accumulating that France might be slipping into the American orbit. And the Gaullists had politicized the incursion. But Servan-Schreiber dramatized the issue in a book that combined a catchy title with the drama of an apocalyptic warning, the authority of some carefully selected economic statistics, and the consolation of obvious solutions. He addressed both aspirations for independence and fears of economic backwardness. He struck what was worrying a nation.

The best-seller's fame was brief. The events of May–June 1968 overshadowed it. For several months the book sat on booksellers' shelves as the public's attention shifted to domestic social and political issues raised by the students and strikers. Then in the spring of 1969 came the resignation of President de Gaulle, which ended the attempt at screening foreign investment designed by Michel Debré.

After de Gaulle, the controls on foreign investment largely reverted to what they had been ten years before. The European community intervened by means of a legal action that dragged on from 1968 to 1971, eventually forcing the Fifth Republic to relax the mildly restrictive policies enacted by Debré.[89] Once again Europe blocked France from doing as it pleased to counter the American challenge. President Pompidou, de Gaulle's successor, de-escalated and depoliticized the issue. Only days after de Gaulle's resignation, by coincidence, DATAR established a "Welcome Center" for investors in New York.[90] In February 1970 the government decided to "liberalize" the Debré policy even further, hoping to attract capital and technology. The principle of selection survived but was henceforth rarely invoked.[91] Given the results of a poll of heads of American and European multinationals, which confirmed the reputation of France as the least hospitable country in Europe for foreign investment, it is no surprise that further action was necessary.[92] A month later at the Waldorf Astoria Pompidou spoke on foreign investment before an audience that included President Nixon. The French president reiterated the Gaullist axiom that his country wanted to avoid letting certain sectors fall under foreign control but also observed,

In my eyes nothing would be more prejudicial to French interests than to see American companies set up business only in other Common Market countries. If England becomes a member of the community, this stance will become even more clear.[93]

He proclaimed himself a "partisan of the circulation of capital" and told American business leaders like David Rockefeller that France and Europe sought American investors.[94] And, as if to reverse matters completely, Pompidou notified the Americans that France intended to take up the offensive and develop its investments in the United States.

By 1970, however, the danger of the American challenge was fading and other issues obscured it. As early as 1965–66 there were more applications for authorization from within the Common Market than from the United States.[95] In 1968 intracommunity direct investments (in value) were twice those coming from the United States (though the community total included investments by American subsidiaries in Europe as community investments).[96] American private investment accelerated again after 1968 and the United States remained the principal foreign investor through the early 1970s, but Europe was closing the gap.[97]

Gaullist policy and the response of the French to the influx of American dollars and business in the 1960s was unique among Europeans. The president of Ford-France told a reporter in 1965 that France was the least welcoming country in the European community.[98] Such an admission testifies to the peculiar stance Gaullist France assumed with respect to dollar imports. Nowhere else in Western Europe was there such official, and probably unofficial or popular, resistance.[99] Prime Minister Harold Wilson may have preached against American economic hegemony, yet he allowed Chrysler to take control of a major British auto manufacturer. Some important West German bankers and industrialists and at least one major politician, Franz-Joseph Strauss, spoke out against the American invasion. A few tactless American incursions also aroused concern, but the government in Bonn took no action.[100] Like the other members of the European community, the West Germans welcomed, even sought, American capital. Attempting to channel foreign investment is a common policy among nation states, and in this respect Gaullist France was not unusual. But in the context of Western Europe in the 1960s, France was unique.

Can this Gallic resistance be attributed to the nature and magnitude of American investment in the hexagon? Was there a peculiarly strong American challenge in some objective sense? In fact, France received a smaller share of dollars than other Common Market countries did yet made the greatest effort at controlling them.

Direct American investment in France in the 1960s was comparatively modest in volume and limited in scope. After reaching a peak between 1961 and 1964, the rate of inflow slowed until 1969 when it resumed under Pompidou's presidency. By 1963, of total United States investment in the Common Market, 40 percent went to West Germany, 25 percent to France, and 15 percent to Italy.[101] By the end of 1967 the total value of direct United States investment in France was $1.9 billion, but this was much less than the amount (in billions) in Great Britain ($6.1) or in West Germany ($3.5), and not much above that in Italy.[102] On a per capita basis France was about average for the European community.[103] At the sectoral level dollars may have been focused on French growth sectors, but levels of control were no more concentrated than in West Germany and elsewhere within the Six.[104]

While the rate of American investment in France slowed in the mid-1960s, it continued to grow elsewhere in Western Europe, at least until 1966. In 1958 France and West Germany received dollars at about the same level but a gap steadily opened so that in 1965 France received only $163 million and West Germany $349 million. In the decade 1959–69 the distribution of American capital among the Six shifted to France's disadvantage.[105] By 1969 only one of five dollars invested in the community went to France.

How much of this fall resulted from the Fifth Republic's restrictive policy is difficult to assess. But it seems likely that the selective policy had a considerable effect on restraining capital flow.[106] The shift to a more pragmatic approach in 1966 was too late, given the deceleration of American investment in 1967–68, to have much effect. In the end Gaullist policy deprived the French economy of valuable capital, technology, and research facilities.

If the American challenge involved no greater quantity of dollars in France than elsewhere, then it seems fair to conclude that the Gallic response was a matter of perception and politics. De Gaulle initiated and led, but the French public accepted the need for control.

President de Gaulle's motives in resisting the American investment challenge were primarily political. At risk was French control over its economic future. The timing and development of policy in this area correspond to the contours of the president's grand policy toward ending the American "protectorate." Resistance emerged in 1962–63, peaked in 1964–67, and then receded. In 1966 de Gaulle set aside politics and accepted economic priorities when he allowed Michel Debré

to pursue a less restrictive, and more successful, course in screening American capital. But this was a tactical concession toward a strategic political goal. For in welcoming American investors, de Gaulle was trying to close the economic and technological gap with France's competitors in order, one day, to possess the capacity to behave independently. The Americans could remedy the very weakness that made the French dependent.

In resisting the dollar, de Gaulle employed both a French and a European strategy. When his European partners proved uncooperative, he tried a French solution. But in whatever direction he looked, he encountered restraints. At home there was the weakness in industrial structures and capital markets that forestalled French alternatives to American incursions. From the European community came legal, diplomatic, and economic restraints that instead of serving the Gaullist policy of independence obstructed it. Ironically de Gaulle's initial decision made in 1958 to spur French growth through a strategy of international competitiveness via interdependence with Europe denied him the capacity in the 1960s to employ national solutions. In the end Europe gave de Gaulle no help in meeting the challenge of American investment and helped dismantle French schemes at channeling it. Denied either a national or a European solution, de Gaulle and the Gaullists moved toward accepting American transfers.

Resisting the American challenge remained the Gallic consensus even after the end of de Gaulle's presidency, but the conception and answer to the problem evolved. American subsidiaries still stirred French fears of dependence and economic decline. But American investments were now welcomed because the need for modernization took precedence over fear of outside takeovers. Economic priorities precluded a restrictive policy that blocked foreign investment. Outside investment was beneficial; if France was to meet the American challenge, it would do so not through selection and protection but through more competitive French manufactures. Thus the way out was for the French to adopt American ways, for example, to import dollars, management techniques, and technology, as well as to foster mergers and homegrown research that would allow France to stay abreast of and maintain independence from the Atlantic colossus. Even a more open society free of the rigidities that obstructed the free movement of resources might be necessary. Just as de Gaulle himself by 1967 continued to complain about the dollar but accepted economic priorities, so French attitudes moved toward accepting American investment

and, more important, certain American techniques, as means of resistance and independence. Both Gaullist policy and consensus advanced toward a more pragmatic and less politicized stance that incorporated a certain measure of Americanization. The outcome of the controversy over the American challenge in the 1960s was, paradoxically, to bring France and the United States closer together.