Capital Markets and the Keiretsu

The maintenance of the central position of the group banks was ensured by the postwar economic reforms pushed by the U.S. occupation, which

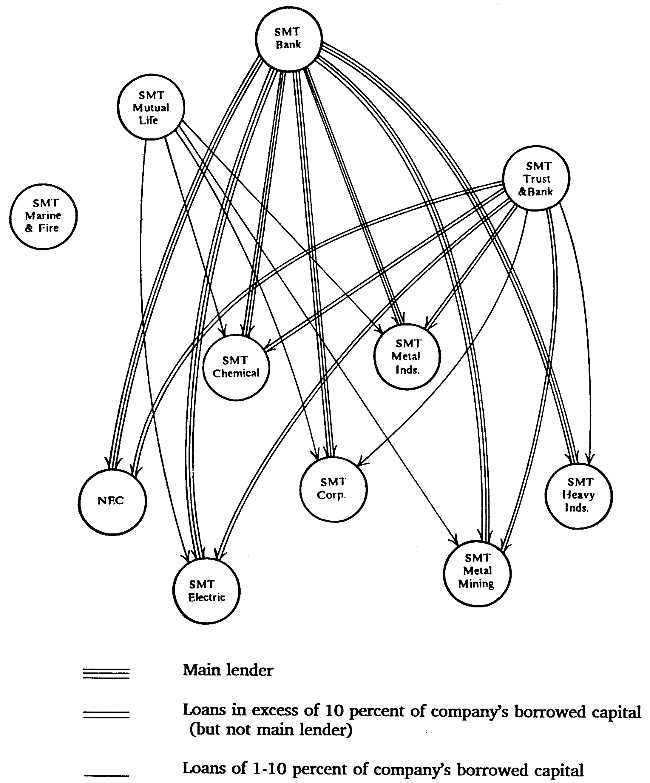

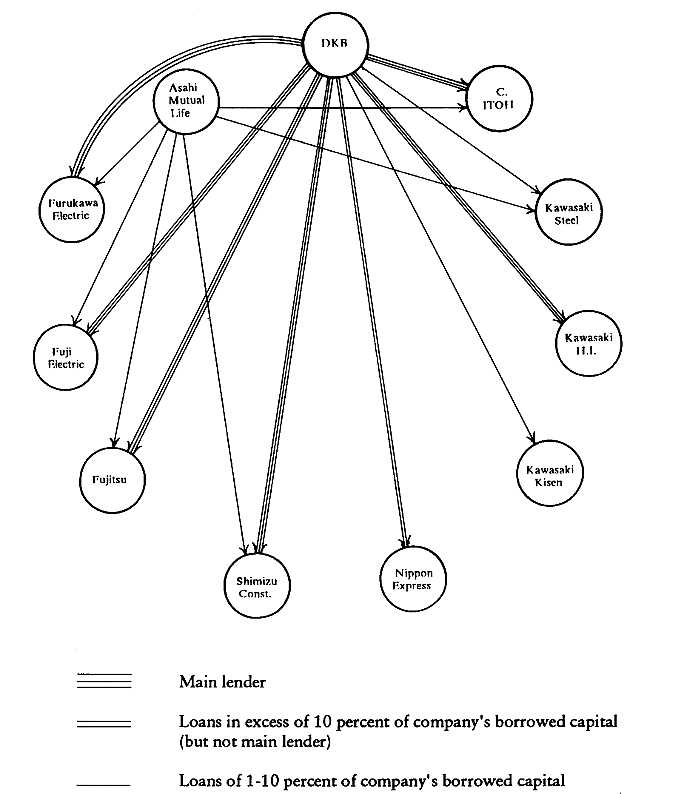

broke up the zaibatsu holding companies but not the zaibatsu banks. As a result and in conjunction with the Japanese government's policy of allocating scarce capital to the city banks through its own financial organs, these city banks reinforced their importance as the leading sources of capital for group companies and were in a position to give preference to their own long-standing clients. Groupings formed around these banks as companies were willing to forego a degree of independence in order to gain access to scarce-but-needed capital, particularly during the economic resurgence in the mid-1950s. Today we find that the large city banks associated with the six big intermarket keiretsu are the main banks for virtually all of their group companies, while other group financial institutions play an important secondary position. Figures 4.1 and 4.2 depict these relationships for the leading companies in two groups, Sumitomo and Dai-Ichi Kangyo Bank.

While the existence of close banking relationships is readily apparent in these figures, it is possible that strong banking ties exist among keiretsu firms and financial institutions in other groups as well. In order to evaluate this possibility, a transaction matrix was created for the two hundred industrial firms in our sample, based on the percentage of capital coming from firms' top-ten lenders broken down by group affiliation. These results are reported in Table 4.1 for the year 1986.

The boldface figures along the diagonal show the extent of internalization of borrowed capital to financial institutions in the same group. As we see here, intra-group capital proportions range from a low of 23.3 percent for Dai-Ichi Kangyo industrial firms to a high of 42.8 percent for Mitsubishi firms and 42.4 percent for Sumitomo firms. Most of the remaining debt capital for each group firm comes from "independent" financial institutions-an amalgamation of smaller commercial banks and insurance companies, as well as long-term credit banks. Capital linkages to financial institutions in other keiretsu account for a much smaller share of the total in each group. No single group is the source of more than 10 percent of the total capital borrowed by any other group, and in the case of Sumitomo group borrowing, the figure is zero in three cells (i.e., none of these ten companies count a Fuji-, Sanwa-, or Dai-Ichi Kangyo-affiliated financial institution among its top-ten creditors). It becomes quickly apparent from the transaction matrix that the hypothesis of substantial across-group ties in the loaned capital market does not hold for the shacho -kai firms in the sample.

The extent of bias toward affiliated financial institutions can be understood through a simple derivative measure, the preferential transaction ratio. This is calculated by dividing the share of same-group transactions

Fig. 4.1. Intragroup Borrowing Dependency of the Leading Companies in the

Sumitomo Group. Source: Data from Industrial Groupings in Japan (1982). Note: SMT = Sumitomo.

by the average for those in each of the other five groups. While internalization points to the absolute proportion of borrowing coming from one's own group, the preferential transaction ratio looks specifically at intra- versus intergroup relationships and the possibility not only that firms prefer to borrow from their own group but also that they prefer to use banks outside the other keiretsu (e.g., the Industrial Bank of Japan)

Fig. 4.2. Intragroup Borrowing Dependency of the Leading Companies in the Dai-Ichi

Kangyo Bank Group. Source: Data from Industrial Groupings in Japan (1982).

Note: DKB = Dai-Ichi Kangyo Bank; H.I. = Heavy Industries.

for their nongroup capital. In total, firms in the six big keiretsu are about 15.1 times more likely to borrow capital from financial institutions in their own group than from those in another group. What this ratio makes clear is that the identity of keiretsu affiliation is itself important in defining patterns of transactions.

Next we consider the role of the keiretsu in organizing Japanese

TABLE 4.1. TRANSACTION MATRIX FOR | ||||||

Affiliation of Industrial Borrower | ||||||

Affiliation | Mitsui | Mitsubishi | Sumitomo | Fuji | Sanwa | Dai-Ichi Kangyo Bank |

Mitsui (3) | 39.5 | 1.9 | 1.0 | 1.8 | 2.5 | 7.1 |

Mitsubishi (3) | 1.0 | 42.8 | 2.9 | 4.3 | 4.8 | 4.5 |

Sumitomo (3) | 3.0 | 3.5 | 42.4 | 5.3 | 1.6 | 4.2 |

Fuji (4) | 0.5 | 0.7 | 0.0 | 26.6 | 8.9 | 3.2 |

Sanwa (2) | 1.0 | 0.5 | 0.0 | 30.0 | 32.2 | 6.8 |

Dai-Ichi Kangyo Bank (2) | 5.8 | 4.0 | 0.0 | 8.1 | 4.9 | 23.3 |

Other Banks (29) | 49.2 | 46.5 | 53.8 | 51.0 | 45.0 | 50.9 |

Total | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

SOURCE : See Appendix A. Note: Figures represent percentages among the top-ten lenders only. Number of sample companies is given in parentheses. Owing to rounding, columns may not add up to 100%. | ||||||

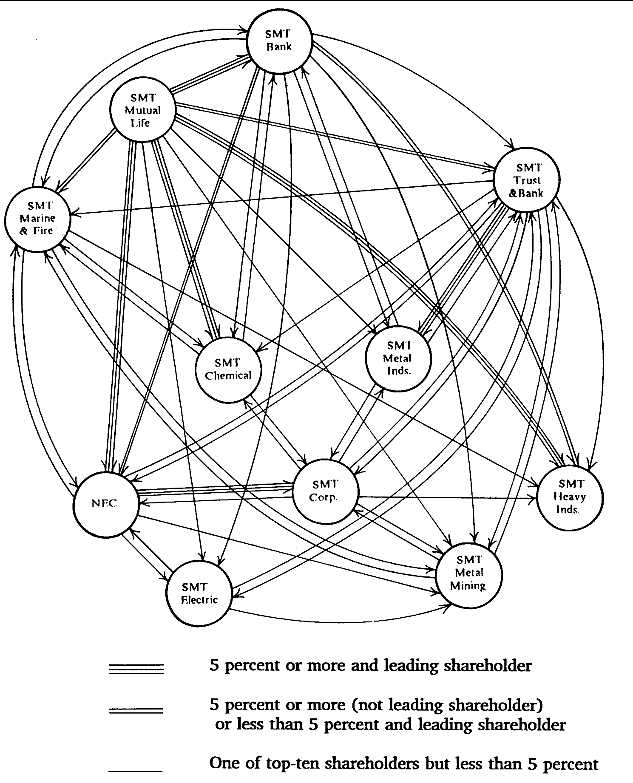

Fig. 4.3. Stuck Crossholdings of the Leading Companies in the Sumitomo Group

(Top-Ten Shareholdings Only). Source: Data from Industrial Groupings in Japan (1982). Note: SMT = Sumitomo.

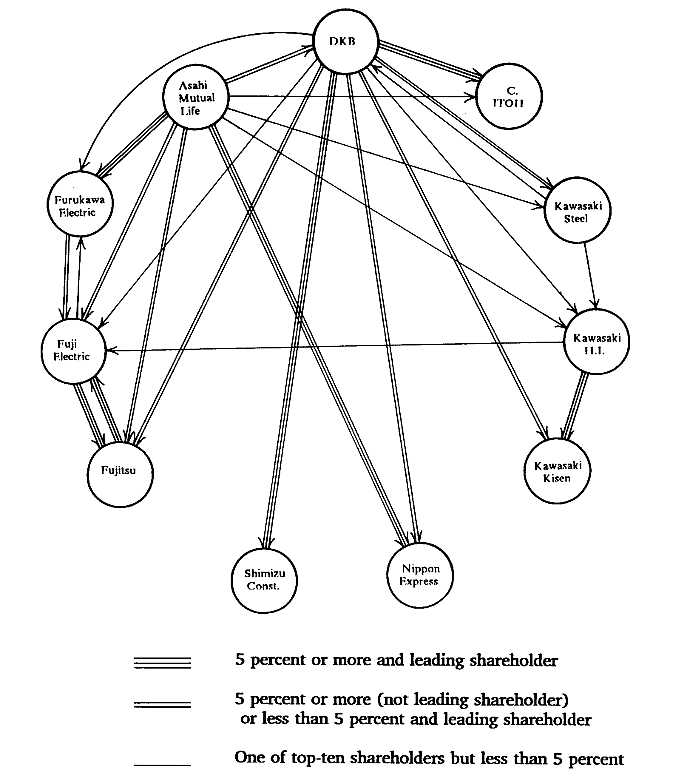

equity markets. Specific patterns of share crossholdings are shown in Figures 4.3 and 4.4 for the leading companies in the Sumitomo and Dai-Ichi Bank groups. The network of crossholdings among the eleven Sumitomo firms shown here is extremely dense, with 71 percent of the possible connections actually constituted.[12] At least four of the top-ten shareholders among each of these firms are other companies in the

Fig. 4.4. Stock Crossholdings of the Leading Companies in the Dai-Ichi Kangyo

Bank Group. Source: Data from Industrial Groupings in Japan (1982).

Note: DKB = Dai-Ichi Kangyo Bank; H.I. = Heavy Industries.

group. The pattern that emerges for the Dai-Ichi Kangyo group is substantially different. Historical connections across the group as a whole have been largely through a single firm, Dai-Ichi Kangyo Bank. The current group is the amalgamation of several smaller groups that had associations with the former Dai-Ichi and Nippon Kangyo banks. Asahi Mutual Life, Furukawa Electric, Fuji Electric, and Fujitsu were all part of the smaller prewar Furukawa zaibatsu and maintain within the larger Dai-Ichi Kangyo group a subset of close relationships, with five of the six

possible connections completed. Among the three firms associated with the Kawasaki zaibatsu-Kawasaki Steel, Kawasaki Heavy Industries, and Kawasaki Shipping-two of the three possible connections are completed. Overall density of the group is 40 percent.[13]

The leading eleven companies[14] within the other two zaibatsu groups, Mitsubishi and Mitsui, have densities of 69 percent and 58 percent, respectively, while the density in the Fuji group is 49 percent and that in Sanwa 45 percent. These findings conform to popular accounts of the cohesion of the various groups. Sumitomo is widely viewed to be, along with Mitsubishi, the most cohesive of the groups. Conversely, the three bank groups are all viewed as more loosely organized than their zaibatsu counterparts.

Table 4.2 shows the transaction matrix for shareholding among the financial and industrial firms in our sample in 1986. Internalization to own-group firms among companies' top-ten shareholders is over 25 percent for all six keiretsu and over 50 percent in the three zaibatsu groups. Shareholdings across keiretsu, in contrast, are generally small or nonexistent. Among shares issued by Sumitomo group companies, for example, less than 3 percent are held by Mitsui, Mitsubishi, Fuji, or Dai-Ichi Kangyo group firms. Equity control is, to a large extent, located among shareholders in the same group. Not surprisingly, preferential transaction ratios are also high. In total, companies in the six groups are 12.8 times more likely to have their shares held by other firms in the same group, a figure nearly as high as for bank borrowings.

It appears from these results that the keiretsu continue to be a major source of both debt and equity capital for their affiliated firms. As recently as 1986, these data demonstrate, shacho -kai member firms and particularly those in the ex-zaibatsu rarely cross boundaries to establish major equity or borrowing positions with firms in other groupings.