SIX

Estimating Costs of Alternative Electric Power Sources for California

Walter J. Mead and Mike Denning

I. INTRODUCTION

The purpose of this chapter is to evaluate alternative electric power sources that will be available to the state of California in the next decade. The evaluation will be based on a conventional social benefit-cost analysis. We will draw on electricity supply-demand forecasts prepared by the California Energy Commission (CEC). These forecasts indicate that California "can meet all of its needs for electricity until the late 1900s" (California Energy Commission, 1987, p. 19). The alternative electric power sources we will evaluate will be imports from the Pacific Northwest, including British Columbia, imports from the Southwest, and new electric power sources that might be developed within California.

Forecasting energy demand and supply is not as simple as it was before the 1970s. At that time, prices for electric power fuel sources were relatively stable, resulting in relatively stable prices for electric power. Economic growth and population expansion produced steady growth in electric power demand at about 7% annually, enabling utilities to efficiently plan new power plant construction to meet demand expansion. The oil price revolution that began in the early 1970s brought these easily predictable conditions to an end when crude oil prices increased from about $3.25/barrel in the early 1970s to $39/barrel in February 1981. With similar price increases for substitute fuels, electric power prices increased and electricity consumption growth rates tumbled to about 2% by the early 1980s. Capital costs for new electric power generating plants also increased sharply in the mid and late 1970s. By July 1986, the price of U.S.-produced crude oil had fallen to $9.25/barrel, then nearly doubled to about $18/barrel by 1988. If oil and gas prices remain at or below present levels for several years and if no new generating

plants are built and qualifying facilities (OF) overpayments are eliminated, then electricity prices are likely to remain stable. In this event, growth rates for electric power consumption are likely to rise above 2% and return toward their pre-1970s levels, and California will need both new generating capacity and energy supplies well above those forecast by the CEC.

II. THE CALIFORNIA ENERGY COMMISSION SUPPLY-DEMAND FORECAST

The CEC and California public utilities face formidable problems as they attempt to estimate future electric power demand and supplies. Before the energy price revolution of the 1970s, with its induced demand shifts (conservation), supply-demand forecasting was a relatively simple matter of projecting past trends. In 1970 electric power was supplied from relatively static sources. In order of importance for the United States as a whole, they were coal, 49%; natural gas, 23%; hydro, 17%; oil, 10%; and nuclear, 1%. In California, oil and gas were the dominant energy sources, together accounting for 70% of the state's electric power generation. Coal combustion was not a source in California electric power generation. Nationally, coal prices were relatively stable. They were essentially constant from 1957 to 1967, when they started to increase at a 12.3% compound annual rate (nominal terms) through 1970.

U.S. residential electric power rates (nominal) were identical in 1940 and 1970, with only minor variations in the 30-year interval. Real prices (adjusted by the Consumer Price Index) declined by 64% from 1940 to 1970, a 3.3% compound annual decline rate. Given a 3.9% rate of increase in the real GNP over this period, one should expect a rapid growth rate in electricity consumption. Consistent with this expectation, electric power usage in the United States increased at an 8.6% rate over the three decades from 1040 to 1970.

In late 1972 oil prices started their upward spiral and, with a lag, produced major reductions in energy-use growth rates. Residual fuel oil prices started a tenfold increase in the last quarter of 1973. Electric power price increases followed with a lag of one or two years. These latter price increases continued into the mid-1980s, causing additional market-motivated conservation. Such dynamic changes suddenly made forecasts based on simple linear projections of past trends in electric power consumption virtually useless and required a new forecasting methodology in which sharp price increases and related changes in economic growth rates, as well as substitution of both old and new electric power generating technologies, would be taken into consideration. Finally, federal and state public policy became an important factor in determining electric power supply and demand.

In 1971 California public utilities projected electric power demand growth through 1980-1985 at a 7.38% annual rate, a reasonable projection given information available to the utilities in 1971. However, rapidly rising energy prices from 1972 through 1980 made this projection increasingly unrealistic. Average U.S. electric power prices (nominal) increased 3.4 times from 1973 to 1985 for a 10.8% compound annual rate. Real prices increased at a 3% annual rate. As should be expected, these rapid price increases caused electric power consumption growth rates to decline sharply. From 1975 through 1987, U.S. electric power consumption (with a two-year lag behind prices) increased at a modest 2.9% annual rate, and the growth rate declined progressively over this 12-year period. Reflecting this price-inspired conservation and (possibly) policy-enhanced trend, the CEC projected a declining electric power growth rate for California through the year 2005 in its December 1986 electricity demand study, as shown in Table 6.1.

However, the CEC electricity price forecast shows that the upward trend in electricity prices, which produced the observed decline in consumption, is expected to peak in 1988 and decline thereafter through the year 2005. Table 6.2 gives these projections, together with historical prices. Real prices increase at a 2.8% annual rate from 1977 through 1988 and then are forecast to decline at a 0.8% annual rate from 1988 through the year 2005.

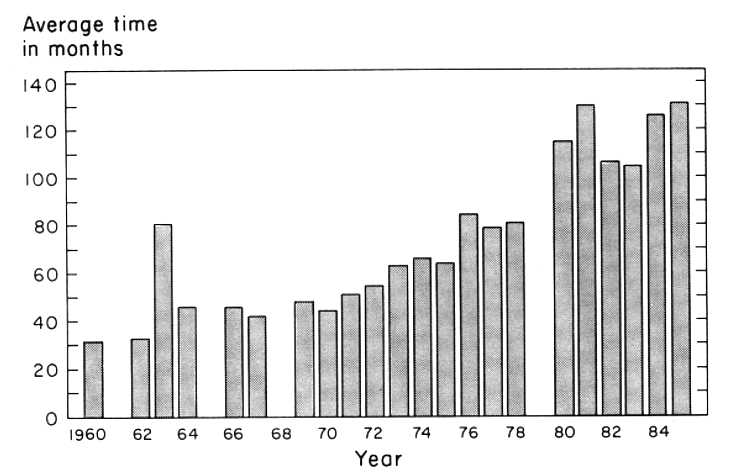

Thus, although rising real electricity prices caused growth of electricity consumption to decline from about 7% annually before the 1970s to about 2% by the early 1980s, the CEC asserts that real energy prices will decline after 1988, but the rate of increase of energy consumption will continue to fall, as shown in Table 6.1. From an economic perspective, this CEC conclusion is difficult to accept. Instead, declining real prices should lead to increasing consumption growth rates toward, but not necessarily reaching, the 7% long-term growth rates realized before the energy crisis years. In fact, electric power consumption growth rates already show very sharp increases. Table 6.3 shows that twelve-month growth rates by month have increased to over 5% beginning in January, 1988. This matter is a serious one for California consumers of electric power. If electricity consumption growth rates are underestimated by the CEC and the actual growth rate turns out to be 3% between 1990 and 1997 instead of the 1.98% forecast by the CEC, then instead of meeting all electricity needs, we will suffer a shortage of about 13 billion kilowatthours. This shortage is the equivalent of about two nuclear plants of Diablo size (1100 MW operating at 75% capacity). Given the extremely long time period required to build new generating plants in California (construction of Diablo required 15.5 years), there will be no opportunity to construct efficient plants. Short-run solutions that are costly for ratepayers are likely to be sought as the only way out.

The CEC assessment of the need for new electric power supplies does not adequately consider the important economic forces that determine supply of and demand for electric power. The assessment gives little weight to electricity prices as primary determinants of electric power demand. Ignoring price implies supply and demand curves as shown in Figure 6.1.

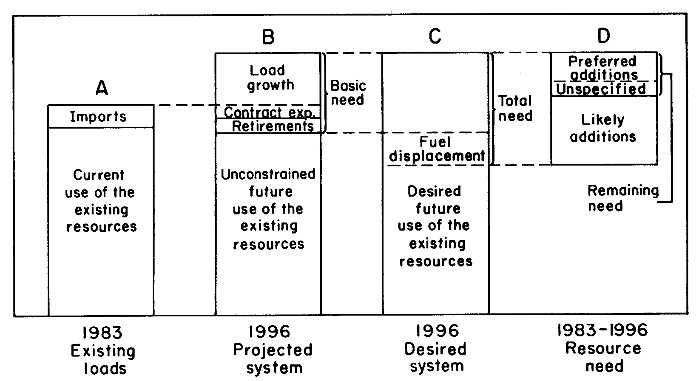

The CEC 1985 electricity report "assessed" 1996 demand and supply, then subtracted one from the other, and arrived at shortage estimates for both generating capacity and energy in that year. Figure 6.2 shows the CEC forecast methodology in more detail: Starting with the 1983 actual load, the commission drew upon individual load growth forecasts provided by the state's utilities. The commission staff and commissioners reviewed and modified these forecasts to conform with their judgment.

Electric power supplies expected to be lost between 1983 and 1996 due to contract expiration (imports from the Pacific Northwest and the Southwest) and retirement of existing plants were subtracted from 1983 supplies and a difference identified as the basic need was calculated. This basic need appears to be independent of electricity prices.

In its 1981 biennial report, reaffirmed in 1983 and again in 1985 and 1986, the CEC determined that "after 1991 no more than one-third of the state's electricity generation (in GWh) should be fueled by oil or natural gas" (California Energy Commission, 1985a, p. 65). Accordingly, the 1996 supply assumptions show a reduction due to fuel displacement. The basis for the CEC policy of reducing oil-based electric power production is twofold: (1) a fear of another supply disruption and (2) expected crude oil price increases. In its 1985 energy plan, the CEC wrote, "Assuming no future oil supply disruptions, oil prices are expected to show average increases greater than inflation for the next 20 years" (California Energy Commission, 1985b, p. 20). This forecast was redefined in the CEC May 1986 energy demand report, which forecast that oil prices (real) would increase at a 3.1% compound annual rate for 1986 through 2005 (California Energy Commission, 1986a, p. B-8).

Regarding the supply disruption fear, the West Coast has what is commonly called the West Coast oil glut, a condition that started in 1977 with the flow of oil from Alaska's North Slope, constrained by a federal government ban on its export. The supply of oil available to West Coast refiners has recently averaged about 3 million barrels/day, while West Coast refinery crude runs are limited to about 2.2 million barrels/day. Thus there is an excess of about 0.8 million barrels/day that is disposed of by shipping or piping it through Panama and then into the Gulf of Mexico refining area. The last supply disruption experienced by the United States occurred in late 1973 as a result of the Arab-Israeli war. During a four-month period, the Arab members of OPEC imposed an

embargo on sales of crude oil to the United States, an action that reduced the world supply of oil by 6.6% (3.7 million barrels/day). At that time, neither the United States nor other large oil importing nations maintained stored reserves to compensate for an imposed disruption. However, the large importing nations now have some reserve capacity to offset the effects of an embargo. The U.S. Strategic Petroleum Reserve (SPR) alone has stored reserves amounting to 545 million barrels as of March 1988 (U.S. Department of Energy, 1988, p. 41). A supply disruption similar to the only one of consequence ever experienced by the U.S. would have no significant direct effect on West Coast crude oil supplies unless federal government regulations forced a reallocation of crude oil out of the West Coast.

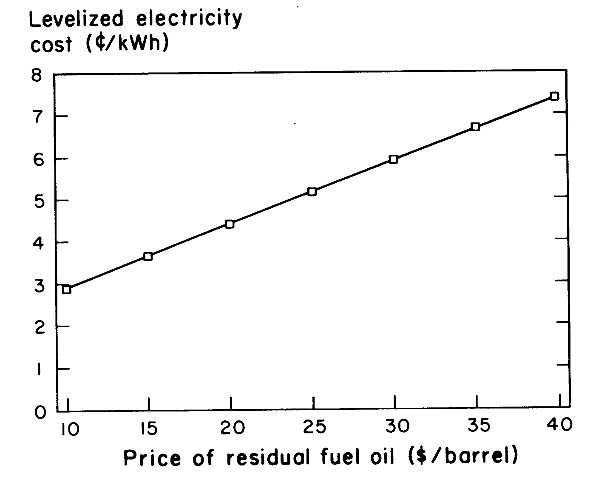

Regarding the oil price issue, crude oil prices reached $39/barrel in February 1981, four years before the CEC 1985 energy plan was issued. As of January 1986, crude oil prices had fallen from their $39/barrel peak to about $21.46/barrel, a decline of 45%. From January 1986 through January 1988, instead of rising, crude oil prices (nominal) declined another 34% to $14.17/barrel (FOB cost of imports). Real prices for crude oil declined even more. The CEC policy regarding oil use in power generation was flawed not only in its incorrect price forecast, but also because of an essential distinction between baseload and peak load use of oil and gas energy sources. Capital costs of oil and gas plants for peak load power generation are relatively low, and oil or gas used in existing plants might be the least-cost source of meeting additional peak power demands. As a baseload source, oil and gas were certainly uneconomic at prices prevailing at the time of the 1985 policy statement. However, at less than $20/barrel for crude oil and approximately the same price for residual fuel oil, oil-fired electric power generation becomes worthy of consideration even for baseload power generation. This point will be discussed more thoroughly below.

The supply forecast was augmented by power supplies from likely additions. These additions consist of likely imports of power from the Pacific Northwest and the Southwest, plus projects that have been completed since 1983, are under construction, or are in various stages of CEC and/or California Public Utilities Commission (CPUC) approval.

The assessments outlined above leave a remaining 1996 energy need of 28,235 GWh of energy (6,349 MW of capacity). This gap may be filled by favored energy sources that have been reserved by the commission. Table 6.4 lists these reserved sources.

The commission makes clear that it will use its power to override the market and the judgment of utility companies to protect and advance its favored power sources. Its electricity report specifies that "only those resources for which the Commission wants to provide preference will have

an unfilled reserved need as of the adoption of this report. . . The Commission can clearly control approval of projects in its siting process that seeks to fill reserved need amounts, but must influence the decisions of other permitting authorities to encourage only those resources that provide the preferred mix that the Commission determines best meets state needs" (California Energy Commission, 1985a, pp. 76-77).

The projected 1996 deficit of 6,349 MW of capacity is approximately equal to three nuclear power plants of the Diablo Canyon size class.[1] Whether this deficit will be filled by the sources preferred under the commission preference system is doubtful. First, 26% of that capacity is reserved for unspecified sources preferred by the commission. The remaining 74% would be forthcoming only if investors or decision makers conclude that the required investments would be relatively profitable. Most of the new in-state sources preferred by the CEC, including solar and wind generation, are uneconomic in the absence of government subsidies, as will be shown below and in Chapter 9. As the prices of oil and gas fall, alternative sources of electric power become less attractive. In the cases of both wind and solar power, the commission specifically notes that "the Commission's preference is for more than is estimated to develop" (California Energy Commission, 1985c, pp. 3-25). Even if the physical supply is forthcoming, the commission should have more concern for the costs that California consumers are required to pay.

As state and federal government subsidies are allowed to expire, the commission's preferred sources are not likely to fill the gap projected by the CEC for 1996 and beyond. In that event, plans should be made relatively soon to meet the projected electric power demand in the late 1990s. We now turn to an examination of the alternative electric power sources for California from both imports and development of new instate electric power sources.

III. POTENTIAL IMPORTS FROM THE PACIFIC NORTHWEST AND SOUTHWEST

Of the many possible future sources of electric power for California, importation of the large surplus of electric power from the Pacific Northwest and Southwest is potentially among the least costly. The cost of such imports depends on (1) intertie access policy and (2) Bonneville Power Administration (BPA) rates. The Northwest and its large network of hydroelectric generation sources has regularly had surplus electricity available for sale during times of heavy rainfall or runoff from snow-melt—typically during the spring and summer months. In the past few

[1] The two units in the Diablo Canyon facility have a total capacity of 2,190 MW.

years, however, a number of circumstances have led to a large surplus of electricity year round. That surplus is expected to last at least into the early 1990s and possibly until the end of the century.

In the Southwest anticipation of continued rapid population growth rates through the 1970s led to the construction of several new baseload coal-burning plants. In both the Pacific Northwest and the Southwest, growth in demand has been less than anticipated due to higher electricity prices and the 1980-1982 recession. Surplus generating capacity has consequently become available for California markets. The first five rows of Table 6.5 give the record of imports from each region.

The electric power imported from these regions is of two basic types—firm and nonfirm. Firm energy is electricity that is guaranteed to be delivered under contract. Nonfirm energy, on the other hand, is power that can be purchased only temporarily, according to its availability. Hydropower systems, such as those in the Pacific Northwest and the Hoover area in the Southwest, produce large amounts of nonfirm energy, because "critical water years" are used to plan for regional electricity loads, ensuring that even in a year with subnormal precipitation, utilities will be able to meet their local load requirements. Therefore, given normal precipitation levels, surplus nonfirm energy will exist year round, becoming particularly abundant in late spring and early summer as rivers swell due to mountain runoff. Available supply also depends on the relationship of storage volume to runoff volume. The Pacific Northwest stores only about 30% of its annual average runoff.

Firm capacity imports refer to purchases, exchanges, and entitlements to energy, from either utilities or specific generating units in other regions. Firm energy imports refer to purchases, under contract, of specified amounts (measured in kWh) of planned surplus energy from utilities in other regions. It should be pointed out that just because energy or capacity is labeled firm, it is not guaranteed to be delivered in all instances. The actual amount of power delivered under such contracts depends on the status of both the transmission system and the specific generating unit(s) from which the power is promised. Most interutility electricity sales are system sales. Because of the very small probability that a utility system will not be able to support a power contract, system sales are firm for planning purposes. On the other hand, power purchased from a qualifying facility2 (QF) is unit-specific and less reliable because it is not deliverable if the generating plant in question is unavailable. In some cases the importing utility is required to pay for contracted

[2] A qualifying facility (QF) is a small power project (generally less than 80 MW capacity) that is not owned by a public utility and meets efficiency standards established by PURPA and the FERC. Cogeneration plants may be included even if their capacity exceeds 80 MW.

power even if such power is not delivered. Therefore the prices bid for such energy and capacity reflect the estimated probabilities of transmission system and/or plant failure.

From a California perspective, firm energy is, when available, the most valuable of these two types for several reasons. If firm power can be purchased at prices below those of a utility's alternative power sources, the use of (formerly) expensive oil- and gas-fired peak load generating facilities may be avoided. In addition, long-term firm power is valuable to the extent that its availability allows California utilities to delay construction of costly new generating facilities. Nonfirm energy, although most plentiful (from the Pacific Northwest) during California's peak energy demand in the warm summer months, is least valuable because its delivery is not guaranteed, thus requiring backup sources of generating capacity to be maintained and run in years when nonfirm energy is unavailable.

Because firm power from the Pacific Northwest commands a higher price than nonfirm power and its availability can be planned, private utilities in the PNW prefer sales of firm power. Accordingly, Pacific Northwest utilities are attempting to firm up their generation system, through water storage and new generating techniques.

Pacific Northwest Imports

California utilities have regularly imported surplus power from the Northwest, but a majority of these transactions have been for nonfirm energy. Table 6.6 summarizes electricity imports from the Pacific Northwest for 1976-1985. Utilities in California and the Pacific Northwest are currently trying to make arrangements to capture more of the potential benefits from sales of surplus power by exploiting the current price difference and taking advantage of the differing seasonal demand patterns in each region. California utilities face their highest demand for electricity in the hot summer months, while the Northwest faces its peak demand in the winter when California demand is low. Consequently, both regions could reduce their required peaking capacity through exchange agreements whereby each imports peaking capacity during its peak season, repaying that electricity during the other's peak season.

The Northwest Power Planning Council (NWPPC) has suggested a number of strategies for maintaining the financial health of that region's electric power industry (Northwest Power Planning Council, 1985). These strategies include the development of a regional conservation plan, more efficient use of the hydropower system, reducing the load factor caused by aluminum industry cyclical demand volatility by increasing the interruptibility of this power, and the possible completion of two unfinished nuclear plants. Implementation of these measures

seems quite favorable for continued importation of power by California utilities.

Utilities in the Northwest and California are currently discussing long-term (15- to 20-year) contracts for firm electricity sales of approximately 1,500 MW of surplus capacity to California utilities (Bonneville Power Administration, 1983, p. 9). Based on existing and planned future construction, the NWPPC projects a surplus of 2,300 MW, which could last from 5 to 20 years, depending on load growth in the region. Rows 6 through 8 of Table 6.5 show California's projected imports from both regions through 2004. Actual levels will depend on transmission constraints, resource availability and prices, and the ability of California markets to absorb additional imports.

Another source of energy likely to be available for importation into California is British Columbia Hydro and Power Authority. B.C. Hydro has tremendous developed and potential electric power supplies and, with actual Canadian demand less than forecast, is anxious to increase revenues by exporting surplus electric power. In addition, the provincial government is currently proposing that B.C. Hydro build projects to generate power dedicated solely for long-term firm export to the western United States. Another advantage is that B.C. Hydro draws much of the water for its hydroelectric generating facilities from areas unconnected with the sources of Pacific Northwest water. Consequently, a poor water year in the Pacific Northwest may not affect exportable energy from B.C. Hydro. Also, B.C. Hydro's capacity to store water is much greater than that of Pacific Northwest utilities, creating attractive possibilities for firm sales with increased supplies in the late autumn and early winter when the Pacific Northwest normally has little or no surplus. Based on its 1983 load forecast, B.C. Hydro is expecting energy surpluses of about 10,000 GWh currently, declining to approximately 800 GWh in 1996-1997 (see Table 6.7). Given average water conditions, these surpluses may be even larger by as much as 4,000-4,500 GWh/year.

The major obstacle B.C. Hydro faces in exporting power to California is a lack of transmission capacity. Existing capacity to the intertie system at the U.S./Canada border is 2,000 MW, which could be increased 300-400 MW at a nominal cost. Due to BPA's current intertie access policy, B.C. Hydro has last priority on use of the intertie. One way in which B.C. Hydro can circumvent this constraint is by selling water to BPA, who then generates power and sells it over the intertie. BPA can also sell power to the Pacific Northwest if the demand exists, allowing Pacific Northwest utilities the option of reselling this displaced power in California markets. BPA is currently blocking these purchases. If B.C. Hydro is afforded greater use of the intertie, it would consider building a large hydro project (Peace Site C) earlier than its proposed 2002 startup

date. This would increase exportable capacity by 900 MW (4,500 GWh of energy) (British Columbia Hydro, 1985). Currently, utilities from California, the Pacific Northwest, and British Columbia are jointly studying the feasibility of the Peace Site C dam. If the assessment is favorable, it appears that BPA's long-term intertie access policy will allocate a much larger portion of intertie capacity to B.C. Hydro. This would make possible the purchase of large amounts of valuable long-term firm energy from B.C. Hydro by the early 1990s.

Any electricity transferred between these regions must travel over the Pacific Northwest-Pacific Southwest Intertie. This network consists of one dc and two ac transmission lines that run from northern Oregon to southern California. The total carrying capacity at present is 5,790 MW. Plans to further upgrade the system by building an additional ac line are currently under the process of review for certificate of convenience and necessity. This line would raise the carrying capacity by approximately 1,600 MW at a cost of $450 million in 1968 dollars (l.4¢/kWh) (California Energy Commission, 1986b, pp. 5-19 — 5-20).

In the past few years, the price of imports from Pacific Northwest utilities has risen from 0.5¢ to 2.3¢/kWh, due mainly to BPA's intertie access policy, which has reduced competition and eliminated the low spill rates formerly applied during very high water levels.[3] Because future rates have not been firmly established, there is some speculation as to whether California will continue to import enough power from the Pacific Northwest to justify construction of this additional line. Barring additional long-term quantity and price commitments for both firm and nonfirm energy, it appears unlikely that the expenditure for any transmission capacity upgrades will be economically justifiable. The intertie expansion issue appears to be a "Catch 22" situation—without assurance of available transmission capacity, buyers and sellers are reluctant to enter into sales contracts, but without transmission contracts, funds for expansion of the intertie are unlikely to be available.

In addition to its existing capacity, the Pacific Northwest has two nuclear plants that were slated for completion in the mid-1980s but that have been delayed due to existing surplus capacity in the region. The NWPPC estimates that the present value of net benefits of finishing these projects is $630 million (Nucleonics Week, 1986). Construction on these plants, referred to as Washington Public Power Supply System (WPPSS) numbers 1 and 3, is scheduled to be restarted and completed when the need for additional capacity in the Pacific Northwest becomes apparent. These plants represent an additional 1,600 MW of generating capacity that could be available in the not-too-distant future. To date, $4.4 billion has been spent on these two projects, and the estimated in-

[3] Rather than spill excess water over the dams and lose potential revenues, Pacific Northwest utilities sold this power very inexpensively.

cremental cost to complete both plants is $2.76 billion (1984 estimate). The preservation costs are $52 million per year.[4] Given these figures, had construction resumed on plants 1 and 3 in 1988, the levelized cost (completion, operating, and finance costs) would have been around 3.7¢/kWh (Bonneville Power Administration, 1984). If construction were to resume at a future date, the levelized cost would be higher because of additional preservation and maintenance expenditures.

Although authorities in the Pacific Northwest are striving to bring about the completion of these plants, they face a number of problems in achieving that goal. BPA, the owner of these plants, does not plan to complete them as a source of exportable energy but will only consider completion if and when the Pacific Northwest region's load growth makes them economic and financing becomes possible.[5] Based on current supply-demand projections, the earliest that either plant could be on-line is 1992, with the most probable startup date being 1999.

California utilities might consider purchasing one of these plants for some share of the sunk costs and then completing and operating it with power dedicated to California. Because these plants can be completed by BPA and brought into use if regional loads grow faster than expected, they are valuable as options and probably would not be sold until they appear to be uneconomic for meeting future loads in the Northwest. Whether such a transaction takes place is likely to be decided on political bases, regardless of the economic costs and benefits.

In the event that additional electric power supplies from the Pacific Northwest or British Columbia become available to California, further expansion of the intertie could become necessary. In addition to the aforementioned construction of an ac line from John Day Dam in northern Oregon, to Tesla, California, another proposed addition is a large dc line from Celilo, Oregon, to either Mead, Nevada, or Phoenix, Arizona. This project would add 2,000 MW of capacity to the system at a cost of approximately $1 billion (1985 dollars) (California Energy Commission, 1980). The transmission capital cost would then be 0.6¢/kWh (assuming a 35-year lifetime and a 5% real interest rate, and a capacity factor on the line of 60%). The cost of these transmission upgrades is relevant to the decision of whether developing new B.C. Hydro supplies or completing the WPPSS plants would be most economic for California utilities, because the total incremental cost of that energy delivered to California is the incremental production cost plus the incremental transmission cost.

The groups likely to be most affected by the outcomes of these negotiations are the ratepayers in the two regions. Pacific Northwest utilities

[4] Midpoint in the estimated range of $24 to $80 million per year.

[5] The estimated holding cost of this policy, excluding deterioration and obsolescence charges, is S81 million per year (assuming a 10% interest rate).

can maintain lower rates by taking advantage of seasonal diversity through power exchanges and supplementing their revenues with surplus power sales. By importing power at a price lower than other alternatives and covering the summer peak demand with power exchanges from the Pacific Northwest, California utilities will also be able to maintain lower prices and further delay capital expenditure for new capacity. In addition, if either one or both of the WPPSS plants were found to be uneconomic in the Northwest and were sold to California utilities, rates in the Pacific Northwest would decrease because payment of some portion of the sunk costs of the project would be required to gain ownership. If the plants (1 and 3) are not used or sold, Pacific Northwest rate-payers or financing interests stand to lose all of the costs accumulated up to that point.[6] Benefits to California ratepayers would be in the form of reduced electricity rates if the incremental costs of the power generated at these plants and delivered to California is less than alternative new baseload sources.

There are problems related to importing additional power from the Pacific Northwest. BPA is obligated to serve the utilities in its area before it can sell to others outside the region. A BPA agreement to supply firm power outside the region requires (by the Pacific Northwest Preference Act of 1964) a clause allowing the agreement to be cancelled with 60 days notice. The option to cancel reduces the value of this power, a point that California utilities must carefully consider before entering into contracts with BPA. Recently, BPA devised firm displacement rates to eliminate this problem. This innovation allows BPA to sell firm power to other Pacific Northwest utilities at a set price, enabling those utilities to individually sell short-run firm power and negotiate a higher price. This arrangement, along with the current intertie access policy, improves prospects for importing firm power from the Pacific Northwest. This development still fails to meet a California need for long-run firm baseload power to meet requirements around the turn of the century and later.

There are two operating constraints that also affect the ability of the California system to accept Northwest imports (California Energy Commission, 1984). First, utilities in California rely on gas- and oil-fired steam boilers for peak load requirements, a use for which these technologies were not designed. Many of these units cannot be taken from a cold shutdown to full output in a short period of time; they must be operated at some minimum level before being available to meet peak loads. This minimum generation requirement reduces the amount of gas and oil generation that can be displaced by imports, especially of nonfirm power, and thereby decreases the value of this power. Second, the addi-

[6] An estimated $3.86 billion in construction costs, plus all preservation costs accumulated up to the time the project is scrapped.

tion of several baseload nuclear plants in California and lower oil and natural gas prices have greatly decreased the variable cost of baseload generation. This has led to a situation in which even nonfirm deliveries from the Northwest (at about 2¢/kWh in 1988) have become more expensive than the variable cost of baseload sources in California. The value of Northwest energy is then dependent on the types of generating capacity it replaces and is further diminished when northern California has good rainfall, which increases the amount of low-cost hydroelectric power available within the state.

Currently, California's demand for Northwest imports to displace existing baseload generation is very small, whereas the demand for power to displace the more expensive oil and gas generation needed for peaking requirements is great. At previous oil and natural gas prices, firm energy could be purchased for a price one-fourth the cost of operating these peaking generators. This leads to further discussion of the benefits derived from importation of electricity (largely firm energy and capacity) from the Southwest.

Southwest Imports

Southern California utilities have been importing a large portion of their baseload resources from the Southwest for a number of years. These resources have come from jointly owned coal plants located in the Southwest, purchases of firm surplus capacity and energy from Southwest utilities, and firm purchases from federal hydroelectric facilities on the Colorado River. Lower-than-expected electricity demand in this region, due to a depressed mining industry, energy conservation, and the recent recession, has led to surplus generating capacity and nonfirm energy, especially in the Rocky Mountain states. California utilities are counting very heavily on this region as a source of continued future imports for at least the next 20 years, as is indicated by the projections listed in Table 6.5. The surpluses in the Southwest are a product of the large fluctuations in daily and seasonal loads, as well as the large base-load component of Southwest generating capacity.

The Arizona-New Mexico-West Texas area and parts of Colorado, like California, are summer peaking, whereas the Rocky Mountain states are winter peaking. More than 60% of the region's generating capacity is coal-fired, with 25% oil- and gas-fired generation. The total capacity is around 30,000 MW and the region's reserve margin in 1985 exceeded 35% (California Energy Commission, 1985d, p. 42). California utilities currently own shares in five Southwest area coal-burning plants and have plans to further increase their ownership in out-of-state coal plants in Nevada, Utah, and New Mexico, as well as nuclear plants in Arizona. These additions would more than double the currently existing

California-held capacity from 2,445 MW to 5,372 MW. California utilities are now buying firm capacity and energy from Southwest utilities, and additional firm contracts are being offered.

The fully allocated total costs of new Southwest baseload construction, including transmission costs, is between 5¢ and 7¢kWh (1985 dollars) (California Energy Commission, 1984). The variable operating costs of Southwest coal plants range from 0.4¢ to 1.6<0162>/kWh. Thus, if excess capacity exists, the relevant economic cost for export sales is quite low. The cost of Southwest nonfirm energy has been in the range of 1.1¢ to 4¢/kWh since 1980. Nonfirm energy costs in 1987 averaged 2.1¢/kWh. Low production costs in the Southwest, in the range of 1-1.4¢/kWh, could allow for further reductions in nonfirm prices, making them very competitive with Northwest prices.

The existing transmission network is adequate for firm energy transfers, but there have been problems in transferring the current levels of nonfirm energy. Recent studies recommend that simultaneous California import capacity (between the Southwest and Northwest) be reduced to correct problems encountered in transfers between Arizona and California. These problems, including loopflow,[7] are due to operation of the Pacific Northwest intertie at high levels and have in the past necessitated the reduction of southwest imports into California. Operation of the Southwest powerlink, a line between Arizona and southern California that was completed in 1984, and the IPP lines, which were completed in 1987, provides a near term solution to this problem. In the longer term, major upgrades of the transmission system may become necessary (California Energy Commission, 1984).

A major transmission project, Palo Verde-Devers #2, has been issued a certificate of public convenience and necessity. However, approval was granted on the condition that the CPUC would have to reconsider the need for the line if the proposed merger between Southern California Edison (SCE) and San Diego Gas and Electric were consummated. According to testimony submitted by Joe D. Pace on behalf of SCE in the FERC hearings on the merger, this line is currently scheduled to become available for commercial operation in June, 1993 (Federal Energy Regulatory Commission, 1989).

The addition of this capacity would raise total transmission capacity from the southwest of California from 5,700 to 6,900 MW. The Palo Verde-Devers line could relieve transmission problems that have, in the past, precluded the importation of considerable surplus energy from Colorado, New Mexico, and Utah. Recent forecasts show that the existing and planned transmission facilities should be able to accommodate the projected levels of nonfirm energy imports from the Southwest.

[7] Loopflow is unscheduled transfers occurring when electricity flows to an unintended part of the system, resulting in lost revenues.

Summary

Electric energy imports are expected to increase (see Table 6.5) in the short term as transmission capacity between California and both the Pacific Northwest and the Southwest increases, new generation facilities come into service, and load management and hydro system enhancement programs continue to be implemented. In the long term, however, importable energy is expected to diminish as demands in the source areas increase, new generating capacity is brought in at a slower pace in the Southwest, and normal precipitation patterns return to the Northwest. As economic prosperity and population growth continue over time, the demand for electricity in California will also increase. The combination of diminishing supply and increasing demand for electric power imports by California utilities will lead to a declining proportion of California's electricity requirements being filled by imported energy. This is not necessarily detrimental for California utilities as there is strategic value associated with in-state gas, oil, and (in the future) possible coal and nuclear generation. The natural gas and coal plants have value as a source of backup energy in the case of performance difficulties encountered with existing nuclear plants, intermittent wind or solar plants, or nonfirm imports. Thus the existence of these plants reduces the probability of California utilities having to make expensive emergency purchases. Also, at present they contribute some firm capacity value to in-state hydro and nonfirm hydro purchases from other regions. Thus there is justification in assigning some added value to in-state generation when comparing it with the cost of out-of-state purchases. (California Energy Commission, 1985a, p. 134).

The level of future imports from the Pacific Northwest is somewhat more uncertain than that from the Southwest, mainly because of the uncertainty associated with the price and availability of that power. BPA, through its intertie access policy, has reduced competition in the supply of Pacific Northwest power, greatly reducing the benefits California utilities receive from such purchases. Rates for nonfirm surplus have increased eightfold since 1979 (California Energy Commission, 1985a, p. 137), and efforts to negotiate long-term rate agreements have been fruitless. Rather than face the risks posed by relying on energy the price of which may be subject to complete control by BPA, California utilities are encouraged to develop cost-effective alternative Southwest or indigenous firm power resources, while leaving open the option to import power if agreements are reached in the future.

The current capacity of the transmission facilities between California and the Pacific Northwest is insufficient to accommodate the potential power transactions between regions, especially in the spring and summer months. One effect of this is that B.C. Hydro, which receives last priority on intertie use, yet which has large exportable supplies, is

severely limited in its ability to sell to California utilities. In addition, most California utilities are participating in the California/Oregon transmission project, despite their inability to negotiate long-term agreements with Pacific Northwest utilities.

The emergence of B.C. Hydro as an important source of low-cost firm energy imports seems almost certain in the near future. As the Pacific Northwest regional surplus declines in coming years, B.C. Hydro, with its large capacity, tremendous resources, and desire to increase its revenues through energy exports, may have the opportunity to greatly increase its sales to California. Although B.C. Hydro controls none of the intertie system, as excess transmission capacity becomes available, the utility will be able to gain greater access to the network, wheeling its power through intertie owners.

Because surplus energy currently exists in the Southwest, as well as adequate transmission capacity to further expand import levels, California utilities are anticipating substantial electric power imports from that region. Also, with the planned additions to the transmission network in the region, import levels will increase even further. Southwest utilities are likely to continue to build mainly coal-fired baseload plants as long as coal prices remain low compared with other fuels. They may also continue to build in excess of their own requirements, depending on the price of surplus energy, the potential for long-term contracts for firm energy, the accuracy of their demand forecasts, and the relative costs of other generation techniques.

Because considerable exportable surpluses of energy exist in both regions, it appears that California utilities can assume that they will be able to make the desired purchases from both regions. One reason for this is that California is the main, if not only, customer for this energy. Either region would therefore be foolish to set high prices that lead California to develop lower-cost alternative sources. If Pacific Northwest power becomes too expensive for continued importation, California utilities will likely be able to rely on B.C. Hydro for increasing amounts of power (if BPA grants intertie access). Therefore, although long-term agreements have not been made with Pacific Northwest utilities, surplus power prices should remain in the range in which California utilities will continue to benefit from such purchases.

IV. ALTERNATIVE NEW CALIFORNIA IN-STATE ELECTRIC POWER SOURCES

In addition to imports of electric power from the Pacific Northwest and the Southwest, California may develop new sources of electricity from in-state investments. These new sources begin with conservation, which

might reduce energy use and therefore reduce the need for new energy sources. More generally, energy may be produced from increased investment in conventional sources of electric power, including coal, natural gas, oil, and nuclear electric power generation. Renewable resources including hydro, solar, and wind energy may be converted into electric power. There is some hope that in the more distant future, nuclear fusion might be a source of nearly unlimited electric power. Finally, miscellaneous sources, including biomass incineration and electric power storage, which expand peak load supply, may offer relatively small increments of electric power. We will consider all of the sources listed except the small increment sources. Geothermal is a major source of electric power in California providing 18% of Pacific Gas and Electric Company's 1986 generation. It is also a potentially large source for future development, although the best sources have already been developed.

Before we examine the cost of some of the alternative energy sources listed above, a methodology for evaluation should be specified. Economists have developed an evaluation system known as benefit/cost analysis for evaluating the relative merits of alternative systems for accomplishing some objective. The subject of analysis in the present case is production of a homogeneous good—electricity. Its benefit is its social value per kilowatthour, multiplied by the number of kilowatthours consumed. Its cost is the value of resources used up in its production process.

A distinction must be made between private investment analysis and social benefit/cost analysis. The former evaluates a proposed investment by identifying the costs paid by the decision-making firm (or individual) and the revenues expected to be received by the firm. Social benefit/cost analysis goes beyond private analysis to identify any costs borne by society at large but not by the decision maker, as well as any benefits that spill over to society at large but are not collected by the decision maker. These spillover costs or benefits are also known as external costs or benefits.

Private decision making based on analysis of private costs and private revenues yields the same results as social benefit/cost analysis in most cases. They differ only when (1) externalities exist, (2) monopoly power distorts prices, or (3) government(s) interfere in markets and distort resource or product prices.[8]

An example of external cost is air pollution, which is imposed on society at large or on one's neighbors but is not paid for by the decision

[8] . Technically, government intervention improves resource allocation efficiency when it corrects for an externality. However, pure cases of such intervention are hard to find. Most intervention is the result of politically powerful interest groups persuading Congress, legislatures, and administrations to intervene in markets and redistribute income or wealth in favor of such interest groups.

maker. Such external costs may be internalized without government intervention when legal action is instituted against a polluter or when a bargain is struck between the parties. In this event, the externality no longer exists. Similarly, an externality exists when a benefit accrues to society at large and cannot be collected by the decision maker who made it possible. An example is a discovery of a nonpatentable basic scientific fact, such as the nature of nuclear fusion.

Most ordinary business decisions do not create significant externalities. Therefore private decision making is in harmony with the general welfare of the society in question. Even when some external costs or benefits exist, they may be minor relative to the costs of correcting them and are therefore best ignored. When externalities are large, then some government intervention might be desirable only if such intervention is likely to improve on resource allocation by internalizing such externalities.

In the analysis to follow, we will examine the benefits and costs of alternative energy sources available to California. Only in the cases of nuclear and conventional coal-fired electric power generation do the external costs appear to be potentially significant. Therefore they will be evaluated in detail.

Major external costs would occur in the event of a meltdown in a nuclear plant or other accident in which a significant amount of radiation is released into the atmosphere. Coal-fired plants may impose externalities because large segments of the population downwind from a coal-fired power plant may suffer from respiratory problems. Both acid rain and the greenhouse effect are potential external costs of coal combustion in electric power generation. Solar and wind conversion systems may offer external benefits. Such potential benefits would be in the form of technological spillovers—declining costs over time as technology advances. Past large federal and state subsidies have paid or possibly overpaid for these potential external benefits.

The reader must be cautioned that the cost estimates shown below are from a variety of sources. Analytic methods are not likely to be uniform. Consequently, cost estimates should be taken as rough approximations of actual costs.

Conservation

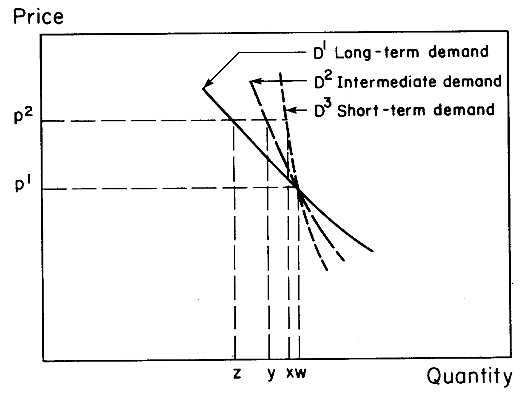

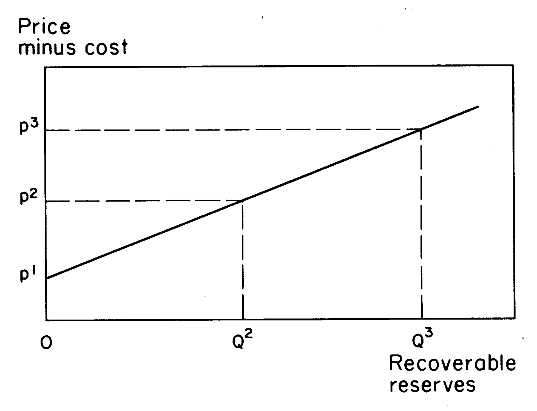

People outside the circle of professional economists frequently use the word conservation as if it were a source of energy. From an economic theory perspective, there are two reasons to expect reduced consumption corresponding with higher crude oil prices. First, Figure 6.3 shows that if prices increase from P1 to P 2 , the quantity demanded in the short

run will decline from w to x. In response, oil consumers shift to the most attractive substitutes. However, this substitution process requires a delay as oil consumers use the available information to determine which substitutes are optimal for their particular needs. Thus in the long run consumers and industrial users reduce oil consumption in favor of coal, natural gas, or other energy forms economically substitutable for oil. The longer the period, the greater will be the reduction in demand for the higher-priced oil.

Second, the demand curve may shift as consumers reallocate their scarce income and consume less higher-priced energy in total, including oil. Again, time is required for this income adjustment process. Thus in the short run the demand for crude oil will be highly inelastic (insensitive to oil price changes) but will become more elastic with the passage of time, as illustrated in Figure 6.3.

Some advocates of conservation frequently have in mind a set of government policies inconsistent with the economic meaning of conservation. These policies include new regulations that mandate less energy use, even though consumers would use other resources in lieu of the one constrained by regulation. Illustrations of this policy include mandated home insulation retrofit in order to save energy, without considering the other resources used in the retrofitting process such as the insulation material, labor, nails, etc. Another kind of conservation policy would add taxes to existing prices of specific energy forms. Examples include a gasoline tax and an import tariff on crude oil. Finally, a more benign form of market intervention simply mandates that manufacturers provide more product information to consumers about energy usage, as in the cases of refrigerator and air conditioner energy consumption. Such policies are inconsistent with the economic definition of conservation in all cases where the present value of the benefits (energy saved) is less than the present value of the substitute resources used, together with regulatory costs.

From an economic perspective, the word conservation has a precise but somewhat difficult definition. Conservation of resources takes place when the present value of the consumption of all resources is maximized. In practice, this means that private and governmental users of resources consider the costs and the benefits (or revenues) that are incurred as they make investment and consumption decisions regarding the use of resources and make those investments only when the present value of the benefits exceeds costs by an amount that yields a competitive rate of return. The great merit of this definition is that it leads to conservation of all resources, not just the one that is the target of a specific regulation or other government policy. This economic definition

serves the general interest of society if external costs and benefits are negligible or nonexistent and there are no market distortions due to monopoly or to government intervention.

Advanced Coal Combustion and Coal-Derived Synthetics

Coal is an alternative to crude oil in several applications. Recoverable reserves of coal in the United States and worldwide are extremely large; world coal reserves are 493 billion short tons (2,219 billion barrels of oil equivalent), of which 34% are in the U.S. The heat content represented by these coal reserves is 4.7 times the heat content of the world's estimated recoverable crude oil reserves.

Coal can be liquefied into a crude oil substitute; it can be gasified into a substitute for natural gas that, in turn, is a substitute for crude oil; it can be gasified and burned directly in a gasification combined-cycle electric power plant, or it can be either indirectly or directly converted into gasoline. It can also be burned in conventional electric power generating plants as a substitute for nuclear energy, residual fuel oil, or natural gas.[9] We consider coal liquefaction, gasification, gasification-combined cycle (GCC), and conversion into gasoline because if these processes are economically viable, their large-scale development would affect oil or natural gas demand and prices and therefore the use of these energy sources for electric power generation.

Fluidized-Bed Combustion. In addition to the conventional method of coal combustion for electric power generation, a new process in the technical development stage and not fully proven commercially is fluidized-bed combustion (FBC), which encompasses both atmospheric (AFBC) and pressurized (PFBC) technologies. Bubbling bed and circulating bed are two types of pressurized FBC. The advantages of FBC relative to conventional coal combustion are short construction time, low emissions of both sulfur and nitrogen oxides, fuel flexibility, compatibility for plant retrofits, easier handling of residual products, potential economic feasibility for small-scale operations, and possibly more competitive capital and operating costs in the future.

Offsetting these advantages to some unknown degree, however, is the unproven reliability of large-scale systems and hence the actual costs of the power produced. Furthermore, turbulence in the bubbling bed, which keeps coal particles suspended inside the combustor by air jets, erodes the metal boiler tubes that run through the beds. A joint federal government and privately funded research project was announced in

[9] The social cost of coal-fired electric power generation is discussed in the section on nuclear and conventional coal technologies, below.

early 1988 to solve this problem (Oil Gas Journal, 1988, p. 16). American Electric Power Company will retrofit its idled Tidd coal-fired plant in Ohio for a FBC process to study this issue. It will become a 70-MW capacity pilot plant and if successful, would be transformed into a 320-MW commercial plant, demonstrating retrofit feasibility. Based on information gathered from several small-scale testing facilities, there is some evidence that FBC may make coal-fired power generation an environmentally and economically attractive source of electric power in coming years.

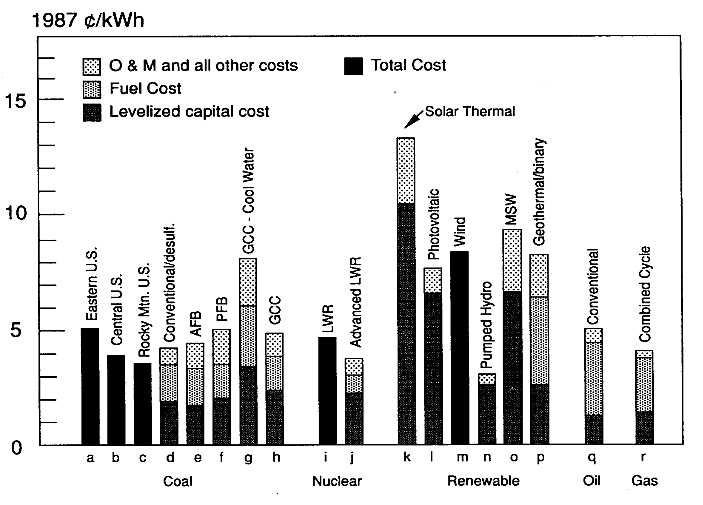

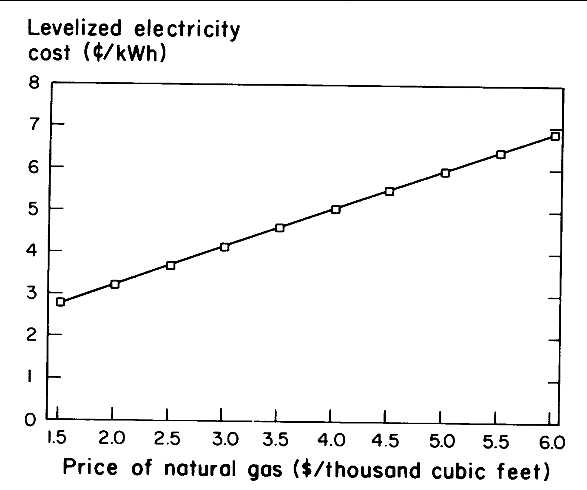

The AFBC electric power generating process burns coal with limestone in an atmospheric pressure fluidized bed suspended by air blown in from below the combustion chamber. The calcium in the limestone captures most of the sulfur released from the coal during combustion. Particulates are captured in a series of cyclones followed by an electrostatic precipitator (Electric Power Research Institute, 1986, p. B-50). Using a fluid boiler design based on the bubbling bed concept, the Electric Power Research Institute (EPRI) has estimated the cost of a 500-MW (net) plant having a capital cost of $1,274/kW of capacity. Using a 7% real interest rate and a 40-year life, the cost of electric power from an AFBC plant is estimated to be 4.41¢/kWh in 1987 cents. Components of this estimate are illustrated in Figure 6.4 (see the bar labeled e ). This figure compares the costs of alternative electric generation technologies discussed below. Included in the comparison are cost estimates for new technologies (such as AFBC) and actual costs for some technologies presently deployed on a commercial scale.

PFBC is another new technology currently under development that uses coal to produce electric power in a more environmentally acceptable manner. In this process, crushed coal is burned with dolomite in a pressurized fluidized bed suspended by air blown in from below the combustion chamber. Pressure in the combustion chamber is maintained at 6-10 times atmospheric pressure. Sulfur particulates are removed by a filter after the hot gases leave the combustor and before the gases are used to drive a gas turbine/electric generator (Electric Power Research Institute, 1986, p. B-52). Based on EPRI data, the cost of power generated by the PFBC process is estimated to be 4.78¢/kWh in 1985 dollars, or 5.05¢ when inflated to 1987 prices (see the bar labeled f in Figure 6.4).

Both AFBC and PFBC plants are in the developmental stages with some retrofits already in use. With their estimated costs being only marginally above conventional coal combustion processes, they offer a promising method of utilizing the large U.S. coal reserves without the troublesome environmental and health consequences of conventional coal combustion.

Neither the availability of large-scale reserves nor the technical feasibility of liquefaction, gasification, or FBC are sufficient evidence that coal is an economic substitute for crude oil. Economic feasibility depends on relative social costs and benefits. The costs shown here are private costs. If the externalities of FBC are not significant (as we believe), then the private cost estimates are reasonable approximations of social costs, and FBC appears to be a promising alternative future source for California electric power generation.

Coal Gasification-Combined Cycle (GCC). Coal may be gasified and then directly burned in a gas-fired electric power generating plant. Operating experience is available from a semicommercial integrated coal gasification-combined-cycle plant at Daggett, California. This plant, known as Cool Water, has been operating since its startup on June 1, 1984. Its net capacity is 103 MW, and it operated at 70.5% of capacity in 1987. Its actual capital cost was $279 million. However, its operator, Southern California Edison, estimates that a similar new plant could be built for approximately $250 million. Using this capital cost, a 7% real interest rate, a 30-year life, and a 65% capacity factor yields an 8.21¢/ kWh cost for electric power production, broken down as shown as bar g in Figure 6.4. In converting 1,000 tons of coal per day into relatively clean-burning gas, air emissions from this plant average about 10-20% of the allowable federal levels for nitrogen oxide, sulfur dioxide, and particulate emissions. At a cost of 8.21¢/kWh, new construction of a GCC plant is not economic relative to other baseload options. However, one might expect further technological improvements in this process. Costs must be reduced by another 50% from these estimates before the GCC alternative becomes attractive.

EPRI has estimated cost data for a plant nearly five times as large as the semicommercial Cool Water plant. Based on a 500-MW net plant capacity, a 30-year life, 7% real interest, coal at $1.52/million Btu, and a heat rate of 9,775 Btu/kWh, the EPRI data indicate a cost of 4.60¢/kWh. Expressed in 1987 prices, this cost becomes 4.85¢/kWh. Thus, a larger plant would appear to incur costs that become attractive when consideration is given to the clean-burning character of GCC compared to conventional coal. Components of this estimate are shown as bar h in Figure 6.4.

Coal Liquefaction. Coal reserves may also be converted to synthetic oil. The proposed Breckenridge coal liquefaction plant, designed to produce 4.2 million barrels of synthetic oil per year, involved a conversion

cost of $96/barrel of oil output in 1987 dollars.[10] This is more than five times the current value of imported oil ($14-$20/barrel). Accordingly, given present technology, coal liquefaction does not appear to be a viable substitute for crude oil in the foreseeable future.

Coal Gasification. Coal gasification is similarly uneconomic. The Great Plains coal gasification plant, partially financed by the U.S. government Synthetic Fuels Corporation, started production in July 1984 but is currently in bankruptcy following withdrawal of the federal subsidy. The cost of converting coal into high-Btu (970 Btu/cubic foot) gas is $8.59/thousand cubic feet in 1987 dollars.[11] This is nearly five times the current market value of natural gas ($1.74 wellhead price, March 1988). Thus coal gasification also appears to be uneconomic for the foreseeable future.

When the Great Plains plant emerges from bankruptcy, the capital cost of $4.08/thousand cubic feet is likely to be eliminated. The most recent operating data for this plant show that operating costs have been reduced to $4.13/thousand cubic feet (U.S. General Accounting Office, 1986, p. 23). The free-market price of natural gas has fallen more than coal prices and well below this operating cost, indicating that the plant is still not economically viable even when omitting the capital cost. In the unlikely event that the value of natural gas exceeds the variable cost of operating and maintaining the plant at the time it emerges from bankruptcy, continued operation of this existing plant would be expected. However, construction of additional coal gasification plants would involve new capital costs and hence such additional coal gasification facilities clearly would not be economically beneficial in the foreseeable future.

Coal to Gasoline. A technology also exists for converting coal directly into gasoline as a substitute for crude oil. With substantial government subsidies, gasoline is produced in South Africa from that nation's large coal reserves. Hitler's Germany produced both oil and gasoline from German coal in World War II. In both cases, government subsidies can be and were justified on the grounds of supply security.

[10] Based on a total capital cost of $2.59 billion and an annual O&M cost of $157 million, in 1984 dollars, a 30-year plant life, and a 7% real interest rate (U.S. Synthetic Fuel Corporation, 1985). The levelized capital cost is $57/barrel in 1987 dollars.

[11] Based on a total capital cost of $2.118 billion and an annual O&M cost of $188.4 million, in 1984 dollars, 125 million cubic feet/day actual production, a 30-year plant life, and a 7% real interest rate (U.S. Synthetic Fuels Corporation, 1985, confirmed by Tenneco). The levelized capital cost is $4.08/thousand cubic feet in 1987 dollars.

More recently, West Germany constructed a pilot plant to test the production of gasoline from coal using the Mobil M process in a plant near Bonn, Germany. The results established the technical feasibility but economic infeasibility of this coal substitution for crude oil in gasoline production.[12] The Bechtel Corporation had earlier estimated that a commercial plant to produce gasoline using the Mobil M process would have a capital cost of $6 billion and that, using a 7% real interest rate, a 30-year life, and a favorable 90% capacity factor, the cost would be $0.8l/gallon (1981 U.S. dollars). This capital cost alone is now approximately 1.6 times the tax-free market value of gasoline. In addition, the cost of coal and operation and maintenance must be borne by the product. In the absence of data on these costs, we roughly estimate them at $0.80/gallon, making the total cost of coal conversion to gasoline about $1.60/gallon in 1981 dollars, or $2.20/gallon in 1087 dollars. These results indicate that this process is uneconomic.

Natural Gas to Gasoline

New Zealand's Synthetic Fuels Corp., Ltd., entered into an agreement with Mobil Oil Corporation in 1980 to build the world's first natural gas-to-methanol-to-gasoline plant using a catalyst developed by Mobil Oil. The lead contractor was Bechtel Pacific Corp. The source of natural gas is the Maui field off the New Zealand coast. This plant has a design capacity of 14,500 barrels/day of gasoline. The capital cost is estimated at U.S. $1.475 billion (Oil and Gas Journal, 1985). The capital cost alone, assuming a 30-year life, a 7% real interest rate, and an optimistic 90% capacity factor, amounts to $0.60/gallon of gasoline (U.S. dollars). As of May 6, 1988, the wholesale spot market price of regular gasoline (excluding tax) in Rotterdam was $0.51/gallon. Thus at zero operating cost, the capital cost alone of gasoline to New Zealand will be more than its market value. Although operating costs are unknown, they are likely to be at about one-half of the capital cost estimated above ($0.25/gallon). The cost of natural gas, valued as low as $2/thousand cubic feet (U.S. dollars), would be $0.43/gallon of gasoline. Therefore natural gas conversion to gasoline costs about U.S. $1.20/gallon, 2.3 times the value of gasoline, in 1984 U.S. dollars. Inflated to 1987 prices, this cost becomes $1.30/gallon. Thus, natural gas conversion to gasoline as a substitute for crude oil is clearly uneconomic.

Oil Shale

Oil shale resources, like coal, are extremely large. Unlike coal, however, oil from shale is not economic under present technologies, costs, and

[12] Based on a pilot plant visit and conversations with plant management.

prices. World oil shale resources are estimated at 88 trillion tons (World Energy Conference, 1983, p. 51). If 10% of this resource ultimately became recoverable, it would amount to nearly 400 billion barrels of oil.

But the economic reality of producing oil from shale is harsh. Current estimates indicate a range from $45 to $60/barrel production costs. Furthermore, the history of oil shale suggests that its production cost increases in tandem with expected revenue. Consequently, oil from shale is not a viable substitute for crude oil under present costs and prices.

Tar Sands

Tar sands and heavy oil resources are very large and are being produced in Alberta, Canada, and California. In addition, heavy oil resources in the Orinoco belt of Venezuela are large but without a subsidy are not producible beyond the pilot plant stage at current costs and prices.

The tar sands deposits located in Alberta, Canada are estimated at 120 billion tons (800 billion barrels) of oil in the ground (World Energy Conference, 1983, p. 51). Commercial production has been under way for nearly 20 years. If 10% of this oil resource is recoverable, then 80 billion barrels of oil are producible from these deposits. According to estimates by Bechtel Corporation, the full cost of new production from the Canadian Athabasca Tar Sands would be $24.90/barrel in 1986 dollars, or $25.70 in 1987 dollars (Leibson, 1987). Thus, with the current price of oil at $14-$20/barrel, new development would not be undertaken, but continued production is profitable so long as revenue covers the variable cost of production.

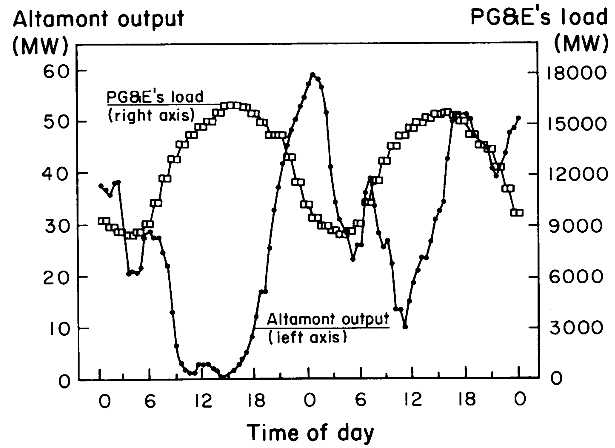

The Orinoco belt in Venezuela is estimated to contain 150 billion tons (1 trillion barrels) of oil in the ground (World Energy Conference, 1983, p. 51). Again, if 10% of this resource is recoverable, then future production of this heavy oil will yield approximately 100 billion barrels. Recoverable reserves depend on production costs and product prices. In the cases of the Orinoco heavy oils and oil shale, although resources are large, economically viable production must await either much higher product prices or significant technological advances that reduce production costs. In contrast, synthetic oils are currently producible from Canadian tar sands. In all three cases, as product prices increase relative to production costs, recoverable reserves expand. This important principle is illustrated in Figure 6.5. The Orinoco heavy oils and oil shale will become significant substitutable sources for conventional crude oil if crude oil prices should increase substantially in the future. However, when crude oil prices were about $34/barrel in 1980 ($45.50 in 1987 dollars), these large resources were not in production. Therefore both oil shale and Orinoco tars are potential substitutes for crude oil only in the distant future.

Alcohol

Ethyl alcohol (ethanol) may also be a substitute for crude oil-based gasoline, either as a blend (gasohol) or as a 100% substitute for gasoline. It may be produced from abundant U.S. supplies of wood fiber or cereal grains. However, both sources have alternative uses and therefore opportunity costs. Like coal conversion to other energy forms, ethanol is considered here because it is a substitute for oil and, if economically viable, would reduce the demand for oil and thereby exert a downward pressure on oil prices.

The most extensive experience in this process has been in Brazil, where ethanol has been used as a motor fuel blend since the 1930s. Responding to the crude oil and gasoline price increases of the 1970s and to severe declines in sugar prices, the government of Brazil in 1975 started a heavily subsidized hydrous alcohol industry based on its sugar and sugar cane production. Hydrous alcohol (distilled ethanol containing 4.4% water) was to be a full substitute for gasoline. The Brazilian Ministry of Industry and Commerce estimated that the cost of this gasoline substitute was $50.30 per barrel ($1.20 per gallon in U.S. dollars). Other researchers have estimated costs as high as $90.00 per barrel ($2.14 per gallon) in 1982 U.S. dollars (Melo and Perlin, 1984). This translates into $2.52/gallon in 1987 dollars. A Brazilian scholar reviewing this experience concluded that "it can be seen that hydrous alcohol production is not the most effective use of society's resources, at least at the present level of production" (Santiago, 1985, p. 15).

Solar Electric Power

Electric power may be generated from the unlimited energy of the sun. The technology is developing rapidly. The relevant issue is the economic cost. We will examine two conversion methods—indirect generation solar thermal, and direct generation using photovoltaic conversion.

Technology for both systems developed rapidly in the 1980s beginning with Solar One, which started operations in the Mojave Desert in April 1982. As a solar thermal pilot plant, it has a design capacity of only 10 MW. At 35% of capacity operations, this plant would generate about 30,700 MWh per year. However, output reached only 10,000 MWh in 1986. Its levelized capital cost alone, based on a 30 year life, would be $1.14/kWh. This plant is now being dismantled.

We may draw on a model for a larger but nonexistent 100-MW capacity plant under a system of specific assumptions. Sandia National Laboratories has used a spreadsheet approach to model a plant, using from one to six heliostat fields. The fully developed capital cost is estimated to be $769 million. The plant's capacity factor is assumed to be 38% at full development. Cost estimates are in 1983 dollars. Small plant size is

paired with a fossil fuel boiler to assist startup and transition periods. Larger-size plants use thermal storage to maintain electric power production after sunset.

Using a 30-year plant life and a 7% real interest rate, the analysis shows a surprisingly consistent 10-20~/kWh levelized cost, regardless of output level in the various models (Norris, 1986, p. 70). Adjusting the 1083 costs to 1087 prices yields a low estimate of 21.5~/kWh. This result indicates that although the addition of facilities increases output, cost increases in tandem with the added output.

These findings are confirmed in general by a study issued by the CEC. That study found that a combination of three special subsidies would be necessary to bring solar thermal power into commercialization, where it might be able to cover its costs (California Energy Commission, 1986e). These three subsidies would consist of (1) reinstatement of the 15% investment federal energy tax credit, (2) reinstatement of the California 25% investment tax credit, and (3) continuation of the "avoided cost" subsidy that is embedded in the price that utilities and their customers must pay for power produced from qualifying solar power facilities. In the case of the two energy tax credits, these subsidies are "high powered" in that the credits are deductions from income tax liabilities, in contrast to deductions from gross income, which is then subject to taxation. They would extend through the year 2014 when, according to the CEC study assumption, commercialization would exist and solar power revenue would equal or exceed its cost without special subsidies.

Learning from the Solar One experience, LUZ Solar is operating solar thermal plants in Daggett and Kramer Junction, California. Five LUZ Solar plants with a total capacity of 134 MW are selling electric power to Southern California Edison. Under the fixed energy and fixed capacity standard offer number 4 contracts,[13] the plants are viable receiving approximately 6.4~/kWh for energy, plus 2.5~/kWh for capacity for a total income of approximately 9~/kWh. In addition to this standard offer price subsidy these plants receive federal and state tax subsidies under those now defunct programs.

Cost estimates are available from EPRI for a 150 MW capacity solar thermal power station located in the south central part of the United States. Using dry cooling, and assuming a 30 year plant life, a 7% interest rate, and no tax subsidies, the EPRI data indicate a levelized cost of 13.45~/kWh in 1987 dollars, as Figure 6.4, bar k. This is about twice the value of the benefits of electric power production, in spite of the declining cost record.

[13] See discussion, under wind, of various standard offer contracts and their subsidy characteristics.

Solar photovoltaic electric power conversion technology has also advanced rapidly in recent years. Central station power generation by direct photovoltaic conversion appears to be on the verge of economic feasibility. Cost estimates are available from EPRI for five plants of 20 MW each, using a concentrator technology. These estimates indicate a levelized total cost of 7.72¢/kWh in 1987 dollars (see Figure 6.4, bar l ). They assume a 30 year life and a 7% real interest rate. Thus photovoltaic central station technology appears to be moving rapidly toward economic feasibility.

Solar power will still suffer from its intermittent characteristic. When the sun is not shining, all solar power plants will have an output of zero. This reduces the value of solar power plants in terms of their ability to displace conventional capacity unless additional capital outlays are made to provide storage capability.

One significant merit of solar power arises out of the fact that the southern half of the United States has its peak power demand in the summer due to the need for air conditioning during hot midafternoon hours. This seasonal peak need corresponds with solar power production capability.

In sum, the evidence currently available indicates that solar power generation—as a substitute for oil, gas, coal or nuclear power generation—is not yet economically feasible without subsidies, but that technological change is moving rapidly toward unsubsidized viability.

Wind

Congress passed the Public Utility Regulatory Policies Act (PURPA) in November 1978. This act authorized the Federal Energy Regulatory Commission (FERC) to set rates under which electric power utilities would be required to purchase power from small power production facilities using wind as well as biomass, water, solar or other renewable energy sources. PURPA specifies that such rates "shall be just and reasonable to the electric consumers of the electric utility and in the public interest."[14] This legislation further mandated that "no such rule prescribed (by FERC) shall provide for a rate which exceeds the incremental cost to the electric utility of alternative electric energy."[15] The term "incremental cost of alternative electric energy" is defined in legislation as "the cost to the electric utility of the electric energy which, but for the purchase from such generator or small power producer, such utility would generate or purchase from another source."[16]

[14] 16 USC 824a-3, Sec. 210(b).

[15] 16 USC 824a-3, Sec. 210(b)(2).

[16] 16 USC 824a-3, Sec 210(d).

The FERC has published regulations to implement PURPA and directed state regulatory authorities to issue specific purchase prices under the avoided-cost doctrine. Following these directives, the CPUC authorized four standard offers (SOs) under which qualifying facilities (QFs) may sell power and utilities must purchase power.