PART TWO

THE TREATMENT

GLENDOWER : I can call spirits from the vasty deep.

HOTSPUR : Why, so can I, or so can any man, But will they come when you do call for them?

I Henry IV III.i. 51–53

3

Government Promotes Medical Device Discovery

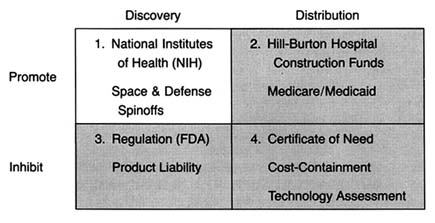

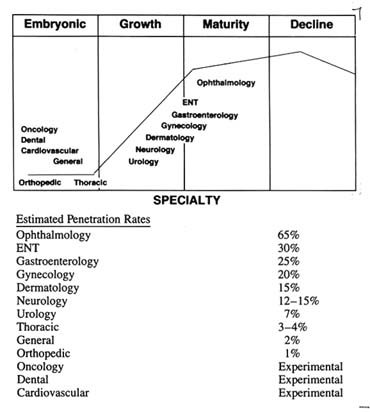

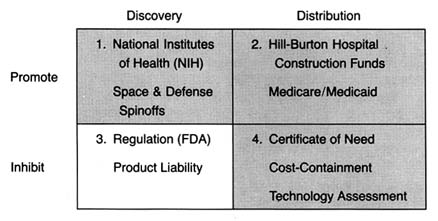

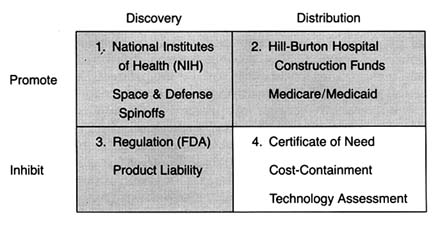

Figure 6. The policy matrix.

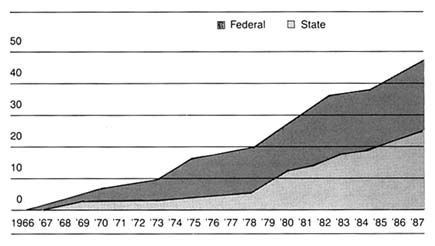

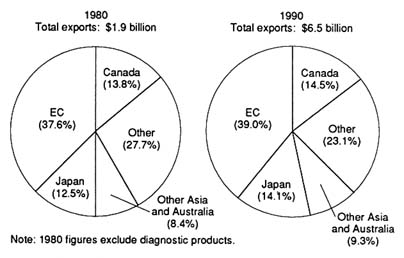

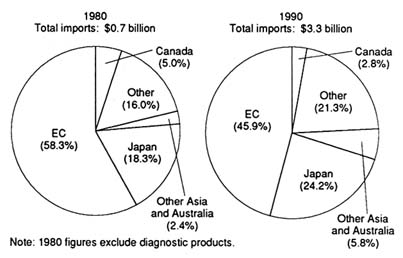

After World War II, the federal government was firmly committed to supporting for basic scientific research. Indeed, government came to be seen as a legitimate vehicle for the promotion of innovation. The issue was no longer whether government should provide research and development (R&D) support, but to whom, how much, and in what form. Three primary areas of federal research emerged—defense, space, and civilian, the last dominated by biomedical science. (See figure 6.) There is constant political debate about the overall size of the federal R&D pie and the allocation of funds among these various programs.[1]

Since 1960, federal funds have accounted for from 47 to 66 percent of all R&D spending in the United States. There are three trends in federal support: (1) from the late 1940s to about 1967 there was steady growth in all areas, with 1957 being a starting point for the NIH budget; (2) from 1967 to 1977 there was a general leveling off of investment in space and defense, although life sciences held steady; and (3) from 1977 and throughout the Reagan era defense spending increased at the expense of civilian R&D. Harvey Brooks, "National Science Policy and Technological Innovation," in Landau and Rosenberg, eds., The Positive Sum Strategy. Overall, defense related R&D accounted for about 50 to 60 percent of total federal expenditures throughout the period. See discussion in Richard M. Cyert and David C. Mowery, eds., Technology and Employment: Innovation and Growth in the U.S. Economy (Washington, D.C.: National Academy Press, 1987), 35-38.

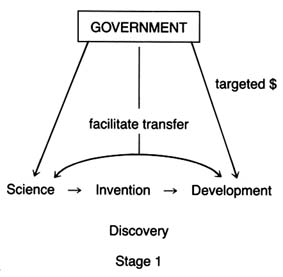

Research and development support can take several forms—federal money for basic science research, federal funds directed or targeted toward specific technologies or products, and federal incentives for institutional transfer of technology from basic science to commercialization. The federal government has provided

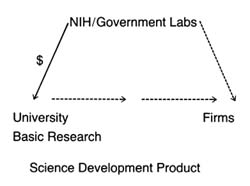

all three forms to biomedical research, each with the potential to affect the medical device industry. Figure 7 illustrates how the forms of funding related to the innovation continuum.

Federal R&D dollars have affected medical device innovation at various points on the innovation continuum. This chapter discusses the evolution of various policies to support medical device discovery. The first, and most significant, policy involves grants for basic science research through the National Institutes of Health. The second, introduced in the 1960s, targets specific technologies at the point of invention and development. The Artificial Heart Program (AHP) at the NIH illustrates this form of support. Medical device discovery has benefited from spinoffs of targeted programs for space and defense purposes, and these programs are discussed as well. Finally, this chapter describes congressional policies to facilitate technology transfer—from universities, government laboratories, and private firms. The goal of these policies is to rectify perceived institutional barriers to progress along the innovation continuum.

Government Support for Basic Science

When Congress promoted health research after the war, the NIH was the logical federal institution to administer it. Congress both enlarged the authority of the NIH and provided increasingly generous funding for it. The Public Health Service Act of 1944 extended NIH research authority from cancer to health and disease generally.[2]

James A. Shannon, "Advancement of Medical Research: A Twenty-Year View of the Role of the National Institutes of Health," Journal of Medical Education 42 (1967): 97-108, 98.

In 1948, the National Heart Institute and the National Dental Institute were established, and the name of the agency officially changed to the National Institutes of Health to reflect the categorical or disease oriented approach of the multi-institute structure. The total congressional appropriation rose from $7 million in 1947 to $70 million by 1952.[3]Cited in Natalie Davis Spingarn, Heartbeat: The Politics of Health Research (Washington, D.C.: Robert B. Luce, 1976), 28.

By 1955, the NIH awarded 3,300 research grants and 1,900 training grants, accounting for over 70 percent of the NIH budget.[4]Shannon, "Advancement," 100.

President Kennedy, a strong supporter of the NIH, included in his first budget an increase of $40 million, the largest increase ever for medical research and the largest percentage raise since 1955. The rationale for this rapid expansion was "an expanding economy, a favorable political ambience, a consensus stemming

Figure 7. Forms of government support for biomedical R&D.

largely from World War II technological success that scientific research can pay off big, and a set of remarkably effective health leaders in both public and private sectors."[5]

Spingarn, Heartbeat, 25.

The primary form or strategy of support has been called the "boiling soup" concept. The investigator-initiated grant process allowed scientists to work on many projects. Essentially undirected, individual investigators each followed his or her own path of discovery. This philosophy was well articulated in the Senate Appropriations Committee Report on the Labor-HEW Appropriation Bill for 1967.

The committee continues to be convinced that progress of medical knowledge is basically dependent upon full support of undirected basic and applied research effort of scientists working individually or in groups on the ideas, problems, and purposes of their selection and judged by their scientific peers to be scientifically meaningful, excellent, and relevant to extending knowledge of human health and disease.[6]

Cited in Shannon, "Advancement," 101.

Congress maintained a hands-off approach and "tiptoed lightly so as not to disturb genius at work."[7]

Spingarn, Heartbeat, 2.

Certain institutional patterns emerged as a result. Support flowed from the NIH to researchers engaged in basic science at universities and medical schools. The NIH had an enormous influence on the research environment. Research became the major, if not the dominant, feature in academic medicine, and a partnership between universities and government scientists developed. As government came to provide virtually all of the resources for academic research, these institutions thrived on the largesse.[8]

Ruth S. Hanft, "Biomedical Research: Influence on Technology," in R. Southby et al., eds., Health Care Technology Under Financial Constraints (Columbus, Ohio: Battelle Press, 1987), 160-171, 167.

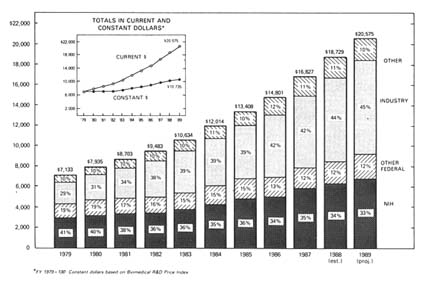

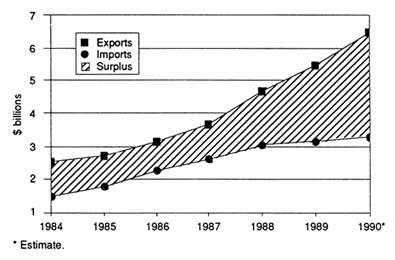

By 1979, the NIH provided over 40 percent of all health R&D funds (see figure 8). This strategy forged a very strong philosophical and institutional link between the NIH and academic medicine.While basic science in the academic research community received the bulk of NIH funds, Congress increased the role of small business in federally sponsored research through the Small Business Innovation Development Act of 1982. The act created the Small Business Innovation and Research Program (SBIR), the goal of which is to support small firms in early stages of research with the expectation that they will ultimately attract private capital and commercialize their results. A small, fixed percentage of all research funds must be directed toward small businesses under the law, and eleven federal agencies are required to participate. The NIH accounts for 92 percent of the SBIR projects within the Department of Health and Human Services and devoted $61.6 million to the program in fiscal year 1987.[9]

U.S. Department of Health and Human Services, Abstracts of Small Business Innovation Research (SBIR) Phase I and Phase II Projects, Fiscal Year 1987. Under the SBIR, phase I awards are generally for $50,000 for a period of about six months and are intended for technical feasibility studies. Phase II, for periods of one to three years, continues the research effort initiated in phase I, and awards do not exceed $500,000. In 1987, NIH awards to the SBIR accounted for $61.6 million.

SBIR proposals are investigator initiated and reviewed through traditional NIH mechanisms. Some successes have emerged from the program. For example, two current commercial devices resulted from SBIR funding—a laser that removes certain birthmarks known as port-wine stains and an electrode that can be swallowed to use in emergency cardiac pacing.[10]

Senate Committee on Appropriations, Subcommittee on Labor, Health and Human Services, Education and Related Agencies, NIH Budget Request for Fiscal Year 1989, cited in testimony of Frank E. Samuel, Jr., president, Health Industry Manufacturers Association (Unpublished document from HIMA, 24 May 1988).

That support for basic scientific research leads to advances in medicine is not in question. In a well-known study, Comroe and Dripps found that basic research provided a critical influence in the long road leading to clinical applications and technology useful in patient care.[11]

Julius H. Comroe, Jr., and Robert D. Dripps, "Scientific Basis for the Support of Biomedical Science," Science 192 (April 1976): 105-111.

While direct links are often difficult to demonstrate, the general consensus can be summed up in the following manner.

Figure 8. National support for health R&D by source, 1979–1989 (in millions of dollars).

Source: NIH Data Book, no. 90-1261 (December 1989).

Although innovation in pharmaceuticals and medical devices has been largely generated in the private sector by private research and investment, it is doubtful whether much of this would have taken place without the base of knowledge resulting from government-sponsored programs. Much modern medical instrumentation and diagnostics derive from basic advances in the physical sciences, including laboratory instrumentation, which occurred as a result of broad-based government sponsorship of fundamental physics, chemistry, and biology.[12]

Brooks, "National Science Policy," 122, citing Philip Handler, ed., The Life Sciences (Washington, D.C.: National Academy of Sciences, 1970); and Henry G. Grabowski and John M. Vernon, "The Pharmaceutical Industry," in Richard R. Nelson, ed., Government and Technical Progress: A Cross-Industry Analysis (New York: Pergamon Press, 1982), 283-360.

How is the information developed in these laboratories transferred to industry? Academic journals are the traditional outlet for scientific findings. Academic researchers are rewarded for publishing the results of their scientific work. This information is in the public domain, and scientists, engineers, and entrepreneurs interested in product development acquire this information and apply it to their own projects. Thus, federal funds only indirectly support product development, depending on the initiative of private firms.

Scientific journals can be an inefficient means of transferring

technology. Delays in publication and the multiplicity of articles affect the speed and completeness of information acquisition. Efficiency of transfer can be complicated for medical devices, the development of which may depend on information from many disciplines with data contained in a wide variety of journals and specialties.

The focus of NIH support on basic science created institutional limitations for medical device development. First, there tends to be an anti-engineering bias at the NIH. Unlike biochemical research, such as studies of organ function or disease processes, medical device innovation is multidisciplinary and may require a confluence of engineering disciplines and materials sciences as well as biochemistry, medicine, and biology. Indeed, as recently as 1987, a committee of the National Research Council concluded that bioengineering studies accounted for only about 3 percent of the NIH extramural research budget. This low figure may reflect either a lack of applicant interest or, more likely, a lack of receptivity by NIH committees, given that few engineers participate in ranking and funding decisions.[13]

Engineering Research Board, "Bioengineering Systems Research in the United States: An Overview," in Directions in Engineering Research: An Assessment of Opportunities and Needs (Washington, D.C.: National Academy Press, 1987), 77-112, 79. While it is true that the National Science Foundation (NSF) sponsors projects in scientific and engineering research, many of which are in biological engineering, the resources of the NSF are significantly less than those of the NIH. For example, in fiscal year 1988, funding for molecular biosciences at NSF was $44.6 million, for cellular biosciences, $54.24 million, and for instrumentation and resources, $34.15 million. National Science Foundation, Guide to Programs, Fiscal Year 1989 (Washington, D.C.: GPO, 1989). Compare this to the 1986 budget of the National Heart, Lung, and Blood Institute, only one of the institutes within the NIH, which received $821,901,000 for fiscal year 1986. National Heart, Lung, and Blood Institute, Fact Book, Fiscal Year 1986 (Washington, D.C.: GPO, 1986).

Thus, although it may be difficult to pinpoint direct cause and effect, medical device innovation was probably assisted in general by the growing expertise in fundamental scientific understanding of the human body and disease processes that the NIH policies encouraged. However, a government policy biased toward biochemistry may have disadvantaged the engineering based medical device industry, at least relative to other forms of biomedical research.

Direct Targeting of Medical Device Technologies

Several events occurred in the 1960s that fostered changes in the NIH research focus. Increased scientific understanding of disease led to more and better options for medical care. That created public clamor for greater access to these new treatments. In 1966, Congress enacted the Medicare and Medicaid programs for the elderly, disabled, and indigent, which are discussed at greater length in chapter 4. Members of Congress could then point to support for medical services as evidence of

their concern for the public's health. Spending for services became more popular than basic science research, the results of which are long-term and difficult to document.

To the extent that Congress supported R&D, the pressure was for "results not research," as President Johnson so aptly put it.[14]

Cited in Spingarn, Heartbeat, 32.

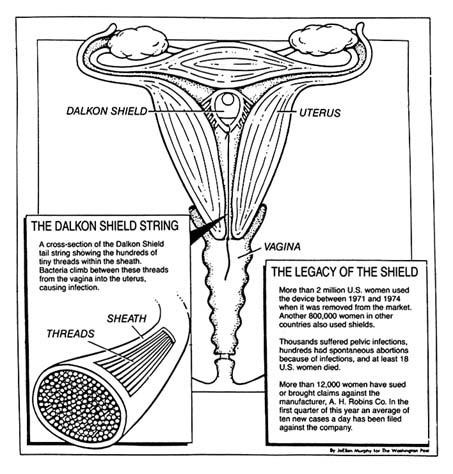

There was growing public concern in the mid-sixties for the NIH to justify its size and its mission. Congress saw the success of the space program, with its targeted and focused goals, as a model for solving technological challenges in health research. The result was increased political pressure for more federal control of research through targeted programs with specific goals.In the next few years, Congress established NIH programs modeled upon a systems approach to innovation. The Artificial Heart Program (AHP) in the National Heart Institute (NHI), the Artificial Kidney (AK-CU) Program in the National Institute of Arthritis and Metabolic Diseases, and aspects of Nixon's War on Cancer are three of the better-known targeted projects.[15]

This book focuses on the artificial heart program. For more extensive discussion of the War on Cancer, see Rettig, A Cancer Crusade; for kidney dialysis, see Plough, Borrowed Time; and Renee C. Fox and Judith P. Swazey, The Courage to Fail: A Social View of Organ Transplants and Dialysis, 2d ed. (Chicago: University of Chicago Press, 1973). Dialysis is discussed at greater length in chapter 4.

Mission oriented research also included the creation of large centers with groups of investigators performing government designed research and clinical trials. By the 1970s, mission oriented research comprised almost 40 percent of the NHI's budget, although other institutes retained a stronger commitment to the traditional model of investigator-initiated grants.The Artificial Heart Program illustrates the institutional adjustments required for the NIH to manage technology development in a targeted program. It also highlights the politics of federal R&D as Congress tangled with scientists over the creation and continuation of the program.

The Artificial Heart Program

In order to understand the political appeal of developing an artificial heart, one must know something about cardiology. Heart failure is the most common disorder leading to loss of health or life. In theory, an artificial replacement heart can prevent the threat of imminent death from end-stage heart disease. Early estimates of the number of patients who might benefit from an artificial heart were as high as 130,000 per year.[16]

As more was learned about the complexities of the technology, the numbers have been revised dramatically downward. See Working Group on Mechanical Circulatory Support of the National Heart, Lung, and Blood Institute, Artificial Heart and Assist Devices: Directions, Needs, Costs, Societal and Ethical Issues (May 1985), 16.

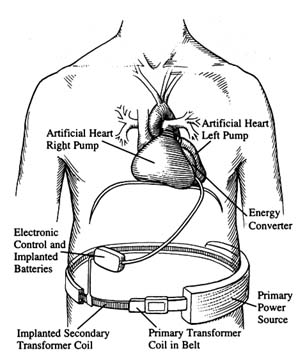

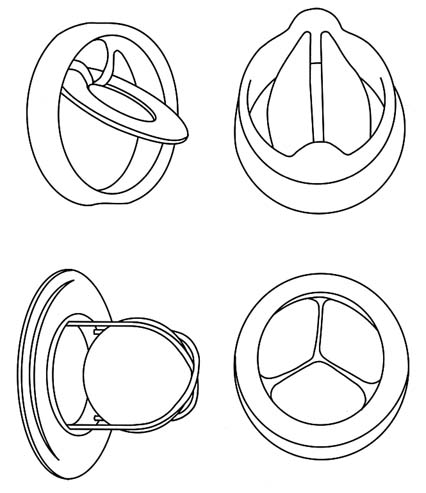

The heart functions mechanically, rather than through a primarily chemical or electrochemical process as the kidney and liver do. Far more than other vital organs, the heart is inherently suitable for replacement by a mechanical device. Scientific work on the concept had been underway in several laboratories in the 1950s. Researchers knew that they had to design a pump, an engine to drive it, and a power source. The challenge was to find materials to line the pump that would not injure the blood and a substance for the heart itself that was flexible and durable enough to withstand the constant squeezing and relaxing motions. All the parts needed to be synchronized to sustain life.[17]

Ibid., 9-14.

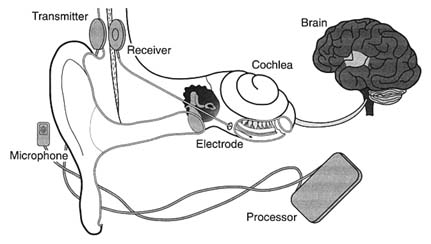

(See figure 9.)Scientists were divided on the feasibility or desirability of artificial hearts; the NIH was unlikely to have funded proposals to work on the technology. The most enthusiastic supporters were some heart surgeons, notably Dr. Michael DeBakey. Congress, unlike the NIH scientists, was receptive because of the political salience of the project. As noted above, many Americans feared death from heart disease, and efforts to eliminate the disease were popular. The idea captured the imagination of Congress and fit the new notion of results oriented research. The successes of the space program were an added impetus. Recently, Dr. DeBakey pointedly recalled the political situation. "Jim Shannon [the NIH director] was opposed to the concept and NIH's involvement in it because he thought there was not enough basic knowledge and that it was not scientifically sound. I went over his head, to Congress."[18]

New York Times, 17 May 1988, B7.

As a result, Congress studied the feasibility of the project. It established the Artificial Heart Program in July 1964 with an initial appropriation of $581,000. The program was housed in the National Heart, Lung, and Blood Institute (NHLBI), the successor to the old NHI.

Targeted programs like the AHP challenged the relationship between academic medicine and the NIH. The program, freed from the traditional concepts of NIH basic research, was much more open to engineering and to industry. Development of the artificial heart required technological expertise not found in medical schools or university science departments; engineers and private firms had to be included.[19]

This involvement was later institutionalized in the Small Business Innovation Development Act of 1982, which increased the role of small businesses in federally supported research and development (Public Law 97-219). This law created the Small Business Innovation Research (SBIR) Program, involving eleven federal agencies, of which the Department of Health and Human Services (HHS) is the second largest participant. The NIH accounts for 92 percent of the SBIR activity in the DHHS. The goal is to support the small business through early stages of research so that it can attract private capital and commercialize the results. U.S. Department of Health and Human Services, Abstracts of SBIR Projects, Fiscal Year 1987.

Figure 9. A fully implanted artificial heart system.

Source: Artificial Heart and Assist Devices:

Directions, Needs, Costs, Societal and Ethical Issues,

NIH publication no. 85-2723 (May 1985), 11.

The NIH needed new tools and procedures to implement targeted programs. The National Cancer Institute (NCI), under Dr. Kenneth Endicott, had pioneered the use of the contract, despite considerable objections from more traditional scientists. The contract form allowed the professional staff at the NCI to specify what research it desired, to solicit proposals from interested researchers in business and academics, and to choose who would undertake the proposed project.

The use of the contract also appeared in the early days of the AHP. Dr. John R. Beem, director of the AHP, came from industry. He assembled a small staff familiar with systems approaches, including experts associated with NASA and the air force. Because of the technological requirements, the NIH sought special

permission to consider contracts rather than grants and, in 1964, let nine contracts which were among their first nondrug contracts. They covered such goals as the development of pumps, drive units, mock circulating systems, and blood-compatible materials. The early contracts were with medical engineering teams at various large industrial firms, such as Westinghouse and SRI, none of which were traditional NIH partners. Contracts with small innovators later became the norm.[20]

One of the successful contractors, Novacor, a small, innovative company, is profiled in chapter 9.

These contracts with industry were controversial within the NIH, primarily because they threatened the traditional partnership with universities. Some NIH leaders did not enthusiastically support contracts. They "did not take kindly … to the idea of taking large amounts of research money and funneling them to profit-making industrial firms through the targeted contract mechanism."[21]

Spingarn, Heartbeat, 148.

Conflicts between engineers and medical scientists arose. One chronicler of the program wrote:The two disciplines, medicine and the scientific art, and engineering with its underpinnings in the physical sciences, could not always fulfill each other's expectations. The NHI emphasis was naturally on the medical researcher and the clinical investigator and their needs; the engineers were often treated as "hardware kids" and many marriages between teams at hospital centers and industrial laboratories ended in divorce.[22]

Ibid., 152.

The program has been steeped in politics throughout its twenty-five years. Congressional enthusiasm began to wane in the late 1960s when results were not immediately forthcoming, but support has persisted, albeit at modest levels. Within a few years of its inception, the program expenditures had increased to approximately $10 million. Since 1975, expenditures have stabilized in the range of $10 to $12 million annually. This amount represents only about 1 percent of the NHLBI budget. The total expenditures to 1988 have been about $240 million.

The most recent political conflict over the program occurred in 1988, when a small group of senators forced Dr. Claude Lenfant, director of the NHLBI, to reconsider a proposal to restructure the Artificial Heart Program. Lenfant had suspended financing for research on totally implantable hearts, choosing to

focus instead on development of LVADs, or left ventricle assist devices, which help but do not replace the diseased heart. The NIH capitulated; the New York Times reported that Lenfant's superiors, "fearing that all of their future programs would be in jeopardy, forced him to 'eat a little crow.'"[23]

New York Times, 8 July 1988.

There is a contentious debate about the wisdom of the AHP, with critics questioning both the costs of the technology and the ethics of the research. Twenty-five years after the program began, a viable artificial organ has not yet been produced. Some of the ethical and social issues raised by this program, and its relationship with other sources of public policy, are discussed in chapters 9 and 10. Without engaging in the debate at this point, we can reflect on the benefits of this and other similar programs for medical device innovation.

For companies in the industry, the benefits of targeted device development are clear. The AHP broke down some of the traditional barriers to bioengineering that had developed within the NIH. The agency began to interact with firms as well as university scientists, reducing institutional and disciplinary barriers for applied bioengineering projects. Thus, medical device innovators have been included in, but are clearly only a small part of, the mission of the NIH.

Medical Device Spinoffs from Space and Defense Research

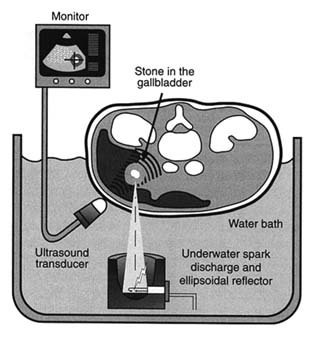

Anyone who has spent time in a hospital is aware of the array of equipment used to monitor a patient's condition. Many patients may not know that the needs of astronauts contributed to this technology. Patients undergoing a noninvasive ultrasound diagnosis are probably unaware that it was the navy's search for tools to detect enemy submarines that generated understanding of this technology. Similarly, the intensive search for military uses for lasers has brought us promising treatments for cataracts and cancerous tumors.

How did these space and defense technologies arrive in our health care system? Obviously, the space and defense programs do not focus on medicine; they have other specific missions to

accomplish. Through a variety of ways, however, medical technologies have developed from research in these nonmedical, government sponsored programs.

Medical Applications of Space Technologies

Sputnik, the USSR's successful satellite launched in late 1957, alarmed Americans who assumed that the United States was losing technological competitiveness to the Soviets. The U.S. space program was a direct response. By early 1958, Congress had introduced numerous bills; President Eisenhower signed the National Aeronautics and Space Act in July 1958.[24]

See discussion in Eugene M. Emme, Aeronautics and Astronautics: An American Chronology of Science and Technology in the Exploration of Space, 1915-1960 (Washington, D.C.: NASA, 1961), 87.

The National Aeronautics and Space Administration (NASA) had to consolidate a number of projects and personnel from government and recast the former National Advisory Committee on Aeronautics (NACA). NACA had engaged in in-house research entirely and had little experience in developing and implementing large-scale projects.[25]

Jane van Nimmen and Leonard C. Bruno, eds., NASA Historical Data Book (Washington, D.C.: NASA, 1988), 6.

NASA became a contracting agency; 90 percent of its annual expenditures by 1962 went for goods and services procured by outside contractors.From the beginning, NASA was a public relations tool for the United States. Not only was it designed to win the space race, but also it let everyone know that the U.S. had restaked its claim to be the world leader in technology. To this end, NASA was to "provide the widest practicable and appropriate dissemination of information concerning its activities and the results thereof."[26]

NASA Center History Series, Adventures in Research (Washington, D.C.: NASA, 1970), 370.

NASA's survival depended on success in its mission and public perception that the program was worthwhile. Thus NASA had to fight to establish and maintain its legitimacy.NASA's first decade was successful in terms of government and popular support. Following the launch of the Apollo and the moon landing in 1969, however, enthusiasm for the program waned. During NASA's second decade, its total budget fell. President Nixon urged NASA to turn its attention to solving practical problems on earth, and funding dedicated to promoting civilian applications of NASA supported technology rose.[27]

Van Nimmen and Bruno, Historical Data Book, 244.

Toward the end of the 1970s, Congress created NASA's Technology Utilization Program, which included regional technology transfer experts. Their job was to monitor R&D contracts toensure that new technology, whether developed in-house or by contractors, would be available for secondary use. In addition, NASA opened a number of user-assistance centers to provide information retrieval services and technical help to industrial and government entities. NASA characterizes itself as a national resource providing "a bank of technical knowledge available for reuse."[28]

NASA, SpinOFF (Washington, D.C.: NASA, 1958), 3. SpinOFF, an annual NASA publication, describes technologies that have been produced using NASA expertise. The examples that appear in the text were derived from a review of SpinOFF stories.

By 1985, NASA claimed an estimated 30,000 secondary applications of aerospace technology.Many of the systems developed for the space program have medical applications. The technology tends to derive from NASA's needs for super-efficient, yet small and light, technologies and its need to monitor the vital signs and overall health of astronauts in space. Technology transfer to medicine has occurred in several ways. NASA contractors form new companies to market products that are based on technology developed for NASA. Sometimes large firms form medically related subsidiaries subsequent to completion of a NASA contract. On occasion, companies with no prior relationship with the agency approach NASA to acquire the technology necessary for the development of a medical product. In all cases, NASA encourages the transfer of technology to civilian uses.

For example, NASA needed new technology to meet the challenges of monitoring the astronauts' vital signs. The commonly used conducting electrode was attached to the body through a paste electrolyte. This method could not be used for long-term monitoring because the paste dries and causes distortions of the data. Other electrodes that made direct contact without use of paste electrolyte failed because body movements caused signal-distorting noise as well. NASA contracted with Texas Technical University scientists who developed an advanced electrocardiographic electrode. It was constructed of a thin dielectric (non-conducting) film applied to a stainless steel surface. It functioned immediately on contact with the skin and was not affected by ambient conditions of temperature, light, or moisture. NASA was assigned the patent and subsequently awarded a license for its use to a California entrepreneur who founded Heart Rate, Inc. The small firm has continued to develop and produce heart rate monitors for medical markets.[29]

NASA, SpinOFF (1984), 61.

The Q-Med firm produced another monitoring product from

electrode technology developed at NASA's Johnson Space Center. Q-Med received an exclusive license from NASA to manufacture and market electrodes in 1984. The firm's monitor assists ambulatory patients who have coronary artery disease and can be worn for days, months, or years to evaluate every heartbeat. It stores information for later review by a physician, who can program it for specific cardiac conditions. The monitor can summon immediate aid if the wearer experiences abnormal heartbeats.[30]

NASA, SpinOFF (1985), 25.

NASA also needed information about spacecraft conditions. For example, McDonnell Douglas Corporation, a firm with many NASA contracts, developed a device to detect bacterial contamination in a space vehicle. In another contract, it developed additional capabilities to detect and identify bacterial infections among the crew of a manned mission to Mars. McDonnell Douglas formed the Vitek subsidiary to manufacture and market a system known as the AutoMicrobic System (AMS). The system, introduced in 1979, offered rapid identification and early treatment of infection. AMS provides results in four to thirteen hours; conventional culture preparations take from two to four days.[31]

NASA, SpinOFF (1987), 76-77.

The confinements of the small spacecraft created a need for miniaturized products. NASA developed a portable X-ray instrument that is now produced as a medical system. The lixiscope, or l ow i ntensity X-ray i maging scope, is a self-contained, battery-powered fluoroscope that produces an instant image through use of a small amount of radioactive isotope. It uses less than 1 percent of the radiation required by conventional X-ray devices and can be used in emergency field situations and in dental and orthopedic surgery.[32]

NASA, SpinOFF (1983), 88.

Lixi acquired an exclusive NASA license to produce one version of the device.NASA awarded a contract to Parker Hannifin Corporation, one of the world's primary suppliers of fluid system components, to develop and produce equipment for controlling the flow of propellants into the engines of the Saturn moonbooster. It subsequently has worked on many other space projects, including miniaturized systems. In 1977, Parker's aerospace group formed a biomedical products division to apply aerospace technology,

particularly miniaturized fluid control technology, to medical devices. Products include a continuous, computer directed system to deliver medication. Parker's key contributions were a tiny pump capable of metering medication to target organs in precise doses, an external programmable medication device for external use, and a plasma filtration system that removes from the blood certain substances believed to contribute to the progression of diseases such as rheumatoid arthritis and lupus.[33]

NASA, SpinOFF (1981), 74-75.

Another application has been an implantable, programmable medication system that meters the flow of drugs. The electronic system delivers programmed medication by wireless telemetry—a space technology—in which command signals are sent to the implanted device by means of a transmitting antenna. Precise monitoring of drugs can be a godsend to a patient. Such a system allows for constant levels of medication, avoiding the highs and lows caused by administering injections at set intervals. Targeting drugs to specific organs makes dosages more accurate and avoids exposing the whole body to toxic therapeutic agents. Some of this research involves cooperative efforts by NASA, universities, and private firms. The Applied Physics Lab at Johns Hopkins University and the Goddard Space Flight Center offer program management and technical expertise. Medical equipment companies, including Pacesetter, provide part of the funding and produce these systems for the commercial market.[34]

NASA, SpinOFF (1981), 88-91.

The NASA experience offers some important lessons. NASA has demonstrated that there is no inherent conflict in government, universities, and industries working together to create useful medical products. It has also shown, on a limited scale and within its particular mission, that government supported R&D can be effectively transferred to the private sector. The benefits to the medical device industry have been important, albeit small relative to NASA's overall expenditures.

Medical Applications of Defense Technologies

Spending on military R&D has been a high priority and accounts for nearly half of all federal R&D. Important medical technologies have emerged from defense research, and the stories of

ultrasound and lasers illustrate the potential, as well as the limitations, of medical spinoffs from defense related R&D.

Ultrasound

Ultrasound is a mechanical vibration at high frequencies above the range of human hearing. In 1880, Pierre and Jacques Curie discovered what is known as the piezoelectric effect, in which an electric charge is produced in response to pressure on such materials as quartz. Conversely, mechanical deformation results from an applied voltage. The impact of sound waves producing this mechanical deformation can be transformed into electrical energy and recorded. Devices to generate and to detect ultrasonic energy are derived from this discovery.[35]

For a complete history of ultrasound, see Barry B. Goldberg and Barbara A. Kimmelman, eds., Medical Diagnostic Ultrasound: A Retrospective on Its Fortieth Anniversary (Rochester, N.Y.: Eastman Kodak Company, 1988), 3; this book also contains an extensive list of references.

World War I led to the first efforts to develop large-scale practical applications of this physical concept. The French government commissioned a physicist to use high-frequency ultrasound to detect submarines underwater. These efforts, conducted in cooperation with Britain and the United States, continued throughout the war. No practical results were achieved at the time, but work continued between the wars. The Naval Research Laboratory refined the basic technology using new electronic techniques and studied the qualities of underwater sound. Scientists also studied industrial applications, including the ability to detect otherwise hidden flaws in industrial materials. There were some medical applications, but these were virtually therapeutic rather than diagnostic, based on the controversial concept of irradiating the body to cure diseases.

World War II accelerated research; military sonar (sound navigation and ranging) and radar techniques were based on the echo principle of ultrasound. Virtually all of the later diagnostic applications of ultrasound involved direct contact and/or collaboration with military and industrial personnel and equipment. The war was crucial to the development of the technology.

Industrial and medical applications began to develop in many nations after the war. Dr. George Ludwig was an early American leader who had spent the years from 1947 to 1949 at the Naval Medical Research Institute. He and his collaborators conducted

experiments for the navy on the diagnostic capacities of ultrasound, concentrating on the detection of gallstones. Ludwig acknowledged military research as well as industrial applications as the sources for his investigations.

Dr. John J. Wild, an Englishman familiar with ultrasonic ranging from his wartime experiences, was another early researcher. He came to the United States after World War II. In conjunction with the Wold Chamberlain Naval Air Station, he began experiments to measure tissue thickness. In collaboration with navy engineers, Wild discovered that echoes from tumor-invaded tissue were distinguishable from those produced by normal tissue, establishing the potential for diagnostic applications. Wild later set up research facilities at the University of Minnesota.

Another early pioneer was William J. Fry, a physicist who worked on the design of piezoelectric transducers at the Naval Research Laboratory Underwater Sound Division during the war. He left in 1946, taking his expertise to the University of Illinois where he founded the Bioacoustics Laboratory. In the 1950s, he recognized that high-intensity ultrasound could eventually provide unique advantages to investigating brain mechanisms. In pursuit of these goals, the Office of Naval Research granted him a contract to develop equipment that would pinpoint lesions within the central nervous system of animals.

By the end of the 1950s, ultrasound diagnosis had been introduced into many medical specialties, including neurology, cardiology, gynecology, and ophthalmology. Engineers and physicists, in private industry and in universities, provided the technical design skills to the medical practitioners who understood clinical needs and had access to patients. This fruitful symbiotic relationship continued through the decades as the benefits of ultrasound became more widely recognized. The NIH supported many of the academic research programs from which commercial instruments emerged.[36]

Frost & Sullivan, Ultrasonic Medical Market (New York: June 1975); Frost & Sullivan, Government Sponsored Medical Instrumentation, Device and Diagnostics Research and Development (New York: March 1978). Cited and discussed in William G. Mitchell, "Dynamic Commercialization: An Organizational Economic Analysis of Innovation in the Medical Diagnostic Imaging Industry" (Unpublished dissertation, School of Business Administration, University of California, Berkeley, 1988).

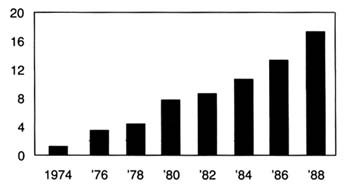

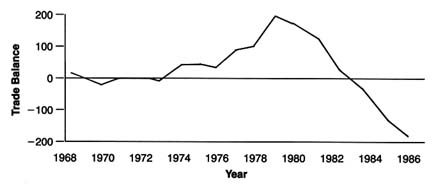

The value of the medical technology was quickly recognized. The procedure was significantly safer than X-rays and could detect certain problems more effectively. The first commercial sales occurred in 1963, and sales held steady at about $1 million

a year until the late sixties. They skyrocketed in the 1970s, rising from $10 million in 1973, to $77 million in 1980, to $145 million in 1987.[37]

Mitchell, "Dynamic Commercialization," fig. 4.3.

Lasers

The medical applications for lasers have had a much more complicated development than ultrasound. Laser is an acronym for l ight a mplification by s timulated e mission of r adiation. The theoretical knowledge to create a laser has been available since the 1920s, but the technical ingredients were not assembled until the 1950s. Pioneers in laser technology include Professors Gordon Gould and Charles Townes, and Arthur Schawlow from Bell Labs. Laser research quickly became the focus of physics, engineering, and optical sciences. Development followed no simple linear sequence. The scientific inquiry, device development, commercialization, and application of system components were parallel occurrences and influenced each other. Lasers represent a family of devices that have each developed and matured at different rates for a wide variety of applications.[38]

U.S. Congress, Office of Technology Assessment, The Maturation of Laser Technology: Social and Technical Factors, prepared under contract to the Laser Institute of America by Joan Lisa Bromberg, Contract No. H3-5210, January 1988.

A laser requires a lasing medium, or the substance to which energy is applied to create laser light. It must also have an excitation source, or a source of energy, and an optical resonator, which is the chamber where light is held, amplified, and released in a controlled manner. There are a number of types of laser light—it can be continuous or pulsed and have several visible colors or only ultraviolet—and a range of power levels. Types of lasers are named for the lasing medium. For example, there are chemical lasers, lasers with a fiber-optic light source, gas dynamic lasers, such as helium-neon with low-energy beams or carbon dioxide with low- to high-energy beams, and excimer lasers, which produce a high-energy ultraviolet output of gases combined under pressure.

In 1960, between twenty-five and fifty organizations worldwide worked on lasers. Within three years, the number increased to more than five hundred. There were anticipated industrial, military, and medical uses for the technology, and the military provided the most lucrative funds for R&D. In 1963, military funding was $15 million while industry invested only $5 to $10

million, and laser sales at that time were a mere $1 million. Clearly the private market could not sustain the costs of research. Many of the early researchers formed small companies and gravitated to the military. Herbert Dwight, an engineer and founder of Spectra-Physics, commented that "it was relatively easy on an unsolicited proposal to go out and get a relatively nominal contract with somebody like the Naval Research Laboratory … a well-known researcher with a good idea could sit down with a top representative of the NRL and pretty much on a word of mouth commitment get money to do work in promising areas."[39]

Bromberg, "Lasers," 28.

The Department of Defense, while quite enthusiastic about the potential of lasers, was unsophisticated in early contracts and got very little for its money in some instances. One company, TRG, received about $2 million of federal money and produced comparatively few discoveries. In 1965, a Battelle Memorial Institute report stated that "[the] very high [Department of Defense] budget for [research and development, testing, and evaluation] funds … encouraged many small companies to be forced to serve extremely specialized defense markets."[40]

The Implications of Reduced Defense Demand for the Electronics Industry, U.S. Arms Control, and Disarmament Agency (Columbus, Ohio: Battelle Memorial Institute, September 1965), cited in Bromberg, "Lasers," 33.

Military funding diverted research from the civilian markets. Consumer oriented firms did not have the resources to invest in long-term R&D. Laser applications in civilian areas stagnated as the Department of Defense directed R&D money to strategic and battlefield weapons, especially during the height of the Vietnam War. The military liked lasers because of their performance superiority over microwave systems. Military R&D focused on very high-powered lasers in the search for "death ray" weapons. Nonmilitary applications required low-powered beams that would not harm human tissue. It can be argued that industrial and medical applications were seriously disadvantaged by the diversion of laser research to military applications.

Thus, many civilian oriented firms floundered. As late as 1987, U.S. manufacturers, as well as European and Japanese firms, struggled to show a profit. These problems are not caused solely by a skewed focus on military applications. The technology has many variations and has advanced rapidly, leaving some companies with outdated systems. There are a wide variety of laser uses, and for any given type there are only a limited number of units produced, so manufacturing costs remain high.[41]

Biomedical Business International 10: 12 (14 July 1987): 113-115.

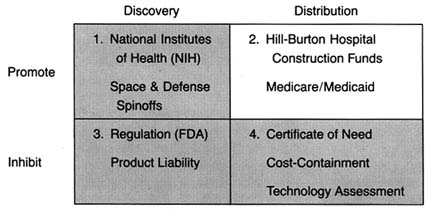

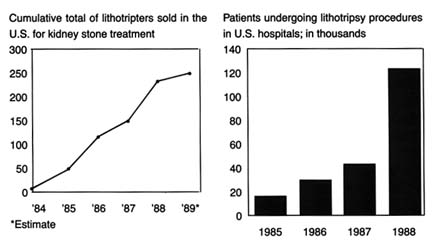

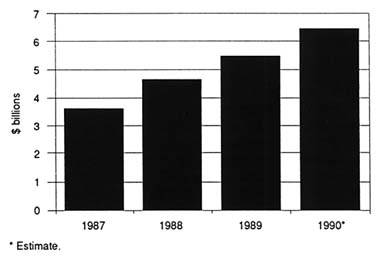

The maturity of the clinical applications varies across medical fields (see figure 10).

However, the civilian laser market, despite its rocky start, still looks promising for medicine in the long term. The most advanced, or mature, area of clinical application is ophthalmic surgery, and many other medical specialties are beginning to use lasers as well. There are promising new applications in cardiovascular surgery, in which research sponsored by the military has played a role. Excimer lasers, developed for the Defense Department at the Jet Propulsion Laboratory,[42]

"Now Lasers Are Taking Aim at Heart Disease," Business Week, 19 December 1988, 98.

generate short pulses of ultraviolet light that break down the molecules in plaque. Doctors can thread a tiny optical fiber through the artery. The laser probe vaporizes the fatty deposits without damaging surrounding tissue. Before this development, the laser beam sometimes burned a hole in the artery wall or made an opening through the blockage that allowed a clot to form or fatty deposits to rebuild. In early 1987, the FDA approved a laser probe developed by Trimadyne Company.It has been argued that while defense related R&D has created important spillovers to civilian uses, these occur only in the early stages of development, when "technologies appear to display greater commonality between military and civilian design and performance characteristics. Over time, military and civilian requirements typically diverge, resulting in declining commercial payoffs from military R&D."[43]

Cyert and Mowery, Technology, 37, citing Richard Nelson and R. Langlois, "Industrial Innovation Policy: Lessons from American History," Science 217 (February 1983): 814-818.

Indeed, some have suggested that defense R&D may actually interfere with the competitive abilities of firms, citing among other reasons the erosion of some firms' cost discipline as a result of operating in the more insulated competitive environment of military procurement.[44]Ibid., citing Leslie Brueckner and Michael Borrus, "Assessing the Commercial Impact of the VHSIC Program" (Paper delivered at the Berkeley Roundtable on the International Economy, University of California, Berkeley, 1984).

In laser research, there have clearly been benefits from military research to the civilian producers. However, the evidence supports the analysis that industrial and medical uses were delayed or disrupted because of diversion of research to military purposes.

Both the space and the defense R&D programs have had spin-off effects for medical devices. However, these benefits have been modest, particularly in relation to the expenditures of the space program, and, in the case of defense research, unpredictable. Without devaluing the benefits, medical science

Figure 10. Surgical lasers: maturity of clinical applications.

Source: "Surgical Lasers: Market, Applications, and Trends,"

Biomedical Business International 10:12 (14 July 1978), 114.

clearly cannot rely on these programs for systematic and sustained technological growth. As the case of laser research demonstrates, defense spending can obstruct the evolution and the development of civilian technologies. Nevertheless, government efforts can facilitate collaboration among universities, firms, and government scientists to produce technologies desired by the government.

Encouraging Technology Transfer

As we have seen, federal policies influenced the relationships among institutions in the research community. The dominance

of NIH investigator-initiated grants solidified the strong connection between universities and the NIH. Significant research also occurred within the NIH in conjunction with its intramural research program. Innovative work often languished in universities and government laboratories without transfer to the private sector for commercialization.

Figure 11 captures these institutional barriers to the transfer of technology in the area of biomedical research. The link between the NIH and universities was very strong; the links between universities and government laboratories and the private sector were weak. Consequently, many innovative ideas were developed in academic and government laboratories, but they were never commercialized. This section explores the reasons for these problems and describes the public policies that were designed to help move technology along the innovation continuum.

University-Firm Relationships

In the early twentieth century, university researchers and industrial firms had little in common. Industrial research was not organized, and industrialists generally believed that the role of manufacturers was to make products. Contacts between firms and universities generally only occurred when university graduates entered firms as employees. Studies of the pharmaceutical industry between the wars revealed that researchers based in universities tended to denigrate the atmosphere in industry, which did not place a high value on research. As firms saw the benefits of research on the bottom line, however, they initiated modest interaction with universities.

In the 1940s and the early 1950s, contact between these two sectors was strengthened through fellowships, scholarships, and direct grants in aid from industry to institutions of higher learning. Individual consulting relationships developed between professors and firms. In that period, 300 firms engaged in forms of university support; 50 of them subsidized 270 biomedical projects at 70 different universities.[45]

John P. Swarm, American Scientists and the Pharmaceutical Industry (Baltimore: Johns Hopkins University Press, 1988), 170.

Federal funding for scientific investigators burgeoned after

Figure 11.

Institutional relationships in biomedical research.

World War II. The presence of federal money for biomedical research decreased incentives for individuals in universities to work with industry. It was much easier to go hat in hand to the NIH for support. Business-academic interactions reached their nadir in 1970, reflecting the high and consistent level in NIH support at the time. Academic institutions have typically received little direct payment from companies to which technology was transferred; most of the benefits have been indirect. The transfer has not generally occurred through licenses, but only when university trained students seek jobs in firms, when firms review academic journals, when individual professors are hired as consultants, or when researchers set up their own companies.[46]

Mitchell, "Dynamic Commercialization," 107.

Indeed, the general trend before 1980 was that most commercial technological advances did not pass through either government or university patent offices. Some start-up companies did negotiate licenses with the institutions where the founders had worked; others did not.

Universities had little incentive to push for patent rights. This lack of incentive is tied to government policy. Under the terms of federal grants, the federal agencies that paid for the research held the patents. Indeed, few universities even had formal patent or licensing offices; many had contract relationships with off-campus patent agents.[47]

Adeline B. Hale and Arthur B. Hale, eds., Medical and Healthcare Marketplace Guide (Miami: International Biomedical Information Service, 1986).

Many researchers failed to disclosetheir research because they either did not want to share revenue with the university or did not want to bother with the headaches of dealing with off-campus agents.

Because the NIH supported so much basic research, few researchers could claim patent rights in any case. The federal agencies were allowed to assign rights to the universities or to individual researchers, but intensive negotiation was required and rarely undertaken. Only institutions with extremely active research units bothered to establish patent offices. A study of the field of diagnostic imaging showed that institutions with patent offices tended to have more academic imaging products licensed.[48]

The term diagnostic imaging refers to medical technologies such as X-ray and magnetic resonance imaging (MRI and ultrasound, among others).

Institutions with no patent office had few licenses even when the researchers were actively contributing to imaging innovation.[49]Mitchell, "Dynamic Commercialization," chap. 5.

By the late 1970s, shifts in government policy triggered changes in these institutional arrangements. The federal government began to reduce its commitment to federal research support. These cuts in federal biomedical research funding were exacerbated by the impact of inflation on research costs. Universities responded by encouraging contact with private industry, a potential source of research funds. One index of interaction is the flow of resources from firms to universities. The National Science Foundation estimated that corporate expenditures on university research would reach $670 million in 1987, up from $235 million in 1980.[50]

Cited in Calvin Sims, "Business-Campus Ventures Grow," New York Times, 14 December 1987, 25, 27. The top university recipients in 1986 were Massachusetts Institute of Technology, Georgia Institute of Technology, Carnegie Mellon University, Pennsylvania State University, and University of Washington.

Corporate funds generally fall into three categories: gifts, research awards, and awards for instruction, equipment, and facilities. In fiscal year 1988 at the University of Michigan, for example, industry provided $104 million in gifts and grants (15.3 percent of total gift income) and $20.5 million in contract research expenditures (8.7 percent of total research expenditures). Research funds from industry rose 82 percent between 1983 and 1988, paralleling the growth in total university research expenditures. These figures do not include individual consulting relationships between faculty researchers and firms.[51]

Judith Nowak, "The University of Michigan Policy Environment for University-Industry Interaction" (Paper delivered at Institute of Medicine Workshop on Government-Industry Collaboration in Biomedical Research and Education, Washington, D.C., 26-29 February, 1989).

Universities also developed significant formal institutional relationships with business, such as the creation of research parks and research consortia on or near campuses. Nearly four dozen universities have or are seriously considering the establishment

of research parks, including Stanford, North Carolina, Duke, Yale, and Wisconsin. By 1988, Johns Hopkins University Medical School had over two hundred separate agreements with industry.[52]

David Blake, remarks at the Institute of Medicine, Forum on Drug Development and Regulation, Washington, D.C., 3 March 1989.

Congress also initiated some affirmative policy changes. In 1980, it passed the Bayh-Dole Patent and Trademark Amendments.[53]

Public Law 96-517 (12 December 1980).

This law gave nonprofit organizations, notably universities, rights to inventions made under federal grants and contracts. The new policy led to increased efforts by universities to report, license, and develop inventions. In 1984, the policy was extended to federal laboratories operated by universities and nonprofit corporations.[54]Public Law 98-620 (9 October 1984).

Many academic institutions have responded by creating patent, licensing, and industry liaison offices or by increasing the activity of existing offices. In 1985, for example, the total royalty income received by Stanford, MIT, and the University of California had risen from less than $5 million per year during the early 1980s to about $12.5 million annually. University of California revenue grew from $3.4 million to $5.4 million between 1985 and 1987 alone.[55]Mitchell, "Dynamic Commercialization," 110.

Holding a patent will encourage technology transfer because licensing patent rights can be profitable. Universities have worked out elaborate policies for royalty sharing. Individual professors and the universities themselves stand to profit handsomely. The act of licensing transfers these innovative ideas to the private sector, a transfer that is consistent with the promotion of private sector initiatives and the downplaying of federal agencies that characterize the 1980s. Unlike the targeting approach of the 1970s, whereby a federal agency like the NIH decided what technologies to procure and paid for them to be developed, this new technology policy provides financial incentives in the private sector to promote technology transfer. The early data indicate that the incentives are working and that relationships between firms and universities have strengthened as a result.

Business-Government Relationships

Basic research also occurs in federal laboratories. The federal government spent approximately $18 billion in 1986 on research

and development at over seven hundred federal laboratories. Although the NIH devotes only about 10 percent of its funds for in-house or intramural research, the research productivity of NIH scientists has grown steadily. Despite the fact that government laboratories have produced over 28,000 patents, only 5 percent have ever been licensed. Indeed, the NIH held few patents and practically gave away licenses. After all, the government scientists worked for salaries and were committed to research; the NIH had ample funds from Congress without supplementing income with licensing arrangements.

In 1980, Congress enacted the Stevenson-Wydler Technology Innovation Act to encourage the transfer of federal technology to industry.[56]

Public Law 96-480 (October 1980).

Technology transfer from federal laboratories to industry became a national policy. The law created government offices to evaluate new technologies and to promote transfer, but it was not fully implemented or funded. Many of the federal laboratories lacked clear legal authority to enter into cooperative research projects.In 1986, Congress passed the Federal Technology Transfer Act, amending Stevenson-Wydler to allow federal laboratories to enter into cooperative research with private industry, universities, and others.[57]

Public Law 99-953 (1986).

It established a dual employee award system of sharing royalties between the agency and the individual researcher and making cash awards as well. Specifically, it provided for at least a 15 percent royalty payment to laboratory employees from the income received by the agency from the licensing of an invention. It also established a Consortium for Technology Transfer.President Reagan issued an executive order in 1987 that called for enforcement and compliance with the law.[58]

Executive Order 12591, Facilitating Access to Science and Technology (April 1987).

This order required that federal agencies "identify and encourage persons to act as conduits between and among federal laboratories, universities and the private sector for the transfer of technology, and to implement, as expeditiously as practicable, royalty sharing programs with inventors who were employees of the agency at the time their inventions were made, and cash award programs." Federal agencies in general, and the NIH in particular, struggled to define the parameters of relationships between its own scientists and commercial organizations. The NIH Officeof Invention Development reported in 1989 that it reviewed four to five cooperative research and development agreements (CREDAS) each month.

Federal policies clearly have promoted innovation in biomedical sciences. How well have medical devices fared under these policies? The relationship between NIH and universities for promotion of basic scientific research benefits all scientific progress, which includes medical devices along with other medical technologies. However, the traditional bias of the NIH against engineering and other physical sciences has undoubtedly meant that some device technologies were overlooked. Most complex devices, particularly implantables, require a multidisciplinary approach to innovation. An unduly narrow focus on biochemistry and pharmacology at the expense of physics, engineering, and biomaterials science would not promote development in those fields.

The medical device industry stands to benefit from policy changes that have promoted government links with private industry. Congressional efforts to direct the NIH toward targeted development have supported some medical device innovation. The support provided to small innovators pursuing long-term investigations undoubtedly has fostered technology that would otherwise be abandoned. The Artificial Heart Program illustrates both the strengths and the weaknesses of the approach. Clearly, some innovative firms, and some technology, would not exist without NIH support.

Similarly, the recent efforts to strengthen the relationship of universities and government labs to private firms will also benefit the device industry. As with targeted development, this approach erodes the traditional focus on basic science, emphasizing instead the commercial potential of new ideas. Collaboration with universities presents positive opportunities for the device industry. Because of the multidisciplinary nature of device development, the more alternative routes available to an innovator the better.

These changes raise significant social issues that are often overlooked. Is government targeting of medical technology a wise use of public funds? Are these products different from other goods, justifying public expenditures for product development?

Such a view "assumes that if a potential capability exists to cure a life-threatening disease, there exists a moral obligation to develop that capability. It is a kind of extension of the philosophy underlying the Hippocratic oath to the development of new technologies."[59]

Brooks, "National Science Policy," 155.

Other issues arise when taxpayers' money is used to develop products. Should these beneficial products be turned over to the private firms who will make a profit on them? What if the products developed with government funds are so expensive that some citizens will not be able to afford them? The artificial heart will be an extraordinarily expensive technology. Does it make any difference whether the source of funds was public or private or whether the product is widely available? Is it equally immoral for government to fail to promote a lifesaving or life-enhancing technology if there is the basic knowledge to develop it but no source of private funds?

How well does government pick technologies to promote? There is contentious debate over the wisdom of industrial policy, which refers to deliberate government programs that channel resources to particular industrial sectors to promote or protect them. Does government have the skill to pick winners in the medical marketplace?

Additional issues arise in relation to the institutional changes discussed above. Some have called the federal policies to strengthen the ties of university and government laboratories to industry misguided because of the institutional effects. They ask, for example, whether the profit motive will subvert the scientific missions of universities and government researchers, who may be lured by profits from the private sector and ignore the pursuit of knowledge for its own sake. Will conflicts of interest between public employees and the private sector arise as a result? Some fear that the NIH will become a private procurement lab for industry. Who will engage in the long-term scientific investigations with no immediate commercial potential if professors are busy collaborating with industry? Will academic researchers hesitate to disclose their findings until the patents are filed, thereby restricting the free flow of information at scientific meetings? Secrecy is antithetical to scientific progress, but it is essential to profitmaking in a competitive environment.

These tantalizing questions are not easy to answer. However, they illustrate the complex issues raised by government promotion of medical discoveries, questions we will explore further in the concluding chapter. Now we turn to government promotion of medical device distribution—the other end of the innovation continuum.

4

Government Promotes Medical Device Distribution

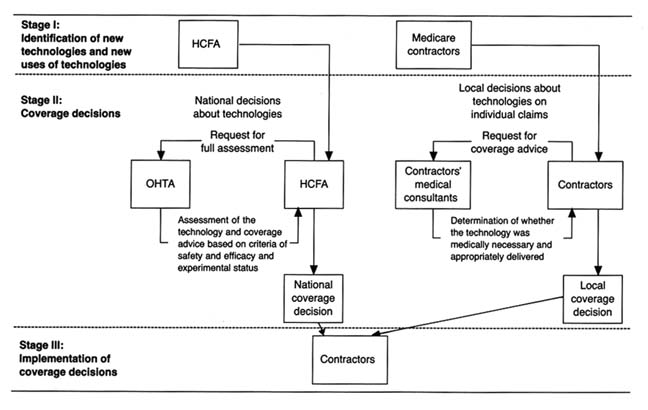

Figure 12. The policy matrix.

Throughout the 1950s and 1960s, the federal government remained firmly committed to promoting biomedical research. Public belief in the benefits of technology characterized this period. As technological improvements in medical treatment emerged after World War II, many people were priced out of the increasingly sophisticated and desirable medical market. At the same time, there was growing belief that it was immoral not to provide some level of health care to everyone who needed it.

Demand for access to health care increased. The economics of health soon became a political issue. In a variety of ways, government accepted greater social responsibility for the structure of health care delivery and access for excluded groups. Indeed, the public sector moved from a refusal to become involved in health

care to the nation's largest single purchaser of services in a relatively brief period. By the mid-1980s, public funds accounted for 20 percent of health care spending and 40 percent of payments to hospitals.[1]

For data on spending, see R. M. Gibson et al., "National Health Expenditures, 1982," Health Care Financing Review 9 (Fall 1987): 23-24. See also Daniel R. Waldo et al., "National Health Expenditures, 1985," Health Care Financing Review 8 (Fall 1986).

This chapter examines how the government commitment to health care has influenced the medical device industry from the postwar period until 1983. Our examination breaks at that juncture because massive changes in the structure of the federal payment system that year ushered in the era of cost containment. In the period before 1983, government policy promoted distribution of medical device technology. The entry of government led to unrestrained growth in the demand for medical devices. Government policy encouraged acquisition regardless of cost and was biased toward growth of hospital based technology. Government affected both the size and the composition of the medical device market. (See figure 12.)

As a third-party payer, rather than a provider of services, government refrained from direct involvement in treatment decisions. The result was only tenuous control over total program costs. These policies provide the background for the cost-containment efforts of the late 1970s and 1980s that will be discussed in chapter 7.

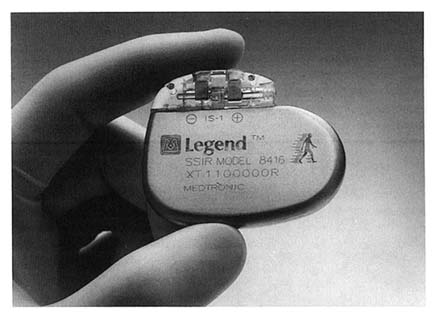

This chapter illustrates the impact of government policy through three case studies. The story of the artificial kidney shows how government spending literally created the market for this expensive, lifesaving technology. The introduction of the CT scanner, a computer assisted X-ray device that revolutionized diagnostic imaging, illustrates the effect of government spending policy on the diffusion of high-cost capital equipment. Finally, the rapid growth of the cardiac pacemaker market reveals how unrestrained payment can lead to market abuse.

A brief caveat before proceeding: Medicare and Medicaid are extremely complex public policies, and the discussion here is inevitably cursory. This chapter examines the impact of the government payment systems on medical devices. Many less pertinent, but otherwise important, aspects of these payment schemes are not discussed. Interested readers should consult the notes for more detailed studies.

Policy Overview, 1950–1983

Hill-Burton Promotes Hospital Growth

Very little hospital construction took place during the depression and World War II. After the war, however, there was both a general belief that hospital beds were in short supply and much concern about the uneven distribution of beds among the states and between rural and urban areas.[2]

Commission on Hospital Care, Hospital Care in the United States: A Study of the Function of the General Hospital, Its Role in the Care of All Types of Illnesses, and the Conduct of Activities Related to Patient Service with Recommendations for Its Extension and Integration for More Adequate Care of the American Public (New York: The Commonwealth Fund, 1947).

Congress passed the Hospital Survey and Construction Act of 1946, which has come to be known as Hill-Burton, the names of its congressional sponsors.[3]Public Law 79-725. For a complete description of the history of the Hill-Burton Program, see Judith R. Lave and Lester B. Lave, The Hospital Construction Act: An Evaluation of the Hill-Burton Program, 1948-1973 (Washington, D.C.: American Enterprise Institute, 1974).

Hill-Burton represented an unprecedented involvement of the federal government in facilitating access to health care. The objectives of the new legislation were to survey the need for construction and to aid in the building of public and other nonprofit hospitals.Consistent with ongoing concerns about the propriety of federal involvement in health services, the program was set up as a federal and state partnership. An agency in each state was designated as the state approved Hill-Burton organization and was given an initial grant to survey hospital needs. The state then received funds to carry out the construction program, subject to federal approval. Priority was given to states where shortages were the greatest. The ultimate allotment formula was based on the state's relative population and its per capita income. The poorer and the more rural the state, the greater the level of federal funds available to it.

In the period of 1946–1971, short-term acute or general hospitals received the largest share of Hill-Burton support, averaging over 71 percent of program funds. While Hill-Burton funds did not dominate spending on hospital facilities, their impact on hospitals was high. Between 1949 and 1962, the federal government paid directly about 10 percent of the annual costs of all hospital construction under the program. In other words, about 30 percent of all hospital construction projects received some form of federal assistance.[4]

Lave and Lave, Hospital Construction, chap. 1.

The number of available hospital beds grew accordingly. In 1948, there were 469,398 short-term beds; by 1969, the number had almost doubled to 826,711. Of these, 40 percent had been

partially supported by Hill-Burton monies.[5]

Ibid., 25.

Studies indicate that the program had a generally significant effect on the change in hospital beds per capita between 1947 and 1970.[6]Ibid., 37.

In particular, it increased the number of hospital beds in smaller cities and targeted low-income states.The impact clearly favored the growth of short-term acute care facilities. Some years after the program began, there was a recognition of the bias in favor of these institutions. In 1954, Congress amended the law to provide grants to assist with out-patient facilities and long-term care facilities. In 1964, additional changes earmarked funds specifically for modernization of older facilities rather than for a further increase of beds. Despite these amendments, the thrust of the program was expansion of acute care facilities. Government funds essentially established the mix of facilities in the marketplace. The result was growth of the potential market for medical technology appropriately designed for these settings. The beds were available; the problem then became access to this costly and sophisticated hospital care.

The Pressure for Access Grows

Expansion of hospitals inevitably led to pressure to provide more services as hospitals sought to fill their beds. During the prewar period, particularly during the depression, families denied themselves medical care. However, medicine now offered more benefits than ever before, particularly in the modern hospital setting. In response, interest groups began to press policies that would increase access to these new and expensive therapies. Some turned to government as the logical source of funds for health care services. However, reformers confronted the traditional long-standing objection to federal involvement in health care services.

This opposition to federal entry into health care was intense. In stark contrast to the expansion of Social Security during the postwar period, there was a political deadlock over state supported health insurance proposals.[7]

Starr, Transformation, 286.

Physicians, represented by the American Medical Association (AMA), and many business groups strongly opposed all forms of national health insurance.The AMA denounced disability insurance as "another step toward wholesale nationalization of medical care and the socialization of the practice of medicine."[8]

Arthur J. Altmeyer, The Formative Years of Social Security (Madison: University of Wisconsin Press, 1968), 185-186, cited in Starr, Transformation, 286 n. 151.

The debate has been characterized as partly ideological, partly social, and partly material. For all these reasons, compulsory national health insurance was not forthcoming in the 1950s. Only American veterans received extensive, federally supported medical care through Veterans Administration hospitals that were greatly expanded during the postwar period. "The AMA opposed the extension of the veterans' program to nonservice connected illness, but the veterans were one lobby even the medical profession could not overcome."[9]

Starr, Transformation, 289.

There is real irony in this physician-led opposition to federal health programs given both the subsequent expansion of the patient base through Medicare and Medicaid and the flow of millions of dollars to physicians from government coffers.Although the government remained intransigent, there were options in the private sector for some groups. The middle class continued to seek forms of private insurance coverage; unions began to look for health benefits in collective bargaining agreements. By the 1950s, there was a stable pattern of growth in private insurance coverage, expanding the market for health care to the employed and the middle class. Much of the insurance was available to working people as fringe benefits; labor managed to bargain successfully for health insurance. By mid-1958, nearly two-thirds of the population had some insurance coverage for hospital costs. The higher the family income, the more likely that it had insurance. In 1948, 72 percent of patients paid directly for health care and only 6 percent had any form of private third-party insurance. By 1966, 52 percent of patients paid directly for health care and 25 percent had private insurance (see table 2). The numbers that received care from public funds remained relatively stable—19 percent in 1948 and only 21 percent by 1966. The poor received welfare and charity care when they could. The retired, unemployed, and disabled were often virtually excluded from the benefits of hospital based care.

The availability of insurance provided stability to the market and increased market size. The financing mechanisms through

| ||||||||||||||||||||||||||||

payroll withholding kept spending stable during recessions and reduced market uncertainty for providers and suppliers. Although causality is difficult to document, the growth in private health care expenditures during this period did expand the market for medical products, particularly in the hospital sector. The value of medical product shipments, based on data in the SIC codes, began to climb, and sales in the five relevant SIC categories rose at an average annual rate of 6 percent, which is three times the growth rate immediately before World War II but less than half of the wartime rate of increase.[10]

Foote, "Crutches to CT Scans," 10.

Table 3 captures the boom in sales during this period.Despite the growth of private insurance, pressure to expand access to health care from those outside the medical care system continued. Some favored a compulsory and contributory health insurance system. Although legislation had been introduced as early as 1958, the real impetus came after the Democratic sweep of the presidency and the Congress in 1964. In 1965, President Johnson signed the Medicare Amendments to the Social Security Act in which the federal government definitively entered the marketplace. The new law's intention was to open the health care system to the elderly. The president declared: "Every citizen will be able, in his productive years when he is earning, to insure

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

himself against the ravages of illness in his old age…. No longer will illness crush and destroy the savings that they have so carefully put away over a lifetime."[11]