Preferred Citation: Gilbert, Richard J., editor Regulatory Choices: A Perspective on Developments in Energy Policy. Berkeley: University of California Press, c1991 1991. http://ark.cdlib.org/ark:/13030/ft838nb559/

| Regulatory Choices |

Preferred Citation: Gilbert, Richard J., editor Regulatory Choices: A Perspective on Developments in Energy Policy. Berkeley: University of California Press, c1991 1991. http://ark.cdlib.org/ark:/13030/ft838nb559/

ACKNOWLEDGMENTS

This book is the end result of a research program supported by the Universitywide Energy Research Group (UERG) of the University of California. We are indebted to the support made available by the University of California and to many of our colleagues who made this effort possible. Mike Lederer, Deputy Director of UERG, deserves the title of executive producer for this project. He helped organize meetings, communicate results, and iron out our differences. Mike thoroughly edited the final manuscript and made many important contributions. If our end product shows a semblance of order, it is in large measure a consequence of Mike's help.

Carl Blumstein, also of UERG, contributed his time and efforts to help keep our project on track. Carl worked with our able copyeditor, Suzanne Holt, and provided valuable advice to the team. Ed Kahn provided valuable comments during his visit to UERG. We are also grateful to Kermit Kubitz, Roger Noll, and Mason Willrich for their suggestions.

I can't give enough thanks to our UERG staff, Carol Kozlowski and Linda Dayce. Carol and Linda worked tirelessly to prepare working drafts and the final manuscript. They endured our many revisions. Their support and good humor were indispensable.

Finally, I have to thank my colleagues whose names appear in this book. Differences of opinion and methodology are inevitable and they are apparent in this book. I am happy to say that we saw through our differences and those that remain reflect the controversy and intellectual excitement of this field.

ONE

Introduction and Overview

Richard J. Gilbert

This book is an attempt to apply an economist's microscope to the process of public utility regulation. Long the bastion of the status quo, public utility regulation has felt the surge of deregulation proposals that have swept the country. Some of the most innovative and far-reaching programs of regulatory reform have originated in the state of California. In this volume we examine the results of this "new" regulation and consider some of the prospects for further reforms. Part I deals with issues in utility ratemaking. Perhaps the most basic principle of public utility economics is the desirability of prices that are as close as possible to marginal production costs.[1] Marginal cost is the additional expenditure required to serve a small increase in demand. Economic principles dictate that the rate each customer should pay should be closely related to the marginal cost of serving that customer.

Traditional utility regulation is concerned with setting rates that just recover the cost of providing service. Rates for particular classes of service, such as residential and industrial, have responded to political pressures to favor one group over another. Often lost in this process is the value of utility rates as measures of the cost of meeting additional demand, i.e., the marginal cost of serving a customer.

Many factors complicate the calculation of marginal cost and its use as a bench mark for rate design. Marginal cost varies over time as utilities

[1] This statement must be qualified by the "theory of the second-best," which states that marginal cost pricing is not necessarily desirable when there are unavoidable distortions in other sectors of the economy. Despite the practical importance of second-best considerations, the principle of marginal cost pricing has remained a primary objective in utility economics. A main reason is the absence of a satisfactory alternative to marginal costs as a foundation for rate design.

respond to changing demand by altering the mix of production facilities. Marginal cost is also very sensitive to changes in the price of fuel or other factors of production. Making rates track marginal cost at every instant of time would be like tracking the tail of a dog. Even if it can be done, it is not clear that it is worth the effort.

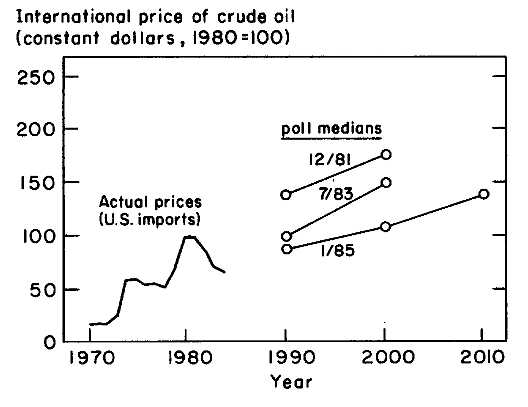

Chapter 2 surveys a number of issues in utility rate design, focusing on the application of marginal cost principles and the difficulties that arise in trying to design and implement policies based upon them. In this chapter L. S. Friedman argues that utility rate design should deal with the complex circumstances that determine a consumer's demand for energy. Consumers might confuse the average cost of electricity with the marginal cost of an increase in consumption. The latter is the real cost to the consumer of a change in consumption, but the consumer might rely on the average bill as a signal of energy costs. By allowing for the idiosyncrasies of consumer behavior, regulators may be able to improve the efficiency of the electric power market. An example is energy-efficiency standards for residential appliances. In addition, if consumers rely on current prices as the main source of information about future economic conditions, there is a case for pricing at levels that are closer to long-run instead of short-run marginal costs. However, Friedman notes that these recommendations must be highly qualified. Although several studies indicate economic imperfections in residential energy decision-making, the regulatory record to date does not show much evidence that regulators are better able than consumers to predict future energy prices and to set rates that lead consumers to act in their own economic interests.

Chapter 3 reviews the role of utility regulation in sharing the risks of capital investment. A main economic function of regulation is to provide a stable financial environment that permits a utility to invest in large capital projects, while at the same time protecting consumers from the exercise of the utility's market power. But in this area, regulation may have succeeded too well. Regulatory policy in the period of the 1960s and early 1970s encouraged utilities to invest in projects that, in retrospect, exceeded the managerial resources of many companies (examples are the ill-fated Washington Public Power Supply System and Public Service of New Hampshire). The Public Utility Holding Act of 1935 discourages merger activity in this industry, as do regulatory policies that prevent stockholders from reaping the rewards of sharp management and from bearing the consequences of errors. In Chapter 3 I argue that the Public Utility Holding Act should be repealed or amended to encourage a restructuring of utility capital and allow utilities to better exploit managerial and technical expertise. In addition, regulatory policy should be changed to replace the "cost-plus" nature of rate-

of-return regulation with a system that compensates firms for superior performance.

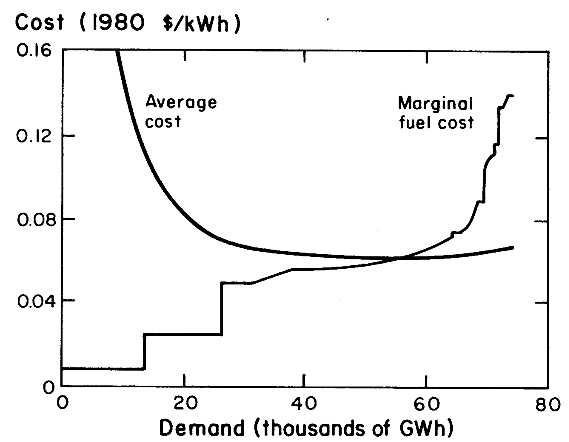

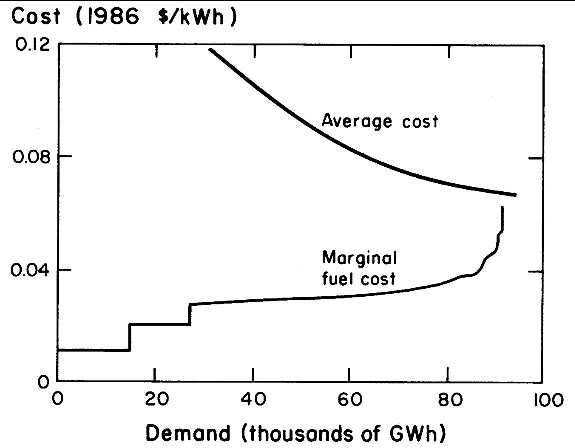

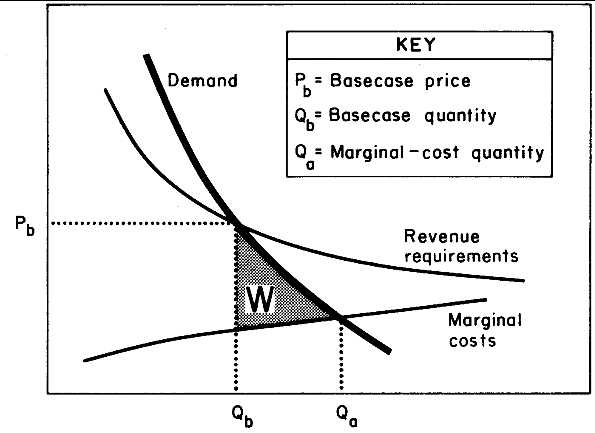

Chapter 4 examines the potential gain from rate reform in the market for electric power. In California (and in many other states) residential customers pay rates that, relative to the marginal costs of service, are lower than the rates paid by commercial and industrial customers. In addition, California residential customers with moderate energy needs benefit from an "increasing block" rate structure, in which the marginal price of electricity increases with use.

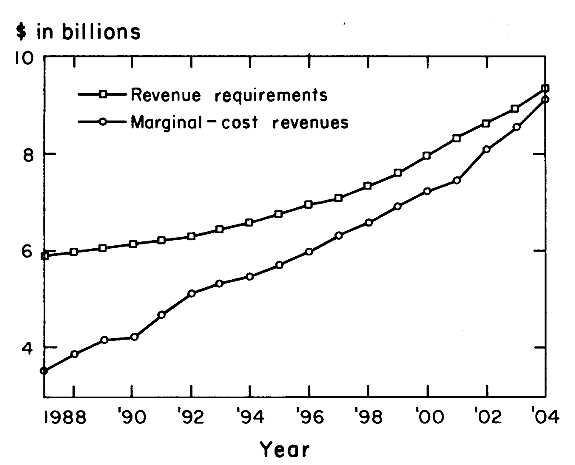

This pattern of utility rates came about in response to both economic and political pressures. When increasing block rates were first mandated by California state law, the marginal price of electricity was high relative to historical average costs. Increasing block rates had an economic rationale because they raised the marginal price of electricity for most customers to a range that was closer to the anticipated long-run marginal cost of service. Since that time new capacity additions, increases in utility reserve margins, and lower fuel costs have sent marginal costs into a nosedive while the average cost of electricity production has soared. In this economic environment increasing block rates aggravate the spread between the marginal prices that customers face and the marginal costs of serving them. High prices tempt large industrial and commercial users to invest in alternative energy sources, sometimes at costs higher than the marginal cost of utility power. Such investment is termed "self-generation" when a customer generates electricity for his own use. Self-generation is an example of the more general phenomenon of "bypass," which occurs whenever a customer replaces utility-generated electricity with an alternative source of supply. The resulting losses in economic efficiency are large. John Henly and I estimate that inefficient pricing of electric power costs California alone about one billion dollars per year. Chapter 4 considers various options to improve the economic efficiency of electricity pricing. Pricing schedules whose effects are limited to rearranging revenue burdens between customer classes or over time have, by themselves, only a modest potential for increased efficiency. The reason is that they do little to close the large gap between price and marginal cost. The use of two-part tariffs or declining block rates can allow prices to move closer to marginal production costs, but the distributional effects in the residential class are unpleasant and the potential efficiency gains for industrial and commercial consumers are constrained by their substitution possibilities. The largest scope for improvement lies in a coordinated approach to rate design that combines a reallocation of revenues across customers with a reallocation of revenues across time. Taking advantage of the likelihood that marginal costs will increase relative to average costs in the future allows regulators to borrow from the future

and narrow the present cost gap. This permits efficiency gains from marginal-cost pricing with smaller distributional impacts.

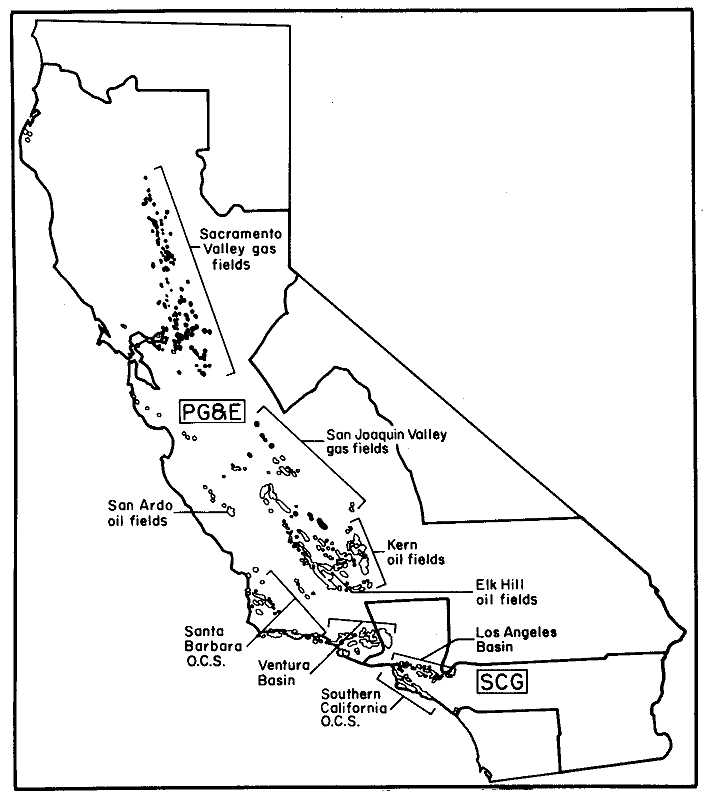

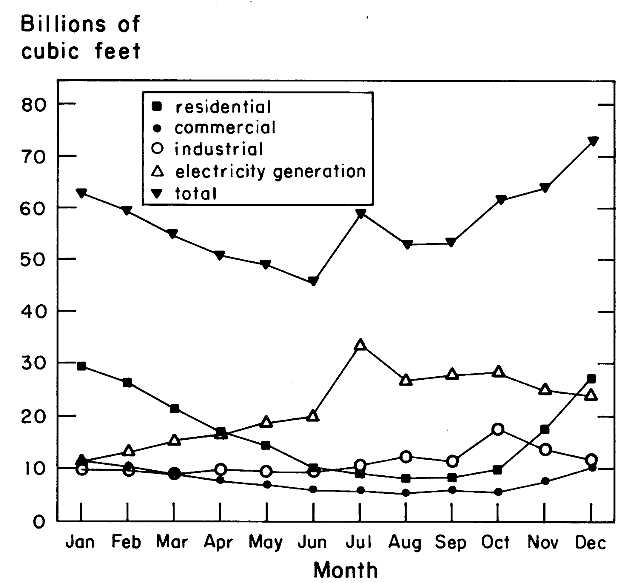

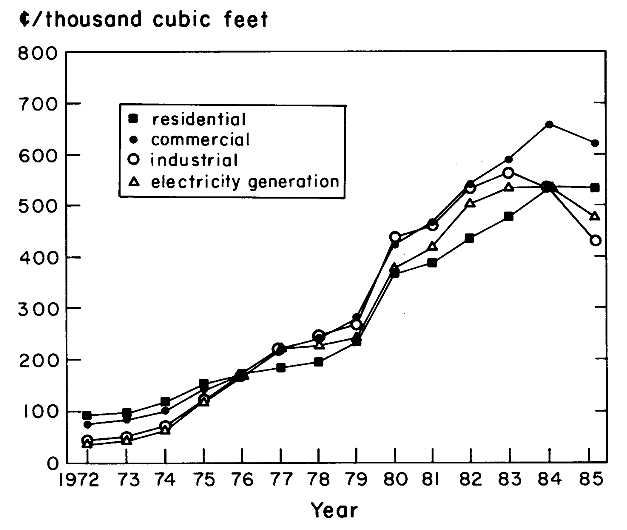

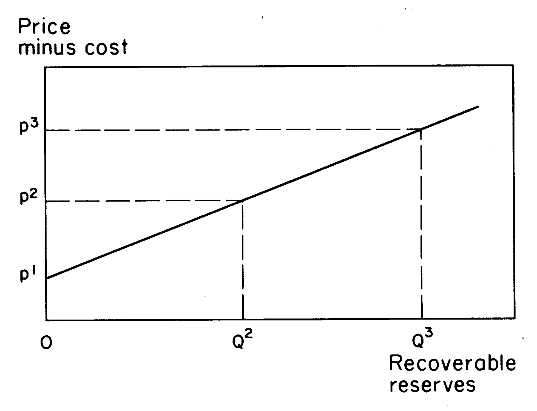

Chapter 5 is a broad look at regulatory trends in the natural gas distribution industry. Partial deregulation of natural gas wellhead prices began in 1985 according to the provisions of the Natural Gas Policy Act of 1978. The sudden increase in prices predicted by many opponents of deregulation did not materialize, and the only dramatic price movements were in the downward direction as markets responded to a surplus of natural gas. Russo and Teece refer to a "take-or-pay crisis," which resulted when natural gas distribution companies entered into firm contracts for the delivery of gas supplies without a guaranteed demand. As the gas markets softened these companies were caught in a squeeze, with mounting supplies and shrinking demand.

A major development in the natural gas industry is the emergence of contract carriage, in which end users contract directly with gas producers and pay the distribution company only for the cost of moving the gas. This contrasts with prevailing practice in which distribution companies purchase gas supplies for resale. Contract carriage is a move toward a deregulated gas market, in that consumers and producers can search freely to make the most attractive deals. Russo and Teece believe that some form of voluntary (or perhaps mandatory) contract carriage should accompany the decontrol of wellhead prices to insure that the benefits of decontrol are not captured by pipelines.

Russo and Teece point to evidence of low market concentration in natural gas production and conclude that "on strictly efficiency terms, the argument for continued regulation of any gas reserves is weak." The picture is less clear in natural gas distribution. Although many large markets are served by several pipelines, and most large customers have alternative sources of supplies, capacity limitations and the immobility of distribution capital may allow exercise of market power in specific situations.

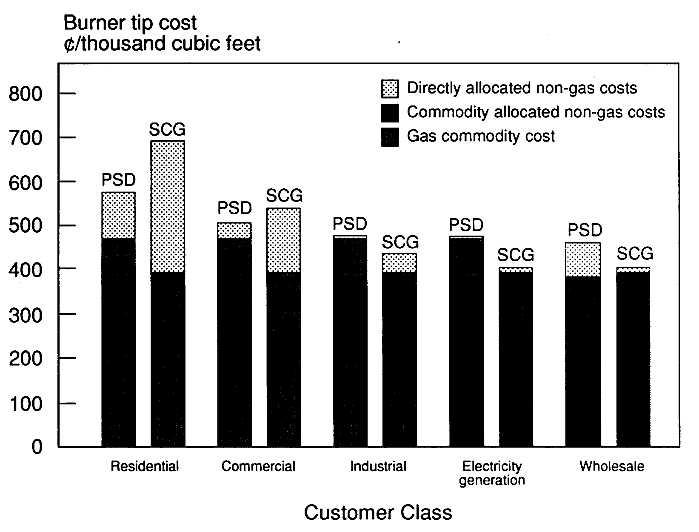

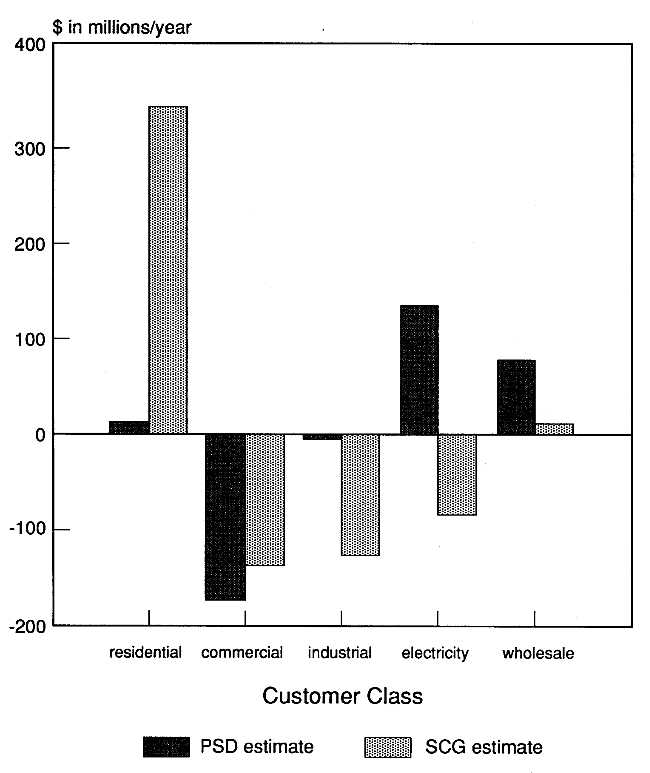

Rate design in the natural gas market, as in electricity, illustrates the interplay of politics and economics that characterizes public utility regulation. Political pressures have favored residential consumers in recent years, while the ability of industrial and large commercial customers to bypass the utility have favored rate reductions for these classes. A novel twist in public utility regulation is the recent designation by the California Public Utilities Commission of "core" and "non-core" customer classes, which receive different treatment, not only for the pricing of gas, but also with respect to procurement of new supplies. Although this regulatory innovation can (and will) be criticized for its unequal treatment of different' customer classes, it is nonetheless a step forward because it recognizes the importance of narrowing the gap between price and the

marginal cost of service for those customers whose demands are particularly sensitive to price. In addition to the economic distortions from prices that diverge from marginal costs, Russo and Teece argue that regulation has contributed to inefficiency by failing to provide utilities with sufficient incentives to contain their costs.

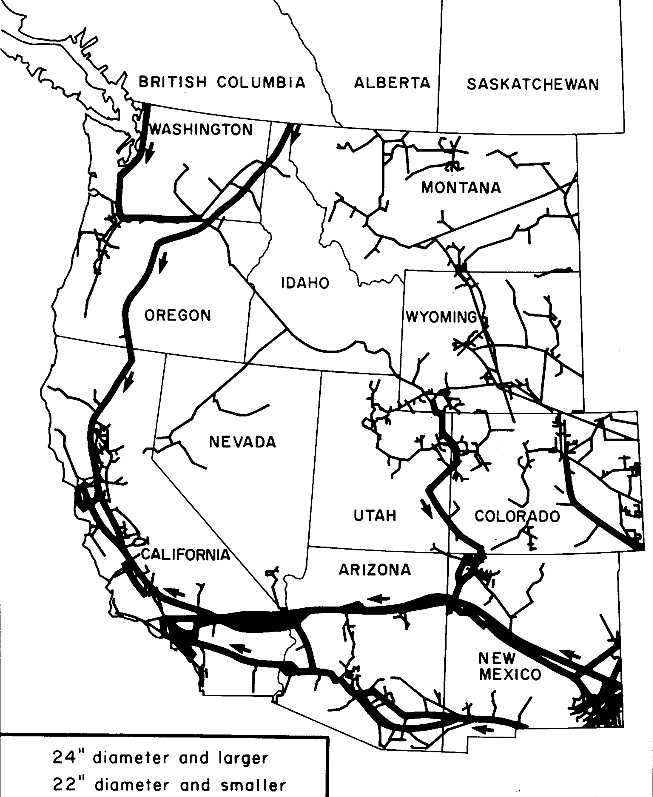

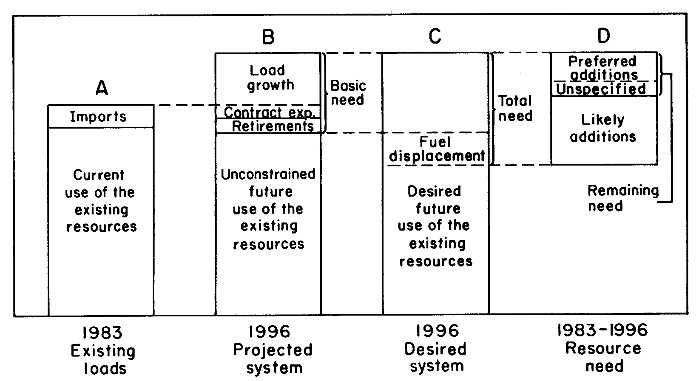

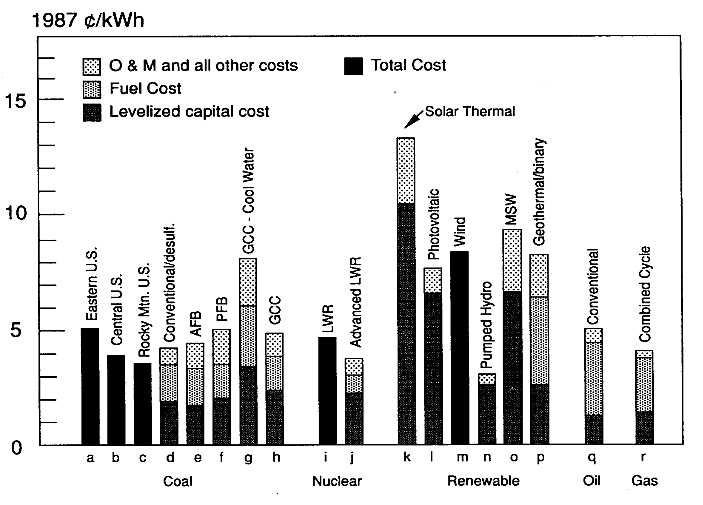

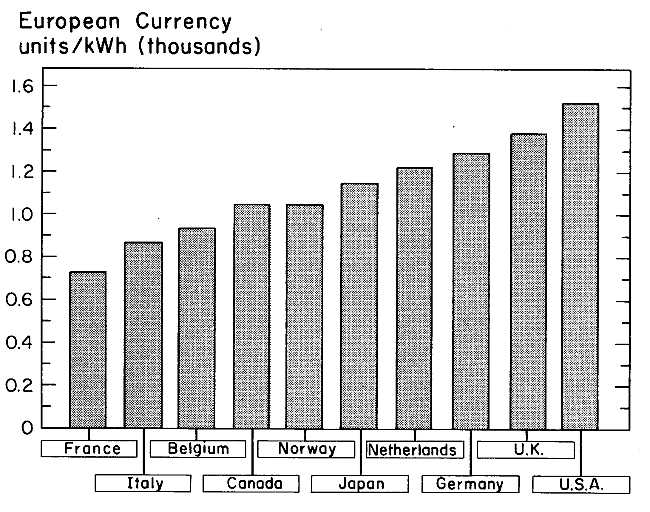

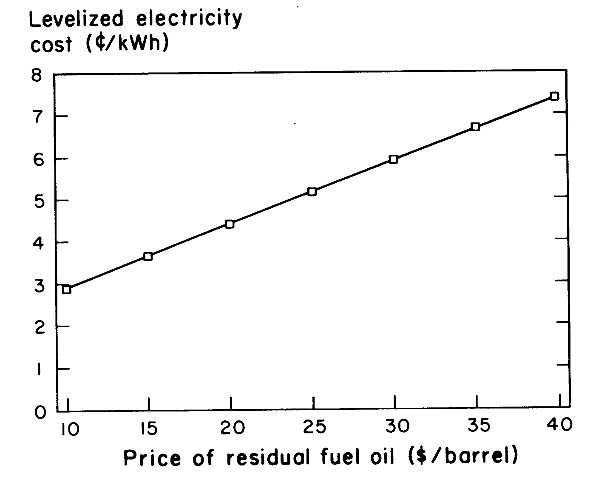

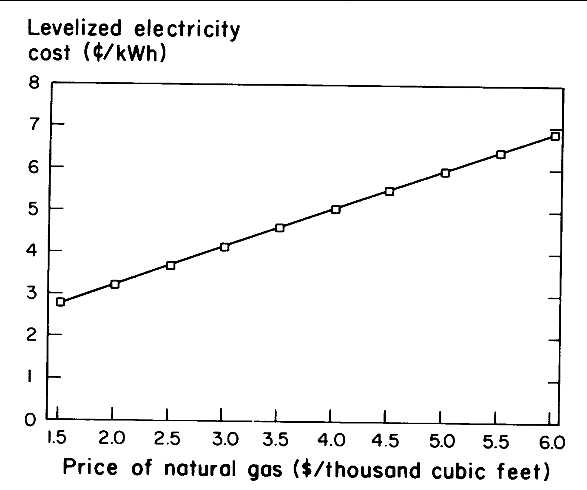

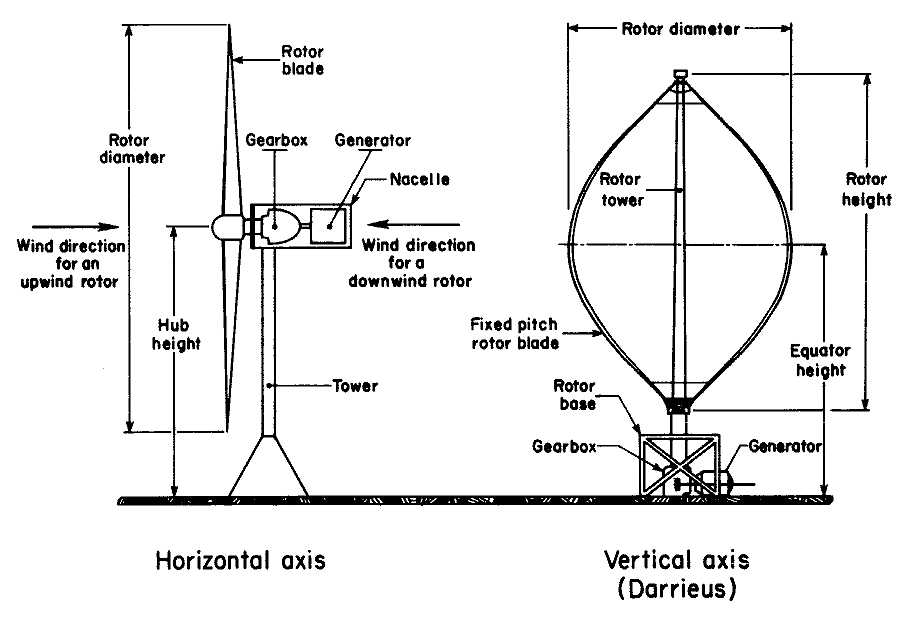

Part II of the book moves from problems of rate design to problems of energy supply. A survey of cost estimates for alternative energy sources is the subject of Chapter 6 by Mead and Denning. In addition to surveying studies of private (direct) energy costs, they also attempt to include estimates of social costs (the total of direct costs and health and environmental impacts). The energy sources they examine include coal, oil, natural gas, nuclear, wind, solar, biomass, and imports of surplus power from the Northwest and Southwest.

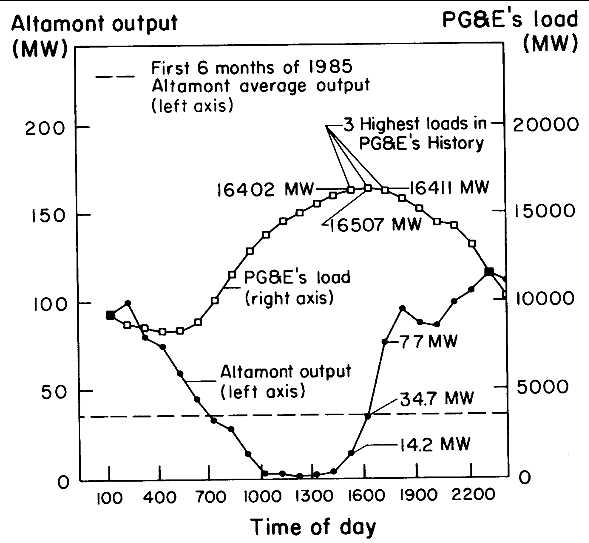

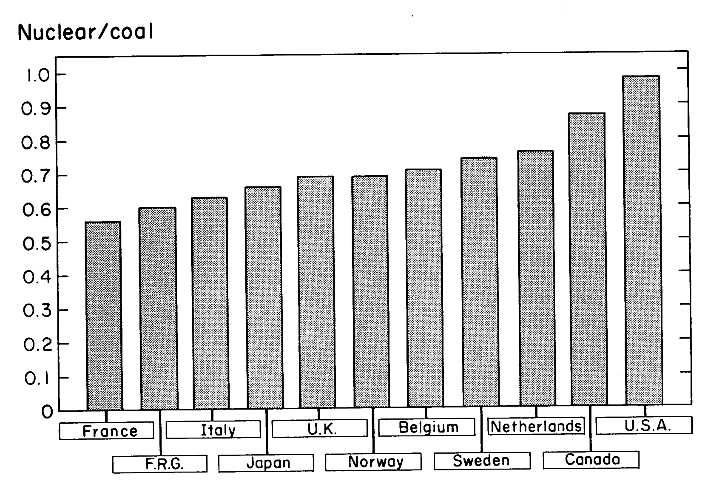

Mead and Denning expect economic growth and lower oil and gas prices (relative to the early 1980s prices of about $32-34/bbl) to cause an increase in electricity demand that will require new reserve additions in the state of California within a decade. They point out that although imports from the Southwest and Pacific Northwest (primarily surplus hydropower) can fill short-term needs, increasing electricity demand in the West will soon eliminate that surplus. Mead and Denning are bullish on the potential for thermal power, particularly nuclear and coal, to meet the electricity needs of the West. They find little evidence to support the view that unconventional sources—solar, biomass, and wind— can provide the large amounts of electric power that will be demanded in the future at social costs that are competitive with coal, nuclear and imports of surplus power. They attribute much of the disappointment with the performance of nuclear power to excessive costs imposed by intervenors and to unnecessarily burdensome regulations, although this conclusion has to be considered in light of the managerial problems that have plagued the industry. Pointing to the low construction costs achieved in other countries and by those U.S. utilities whose construction programs have proceeded smoothly, they argue that nuclear power can be an economic source of electric power.

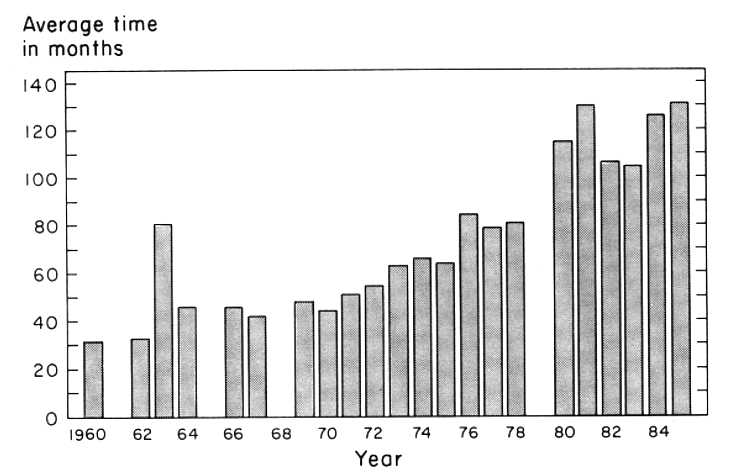

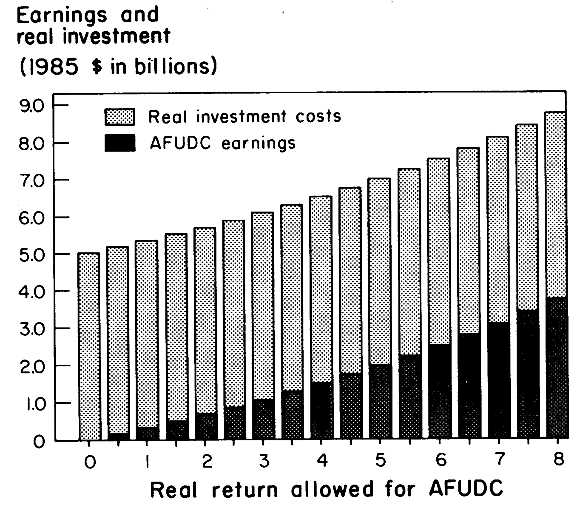

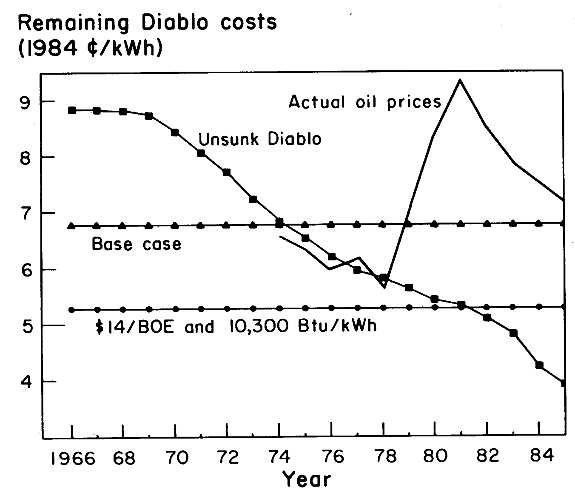

Chapter 7 is a case study of the Diablo Canyon nuclear power plant, built by the Pacific Gas and Electric Company. The Diablo Canyon plant embodies much of the frustration that has accompanied the U.S. commercial nuclear program. The plant took more than 15 years to complete. Originally forecast to cost about $450 million, the book cost of the completed plant was $5.7 billion. In 1985 dollars, and including allowances for the opportunity cost of capital, the plant cost almost seven billion dollars.

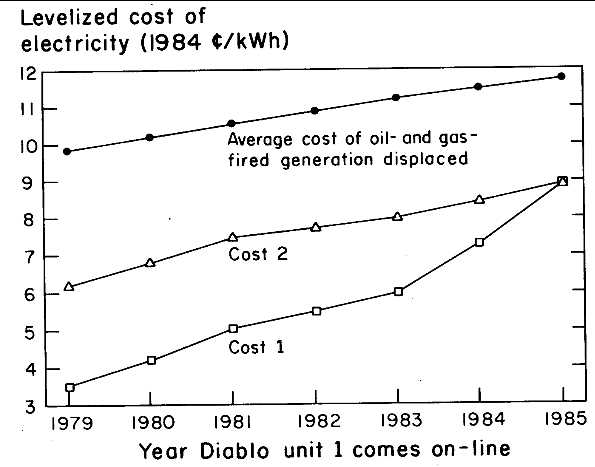

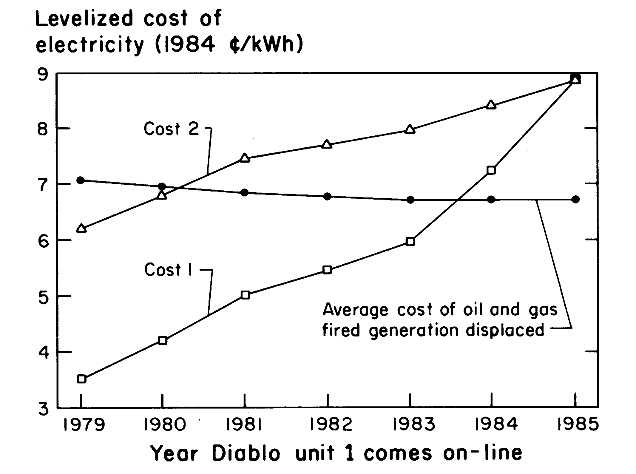

Although Diablo Canyon may never produce benefits that cover its costs, Cox and I claim that, on the basis of information known at the

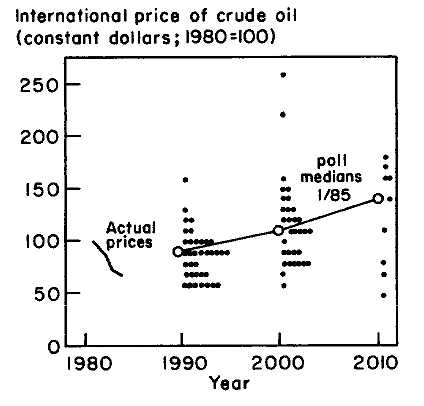

time, proceeding with Diablo Canyon in the decade of the 1980s was economically justified even if the large cost overruns could have been correctly anticipated. In the late 1970s and early 1980s, most forecasters projected that the value of oil and gas that would be displaced by the plant would exceed the plant's cost, even including eventual overruns. Actual and forecast oil and gas prices fell in the last years of the Diablo Canyon project, but by that time sufficient capital had been sunk into the plant that it made economic sense to continue with the construction program. Thus, based on commonly accepted forecasts and the history of expenditures, the Diablo Canyon nuclear power plant (and many other utility projects in the U.S. that shared a similar history) was an appropriate investment decision. Of course this analysis does not consider whether Doable Canyon's cost overruns were avoidable, or whether other investment strategies could have replaced Doable Canyon at lower cost or lower risk.

Part III of our monograph takes a look at the results of programs designed to subsidize particular energy projects. In Parts I and II, the discussion focused on the process of utility regulation, the principles of rate design, and on the economic evaluation of energy sources. The topics in this section differ in that they deal with the effects of market intervention that is targeted to the promotion of a particular course of action.

Our objective in this section is to review the results of selected "target" subsidy programs with attention to the magnitude of the results and their economic costs. We do this for the case of residential energy conservation programs and wind power. In Chapter 8 Quigley takes a hard look at the record of programs to encourage residential energy conservation in California. Quigley finds a very wide variation in the economic effectiveness of different conservation programs. At the top of the list is a utility-provided service to turn pilot lights on and off, which cost less than a dollar for each barrel of oil (or natural gas measured on an oil-equivalent energy basis) saved by the program. But other programs were not nearly so cost-effective. Solar financing programs absorbed about $50 for every barrel saved, and many other residential energy conservation programs were in the $20-$40 range.

Quigley's results show that the potential exists for cost-effective subsidies in the area of energy conservation, but it is crucial to monitor the results of these programs carefully and winnow out those that absorb more in subsidies than they deliver in energy savings. Moreover, Quigley shows that in many cases the burdens of these programs fall disproportionally on the poor. Federal and state energy conservation tax credits were claimed predominantly by people in higher income brackets, often for the solar heating of pools and hot tubs before these applications were

curtailed. The costs of these programs were borne by all taxpayers, while the benefits (as measured by both tax credits and energy investments) were enjoyed by those with higher incomes. Energy conservation programs can work, and sometimes with spectacular success, but they are not a free lunch.

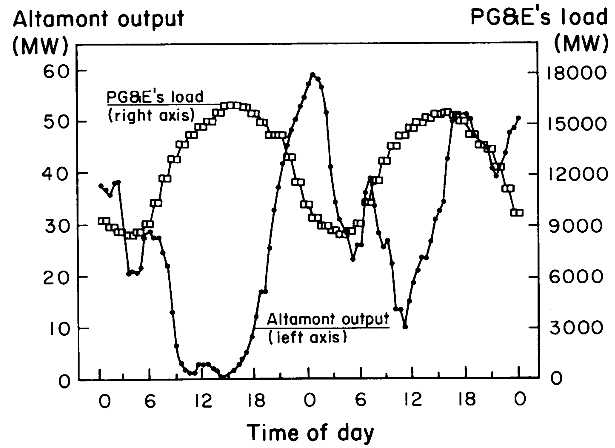

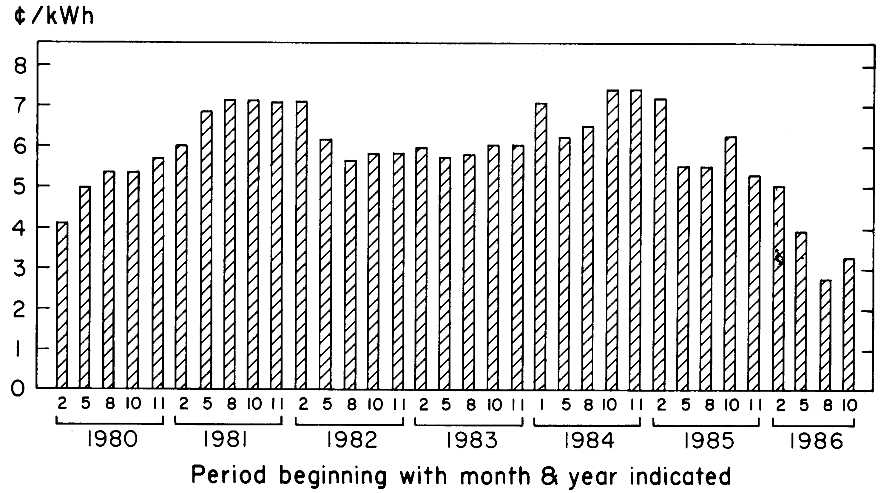

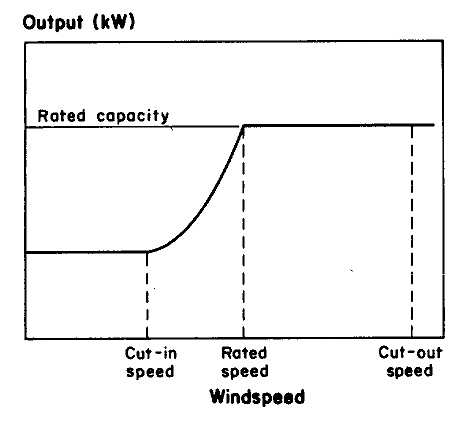

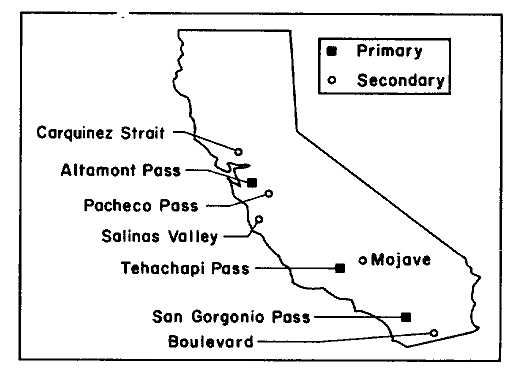

Compared to residential energy conservation, it takes a Don Quixote to find inspiration from the economic performance of subsidies for wind power. The development of wind power in California was stimulated by the availability of federal and state tax credits and legislation promoting favorable rates for the purchase of non-utility power. The results were dramatic. Over a space of five years, more than a billion dollars was spent on wind power in California and installed capacity grew to more than 1,200 MW. The vehicle for nearly all of this growth was the limited partnership, which enabled individual investors to reap the benefits of the tax provisions.

The subsidies for wind power succeeded in establishing a source of supply, but at a high cost. Windmills currently operate in the state on a commercial basis. These are small to moderate-sized machines with short construction lead times and relatively unsophisticated design. The federally sponsored research and development program for wind power concentrated on very large machines. Although these may prove economic in the future, in contrast to the private partnerships, the federal program has yet to demonstrate a commercially useful machine.

Although the California machines are in commercial use, their profitability depends on the existence of tax subsidies and long-term electricity price guarantees. In Chapter 9 Blumstein, Cox and I show that the California wind power program produced a net loss of about $2 billion, shared by California ratepayers and California and federal taxpayers (as well as by some investors who failed to break even, despite large tax write-offs). The subsidies succeeded in promoting development of a commercial industry, and substantial improvements in costs and reliability have been achieved since the subsidies were first offered. But despite this progress, we conclude that the benefits were not worth the costs. At current energy prices the windmill industry is not commercially viable in the absence of continued state and federal subsidies. Although it is useful to know that a windmill industry can exist and supply electricity to the grid, this information could have been obtained at much lower cost. Earlier termination of tax subsidies could have succeeded in accumulating adequate information about the capabilities of wind power with considerably less investment.

What conclusions wind their way through this book? One clear message is that even regulated industries are not immune from the forces of competition. Regulators are not free to design rate structures and

incentive programs without regard for the economic conditions of the market. Technological, political and economic changes in the industry have made energy industries more responsive to competition. Scale economies have diminished somewhat, making competition easier. The Public Utility Regulatory Policies Act of 1978 mandates utilities to contract with independent sources of supply, and is a chink in the regulatory armor.

Another conclusion is that regulators have always had a hard time outguessing the market and will continue to do so. Innovative regulatory programs have been a mixed bag. The record of energy subsidies targeted at specific industries, such as the renewable energy tax credits, has been dismal. The wind energy program in California was an elaborate structure that pumped dollars from ratepayers and federal and state treasuries into the pockets of general partners and underwriters, in the process creating a new energy industry with only marginal viability in the absence of continued subsidies. In contrast, some conservation programs have produced significant economic benefits. The most successful programs appear to be those that deal with a lack of consumer information, such as appliance efficiency labeling. Programs designed to subsidize new technologies have fared much worse.

Our consensus view is that regulatory policy should try harder to imitate the function of the marketplace. Current price structures in electric power and natural gas bear too little resemblance to marginal-cost pricing, or even to approximations of marginal-cost pricing that satisfy the constraint of meeting revenue requirements. Innovative rate design, such as nonlinear and interruptible prices, can go a long way toward improving the way in which energy is used and can mitigate the cost of inefficient "bypass" of regulated services.

We have largely ignored the question of whether regulation should be abandoned. Although this is an intriguing prospect, we believe that this question is not critical to our energy future, because regulation must in any case respond to the forces of competition that are developing in this industry. Independent power production and bypass of traditionally regulated utility services will exist in the electric power industry whether or not electric power generation is deregulated. Competition for natural gas supplies and for alternative fuels will exist independent of regulation, although measures such as contract carriage can greatly increase the scope for competition.

Another area that this book ignores is the interaction between environmental and energy policies. Although Mead and Denning estimate some of the costs of environmental damage from coal and nuclear supply systems, this is a limited effort. Moreover, societal objectives such as the use of best available emission control technologies mean that the im-

plementation of pollution abatement measures need not have a direct relation to the costs that energy technologies impose on the environment. With respect to environmental impacts, an analytical approach that attempts to define appropriate pollution control measures based on the cost of environmental damage from energy technologies need not result in recommendations that are agreeable to the voting public. Yet public sentiment about environmental consequences can have major impacts on the evolution of energy supply and demand. For example, even with a full accounting of the economic costs of environmental hazards, it is unlikely that in the near term solar and wind power could be justified as economic sources of supply relative to fossil fuels with pollution abatement technology. Yet this need not interfere with a public determination to promote solar and wind power as alternative sources of supply.

Regulators have become more responsive to changes in energy markets, but their performance shows little cause to conclude that regulation is "better" today than it has been in the past. Economists' skepticism of the workings of regulated markets remains valid. Political pressures offer too many opportunities to interfere with economic efficiency. There is as yet little evidence that regulators act as if they are fully aware of the limits of their information about the markets they attempt to control. As competition increases in the energy industries, as we expect it will, we wonder whether regulators will adapt to competitive forces or attempt to further isolate the industry from change. The challenge to regulation is how to cope with these emerging forces while attempting to fulfill its traditional economic role of protecting consumers from abuses of market power.

TWO

Energy Utility Pricing and Customer Response The Recent Record in California

Lee S. Friedman

I. INTRODUCTION

This chapter surveys a variety of ideas and policy reforms concerning consumer demand for utility-provided energy. The focus is primarily on pricing policies and how they affect demand. Evaluative discussion relies on traditional economic criteria. However, in the discussion special analytic emphasis is placed on the importance of understanding actual consumer responses to complex decision problems and political and organizational constraints faced by policy makers. Data and examples are drawn largely from electric utilities in California, with emphasis on the regulatory role of the California Public Utilities Commission (CPUC).

The chapter is organized as follows. First, I briefly review some general aspects of consumer demand for energy, the institutional setting for its regulation, and the economic criteria used to evaluate pricing policies. Then I describe the process of rate setting in California and the actors involved. The description emphasizes the limited attention given to economic reasoning in the regulatory process. I conclude that the nature of this process leaves considerable room for the acceptance of economic analysis, provided that its implementation is not too complex.

I then examine recent policies for rate structure in California and proposals for their reform. These policies include the method of reve-

I would like to acknowledge the valuable research assistance of Brian Wood, who gathered primary research material, conducted interviews with key officials, and provided much fruitful conversation on the issues discussed herein. I would also like to acknowledge valuable comments from Barbara Barkovich, Carl Blumstein, Karl Hausker, David Gam-son, Richard Gilbert, Walter Mead, John Quigley, Michael Rothkopf, and Michael Russo. The opinions expressed in this chapter are my own, and the responsibility for any errors or misjudgments is fully mine.

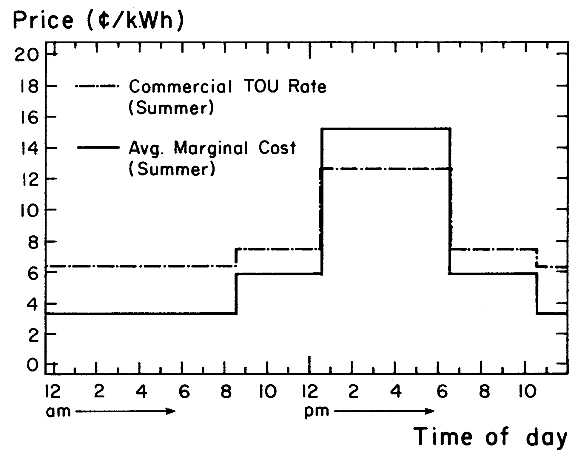

nue allocation and the use of charges for maximum instantaneous demand within a month, time-of-use (TOU) prices, and prices that vary with service reliability. In each case, the complexity of the customer's decision problem is considered as a factor in evaluating proposed reforms. A final section provides a summary and conclusions.

II. PRICING UTILITY-SUPPLIED ENERGY: THE INSTITUTIONAL SETTING AND ECONOMIC CRITERIA

There is a great public interest in understanding and regulating consumer demands for energy resources. In this age of heightened environmental sensitivity, it is easy to see the reason for this interest. The demands of consumers for electricity and natural gas influence the rate at which we use up exhaustible resources, such as oil (to fuel power plants) and wilderness areas with rivers (to build new sources of hydroelectric power). They influence our perceived needs for using controversial technologies, such as nuclear generating plants. Energy demands are important because of their primary functions: their uses for basic heating and cooling influence our health and our comfort at home and at work, and their uses within firms influence the cost and composition of goods and services produced in the economy and thus our overall economic well-being. If the public interest is to be served, it is important that our energy policies be as rational as possible.

To understand the policy issues that arise in energy pricing, one must have a sense of the institutional settings in which policies are formulated, debated, and implemented. Energy utilities in the United States virtually always operate under one of two types of institutional arrangement: (1) a privately owned company the retail rates of which are regulated by a public utilities commission (PUC) or (2) a publicly owned and operated enterprise. In either case, the public sector has direct and continual responsibilities for the setting of utility prices. The analysis of rate design issues I shall be discussing applies generally to both institutional arrangements, because the public sector powers and responsibilities are similar.[1]

The primary reason for the particular institutional arrangements that characterize energy provision is that the technical features of the energy distribution system make it a natural monopoly. It is not sensible to have more than one set of electric wires or natural gas pipes distributing

[1] The behavior of energy utilities may vary systematically by institutional structure. The publicly owned utilities, for example, often set relatively low prices because they are financed, in part, through tax-exempt municipal bonds, which keep their capital costs low.

energy to particular physical locations.[2] However, if there is only one private profit-seeking supplier to serve customers in the area, with neither competition from alternative suppliers nor regulation by the public sector, what forces would act to prevent monopolistic price gouging and service of poor quality or inadequate quantity? Thus energy utilities have historically been regulated or operated by the public sector, as have providers of local telephone service and water.

Traditionally, public sector officials have emphasized the need for equitable prices. Various conceptions of equity may underlie different aspects of ratemaking. For example, virtually every state PUC limits the total revenues collected by a utility to consist of operating costs plus a normal profit (a "fair" rate of return on capital). In recent years a small number of states have adopted explicit policies to ensure that some minimal level of energy is available at a subsidized rate to some or all residential customers. State PUCs also have responsibility for the efficiency with which scarce energy resources are used, and in recent years attention to this aspect of energy regulation has been growing.

When economists have analyzed local power provision, they have always used one key principle in their pricing recommendations: prices should be based on marginal opportunity costs. The opportunity cost refers to the value of the resources used to provide a service in their best alternative uses. If a price is set equal to the marginal opportunity cost of supplying a service, then, in effect, every potential consumer is encouraged to consider whether the benefits of additional consumption are greater or less than the costs in terms of foregone benefits from the best alternative use. If all customers perceive this and respond in a fully knowledgeable way, they will only consume those quantities for which the benefits outweigh the costs. This will result in the allocation of resources to their most highly valued uses; such an allocation is called efficient .

In fact, it is much simpler to advocate the use of theoretical principles than it is to achieve their implementation. Important real-world complexities, which theory often assumes away, must be faced. Thus perhaps it is not surprising that in the United States today only a handful of state PUCs (such as those in California, Oregon, New York, and Wisconsin) have embraced marginal-cost-based pricing principles. We shall use California as a case study of the progress made and problems encountered.

The CPUC first made explicit reference to marginal costs in rate design in 1979 (Parry, 1984). In its decisions it has indicated a rationale for using marginal costs virtually identical to the social objectives stated above: "The result of basing rates on marginal costs is that . . . each consumer pays the resource cost . . . Conservation is achieved since con-

[2] For some customers, self-generation of energy may provide a viable substitute. But these are exceptions.

sumption is made only when the benefits of consumption are greater than or equal to the cost . . . Efficiency is achieved since the least-cost combination of resources neither overuses the good nor underuses the good . . . Finally equity is achieved since no customer underpays relative to the resource cost" (California Public Utilities Commission, 1980, p. 10).

These laudable goals have been subservient to the objective of total cost recovery in utility ratemaking. The CPUC did not intend to set consumer prices equal to the marginal cost of providing utility service to the customer. Rather, the CPUC designed a formula using marginal-cost estimates to allocate the total cost of utility services to different customers such that each customer pays a rate that is a multiple of the marginal cost of serving that customer, with the same multiple for every customer. This is known as "equal-percentage of marginal cost" (EPMC) ratemaking. When the average cost of service differs from the customer's marginal cost, EPMC rates also differ from the marginal cost of service.

Notwithstanding the fact that EPMC ratemaking is only a partial move toward the principle of setting rates equal to marginal cost, progress in this direction has been impeded by other considerations. In general rate cases involving the Pacific Gas and Electric Company (PG&E) (1984) and the Southern California Edison Company (SCE) (1985), the CPUC chose to weight the revenue allocation among customer classes (residential, commercial, industrial) by only 5% based on marginal-cost considerations (EPMC) and 95% based on historical allocations.[3] In other areas as well, the CPUC approves rates that depart significantly from those based on marginal costs. What is preventing, or retarding, more extensive use of marginal-cost principles? I shall consider and illustrate this shortly by examining several of the rate design questions at issue in a CPUC general rate case.

Most theoretical studies assume only a few prices to be set. But in actual practice utilities sell a large number of services and must set a price for each. For example, SCE has 49 different rate schedules for electricity sales (varying by the type of customer and service provided), each with between three and eight price components. Thus the CPUC must set hundreds of prices for just this one utility. Other utilities sell both electricity and natural gas and have even more rate schedules. The entire set of utility prices is referred to as the rate structure. Each component of the rate structure must be determined so that the revenues raised overall lead to the allowed profits. This complexity complicates considerably the

[3] On the other hand, the CPUC relied completely on the EPMC methodology for its revenue allocation in the most recent general rate case for the San Diego Gas and Electric Company (1983).

price-setting process. To consider the use of marginal-cost principles to determine the rate structure, it is useful to review its components.

Energy prices are set separately for the major classes of energy customers: residential, commercial, and industrial. Within any class of customers, price may vary by season and by time of day (e.g., peak load pricing), by the quantity purchased (e.g., connection charges, baseline or lifeline tier quantities), by the instantaneous speed or flow of delivery of the quantity (demand or maximum kilowatt charges), and by the quality in terms of reliability of the service purchased (interruptible contracts or direct load management services). Thus many rate schedules apply within a customer class, depending on the specific type of service a particular customer receives. A question of equity that typically arises in regulatory proceedings and constrains the prices in specific schedules concerns the proportion of total revenue that is raised from each major customer group; this is referred to as the class allocation issue.

Marginal-cost principles can be used to guide pricing of each component of the rate structure. The key question is whether each customer perceives the appropriate price for marginal changes in his consumption. Because the actual marginal cost varies substantially, depending on such factors as the time the service is demanded or the reliability of the service promised, the presumption is that the rate schedule should reflect these variations. Several of the ideas discussed in the literature, such as peak load pricing (also called time-of-day [TOD] and time-of-use [TOU] pricing) and interruptible contracts, have been tried as experiments or are used to a limited extent. However, many of these ideas have not received the widespread acceptance originally hoped for by their proponents. I shall consider the obstacles to their fuller implementation.

The next section reviews the actors involved in California rate setting and the process used to determine rates. Such review helps identify Political forces and organizational capabilities that constrain the use of marginal-cost pricing principles to achieve equity and efficiency objectives.

III. THE PRACTICE OF ENERGY UTILITY POLICY MAKING IN CALIFORNIA

In most respects, the institutional structure for regulating power utilities in California is similar to that used in other states. The CPUC is responsible for regulating the rates charged by private utility companies to their customers. Unlike most other states, California has a separate body, the California Energy Commission (CEC), which has regulatory

authority over utility requests to add new power sources. Because this chapter focuses on the rate-setting process, I will concentrate on the CPUC.

Every three years, each private utility initiates a general rate case.[4] The utility requests authorization from the CPUC to charge particular rates, and the requests are analyzed and considered in a quasi-judicial process that takes about 14 months. Between general rate cases, rate adjustments are allowed through frequent "offset" rate proceedings. Offset proceedings are intended to adjust rates and revenues in response to changes in a utility's costs that are beyond management control. These costs are principally for fuel, and changes are largely based on the application of preexisting fuel adjustment clauses. Offset cases do not generally result in major policy changes.

The main issues of rate design are considered in the general rate cases. These cases have three stages: analysis, hearings, and decision making.[5] CPUC staff analysis begins when the utility files a Notice of Intent to apply for rate changes, along with draft versions of its supporting testimony. Individual staff members from the CPUC Rate Design Branch are appointed to analyze the utility's rate structure proposal, and the commission selects one of its five members to oversee the case and appoints an administrative law judge to conduct the hearings.

About two months after the Notice of Intent is filed, the utility formally files its rate change application and submits final versions of its supporting arguments. The CPUC staff then has about three months to analyze the request and prepare its response and rate change proposals. Then the hearings begin. Testimony is given, with all parties (utilities, CPUC staff, and interest groups) represented by lawyers who can cross-examine witnesses. The hearings themselves usually last four or five months, and the presiding administrative law judge issues a draft decision about two months after the hearings are concluded.

The final stage of decision making begins with the issuance of the draft decision. The draft is circulated to the commissioners and senior staff, and within the next month oral arguments are formally presented to them by the parties to the case. Then the informal process of building consensus among the commissioners for an amended decision occurs, and the final decision is usually issued about two months after the start of this stage.

Substantively, each case proceeds in the same way. First, the utility's revenue requirement and marginal costs are determined. Second, the

[4] Until recently, the general rate cases were held every two years.

[5] Much of the following information is drawn from Hausker 0985).

commission comes to a broad decision about how to allocate that revenue among customer classes. Finally, actual rates within classes are set to raise the allotted revenue. However, a closer look at the process reveals important constraints not seen by considerations of substance alone. The logic in decision making is strongly influenced by the CPUC organizational routines, as well as the backgrounds of the individuals from the CPUC involved in the case.

About 20 staff members comprise the Rate Design Branch, with about two-thirds working on electricity issues and the rest working on natural gas. By training, roughly half have engineering backgrounds with a few economists, statisticians, business administrators and others comprising the balance. In making recommendations, the staff usually follows precedent from past cases. There are several important reasons for this. It eases the staffs heavy work load. Because the administrative law judges and the commissioners strongly attend to precedent in their reviews, following precedent is most likely to be acceptable to them. Acceptability is itself important in CPUC evaluation of the work of the Rate Design Branch. In addition, following precedent will result in fewer requests for additional work in the later stages of a rate case.

Another reason for often following precedent is that the staff typically lack the information necessary to apply innovative designs, such as those based on recent theoretical work in economics utilizing marginal-cost principles. Most of the Rate Design staff are unfamiliar with theoretical concepts such as optimal nonlinear pricing.[6] The few economists on the staff have never attempted to apply any of the more sophisticated concepts from welfare economics to a specific electric rate design.

Furthermore, even if the staff were more inclined to apply such ideas, it does not generally have the necessary empirical information. For example, these ideas usually require knowledge of price responsiveness of the specific consumers affected by the design. But the Rate Design Branch only has a fixed sales estimate as input with which to work. The latter implies the false assumption of zero price responsiveness, but it has the great virtue Of simplicity and easy availability. These reasons explain why the Rate Design Branch usually follows precedent, although there are exceptions.[7]

The next organizational layer, the administrative law judges, adhere even more strongly to precedent. Most of the administrative law judges are lawyers, although some are engineers. Lawyers are, of course, highly

[6] This concept is discussed later in the chapter. Note that more expertise with concepts of welfare economics could be obtained by having more economists on the staff. However, one should keep in mind that economists generally have little or none of the engineering skills useful in rate design, and the optimal staff composition is not obvious.

[7] For more detailed discussions of the exceptions, see Hausker (1985, Chapter 7).

trained to attend to precedent. Furthermore, because these individuals are generalists who must deal with all aspects of rate cases, they are less familiar with the details of analytic methodologies applied to specific issues in a case. They are more comfortable checking arguments for consistency with prior decisions than making decisions on methodological grounds, such as those involving sophisticated economic reasoning.

In the final decision-making phase of the case, the role of the commissioners themselves takes on a great importance. The commissioners are not elected officials but are appointed by the governor for six-year terms. They rarely come to the job with experience in public utility regulation or knowledge of economics, and they are almost never reappointed. They generally see their role as one of avoiding "unfair" rate design. They check the rate design by eyeballing tables of numbers reflecting class allocations and residential rates. The underlying rationales for these numbers are not too important to them; significant departures from the outcomes of the current rate structure are. They demand repeated iterations of the numbers to see the effect of certain changes.

Because the commission often makes none of the major substantive decisions in the case until the final weeks, myriad frantic recalculations are typically necessary as the commission tries to reconcile modifications to one part with their implications elsewhere. For example, commissioners often do not decide the total revenue requirement until the last minute, which requires a revised class allocation decision and then recalculation of all specific components of the rate design. Thus the latter must be easily and quickly alterable to meet the overall requirement.

Naturally the utility being regulated fights hard for its positions throughout this process. However, the offset policies mentioned earlier have the effect of reducing the utility's stake in rate design. In particular, the energy rate adjustment mechanism (ERAM) insulates the utility on the revenue side, and the energy cost adjustment clause (ECAC) insulates it against changes in fuel costs. Both mechanisms provide for adjustments in the per-kilowatthour rates to ensure the collection of the forecasted (and CPUC approved) total revenues as well as to adjust for any differences between forecasted and actual fuel costs.

Except for administrative and other nonfuel operating costs, these clauses guarantee the dollar return to the utility specified in the general rate case. Thus unanticipated revenue and fuel cost effects of specific changes in the rate design (e.g., increased use of TOU rates) are eliminated by the adjustments. Although these clauses mitigate utility concern over rate design changes, they do not eliminate that concern. The utilities still prefer not to change the design if they think the change will confuse customers and create complaints. However, the clauses minimize utility opposition to rate design changes and thus enhance

the ability of the CPUC to experiment with marginal-cost-based pricing principles.[8]

To sum up this discussion, the process of deciding a general rate case reveals important constraints not seen by considerations of the substance alone. The economist interested in the increased use of marginal-cost-based principles must keep several ideas in mind. To increase chances for adoption, four characteristics are desirable for any new method of rate design. One is that it should be simple to calculate and should require only information that is already available or easily obtainable. Two is that it should be simple to explain to noneconomists, particularly the extent to which it utilizes principles acknowledged in prior decisions (and thus can be seen to have precedent). Three is that its distributional effects on consumers (particularly across recognized classes of consumers) should be minimal. Four, it should be easily understood by consumers. This last point is given more extended discussion in the following section.

IV. CONSUMER DEMAND FOR UTILITY-SUPPLIED ENERGY

Customer demands for utility-supplied energy are called derived demands: customers (whether residential, commercial, or industrial) are generally interested not in the energy per se, but in the services that use energy (e.g., lighting, heating, cooling). That is, the customers' demands for energy are derived from their demands for energy-using services. Many factors influence the derived demands for energy. It is useful to divide these factors into two broad categories: exogenous factors, which individual customers do not control, primarily technology and prices, and customer decision making in light of the exogenous factors.

The exogenous factors determine the options customers face for obtaining the (energy-using) services they seek. For example, the energy demanded by customers for the purpose of cooling a building depends on how much energy is used by the various air conditioners available on the market, as well as the availability and attributes of such alternatives

[8] Whether or not these clauses are desirable for reasons other than easing the transition to a marginal-cost-based rate design is questionable. Essentially, they shift the risk from factors beyond the utility's control (such as weather, general economic conditions, and unanticipated consumer responses to CPUC-mandated rate designs) away from the utility and onto its customers. This shift lowers the interest rate the utility must pay to borrow funds (and reduces the risk to its stockholders), but it makes all customers feel worse off because they bear increased risk. Although this issue is a difficult one to resolve empirically, efficiency requires that risk be borne by the agent who has the least cost of bearing it. If the extra risk cost to consumers from each of these clauses exceeds the savings to the utility from its reduced capital costs, then they should be eliminated eventually.

as thermal coating of windows or other insulating measures. The climate is another important exogenous factor. For buildings that already exist, the climate is determined by location. If constructing a new building, however, a customer may choose from among a variety of climates by deciding on a location.

Customer choice from among the available options depends on knowledge, preferences, and budget constraints.[9] Knowledge refers to the customer's understanding of the various attributes of each alternative. For example, does the customer know how much energy a particular air conditioner will consume when operated, and does the customer know how much this energy will cost over the life of the air conditioner? Does the customer know how to translate future costs into present-value terms? Does the customer know about alternatives, such as thermal coated windows? Does the customer know how energy costs are affected by building or plant location in a hot region or a moderate one, even within a metropolitan area near a windy shore or a sheltered site inland? When making choices, some customers may have much more information than others faced with comparable choices and may use it more effectively.

In light of the customer's actual knowledge, choice still depends on the customer's preferences and budget constraints. To continue with the cooling example, the customer may have limited space for an air conditioner and therefore may seek a relatively compact one. Or a customer may seek an air conditioner that is unusually quiet. The residential customer may know about thermal window coatings but may not like their aesthetic effects. The industrial customer may know how much greater energy costs are in a southern location, but the quality of the available work force may be more important. Finally, the customer must reconcile preferences with economic means. Not everyone can afford a deluxe model air conditioner, and the purchase choice will reflect the customer's budget constraint.

These examples suggest the following points. We know from basic economics that energy prices are factors in customer decisions about how much energy to demand. However, in many cases prices may be minor factors compared with other attributes of the energy-using services customers seek. In making their decisions, fully informed consumers may consider extensively the consequences of energy prices.

[9] The customers of utility companies consist of households and firms. In economic theory, preferences and budget constraints are attributes of consumers seeking to maximize utility. Although households are typically treated as this type of economic agent, firms are generally modeled as seeking to maximize profit. For simplicity, the above discussion does not make this distinction and describes all customers with the language for consumer choice. The behavioral points made are valid for firms as well as households.

Neverthless, in these cases, other factors may matter much more. In addition, many other customers may-perceive only dimly at best the consequences of energy prices for their decisions. In these latter cases, the effects of energy prices may be more difficult to analyze.

Public policy can affect the demand for utility-supplied energy through the use of diverse instruments. Prices can be lowered or raised to encourage or discourage the purchase of particular goods or services. Regulatory restrictions can be used to limit the range of options available to the consumer. Educational efforts can be undertaken to alter consumer choices from the available options. These actions can affect customer decisions directly, as well as indirectly, by causing changes in the available technologies for energy-using services.

Much of the rationale for policies involving regulatory restrictions and educational efforts depends on the assumed existence of important imperfections in the consumer decision-making process. To the extent that these imperfections are present, they may also affect pricing recommendations. Let us consider as an example technological regulations. These are restrictions that limit the choice of options available to consumers. Energy efficiency standards for refrigerators or required conservation measures in new homes and buildings affect demand by restricting the available options for energy-using appliances and structures. That is, these regulations are choice restrictions because they ban the sale of products (refrigerators and new homes) that do not meet the standards.

What is the rationale for such standards? Obviously the regulators must think that without the regulations too many refrigerators of the energy-hogging type are bought and too few conservation measures are installed in buildings. Do the regulators have different objectives than the consumers? According to the reports of the CEC, this is not the reason for such regulations in California. Rather, the CEC relies on the idea that many consumers will not be aware of the energy-cost implications of purchasing unregulated appliances or buildings and thus not act in their own best interests.[10] If consumers only lack information, why not solve the problem through educational efforts rather than regulations? To this idea the commission responds by citing the difficulty and great expense of educating consumers and states "there are cases where it costs less to install measures for free than to provide information to consumers" (California Energy Commission 1983, p. 126).

[10] The commission also argues that imperfections in capital markets will leave some consumers unable to finance conservation measures that save them money in the long run through lower utility bills. However, regulations banning the alternatives with lower initial costs do nothing to make the remaining unbanned alternatives with higher initial costs more affordable. Thus imperfect capital markets are not a rationale for the types of regulation we are discussing. See California Energy Commission (1983), pp. 124-126.

Based on the studies available, the CEC appears to be on solid ground in its claim that energy consumers often do not act in their own best interests. According to evidence summarized by Stern, "people tend to overestimate the amounts of energy used by . . . technologies that must be activated each time they are used. Thus people overestimate energy use by televisions and lights and underestimate energy use by furnaces and water heaters . . . to save energy they will do more light dousing and less furnace retrofitting than is in their economic self-interest" (Stern, 1986, p. 205).

Furthermore, there is often little or no effect of providing information to consumers in the hope of inducing them to act in their own self-interest. Numerous factors explain this disappointing result. First, the information may be ignored if it is only relevant to a calculation the consumer does not know how to make. In a study of disaster insurance purchases, Kunreuther (1976) found many consumers who had no notion of expected-value calculations and thus no response to information about damage probabilities. With respect to energy consumption, consumers who have no notion of present-value calculations may ignore information about future energy prices.

Second, the form of the information matters a great deal. In one study, consumers receiving a carefully designed package of information cut energy use in response to TOU energy rates by 16% compared with a control group receiving the sponsoring utility company's standard information package (Heberlein and Baumgartner, 1985; cited in Stern, 1986, pp. 205-206). In another study, the best-designed information package increased the average efficiency of a household's choice to 51% from the 43% based on the standard utility-provided package; this example illustrates that even the best information efforts still result in large numbers of consumers making choices substantially worse than their optimal ones (Magat, Payne, and Brucato, 1986).[11]

Finally, the source of the information, particularly its trustworthiness, also matters to consumers. Two groups of energy consumers in New York State were sent conservation brochures that were identical except for the letterhead. The group receiving the brochure with the letterhead of the New York State Public Service Commission cut energy by 7% in the following month, compared with no reduction from the group receiving the brochure with the letterhead of Consolidated Edison. In another study, a county government with no energy expertise was five times as effective as an energy company in enrolling participants in the same home retrofit program offered at no cost to participants. In both cases, the difference was attributed to the differential trust consumers

[11] The study is based on a laboratory experiment in which the most efficient household choices were controlled by design.

had for the respective information sources (Craig and McCann, 1979; Miller and Ford, 1985; both discussed in Stern, 1986, p. 206). These studies also help explain why consumers often rely on the advice of non-expert friends while ignoring the advice of experts.

One of the missing pieces of information to many consumers may be the price of energy.[12] To continue with the example of an air conditioner purchase, a customer should know not only current but future energy prices. That is, it is not enough to know how much electricity the air conditioner will use, but how much will be charged for that electricity, which depends on the price of electricity over the life of the air conditioner.

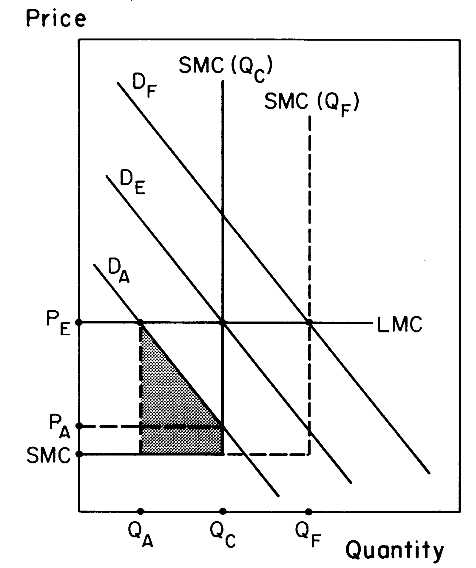

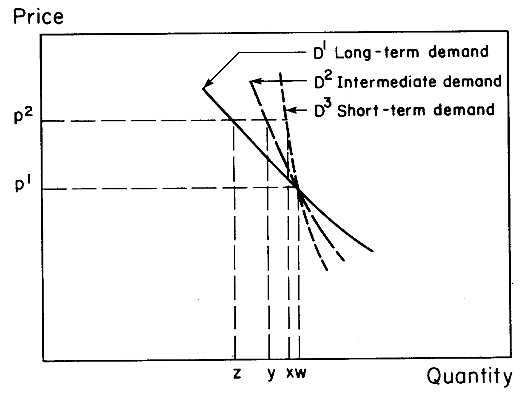

Figure 2.1 illustrates in one simple way why prices may be difficult to perceive. Imagine the following scenario, which is like the position of electric utilities with excess capacity in the late 1970s and early 1980s. Let De be the electricity demand originally expected by planners,[13] and let the long-run marginal cost per unit including capacity be QE These parameters lead planners to provide a capacity of Q C , where the demand and long-run marginal-cost lines intersect. However, actual demand turns out to be DA and if price PE were charged, only QA units would be demanded and there would be much unused capacity in the system. Therefore price is set in the short run at PA , which makes the actual demand fully utilize the available capacity.[14]

In this scenario consumers are currently facing a price of PA per unit of electricity. However, suppose planners expect (more reliably this time) system demand to grow over the next few years to DF . Then, the utility will have to add new capacity (to QF ) and in the future charge price PE .[15] The question is, if you are the consumer deciding on an air conditioner purchase today, what assumptions about future energy prices will you be

[12] For evidence and discussion of this point, see Stern (1986), Quigley (1986), Friedman and Hausker (1984), and Kempton and Montgomery (1982).

[13] By planners, I am referring to the technical staff of utility companies and regulatory agencies with extensive resources for econometric forecasting. Although the accuracy of any forecast is always uncertain, I am assuming that better forecasts can be produced when more resources are put into the forecasting effort. That is why I assume planners make better forecasts of future prices than average consumers.<HR>

It also should be noted that utility companies and regulatory agencies may have reasons to bias their forecasts. My impression from examining demand forecasts made by Califor-nia utility companies and by the CEC is that some biases do exist but that they tend to be offsetting.

[14] This is the price at which the short-run marginal-cost curve SMC(QC ) intersects the actual demand curve. The short-run marginal-cost curve typically consists of two segments: a horizontal segment with height equal to the marginal operating costs for any quantity up to the system capacity, and a vertical segment when system capacity is reached.

[15] Note that PF . is again the price at which the short-run marginal-cost curve intersects the demand curve. The additional capacity causes the short-run marginal-cost curve to shift from SMC(QC ) to SMC(QF ).

making? It is quite plausible that many consumers are myopic and only consider the current price. They will act as if future prices will be close to PA , despite the much higher likelihood that they will be close to PE .

This raises the following interesting policy question. If all consumers have correct perceptions of current and expected future energy prices PA and PE (as well as of other decision factors), then they will make both short-run and long-run energy consumption decisions that are in their own best interests. Suppose, however, that a certain portion of consumers are myopic in the manner suggested above, and suppose further that there is no inexpensive way of correcting their expectations.[16] Is there some way that policymakers can take account of this behavior? For example, might it be better to make the current price equal to PE ? Then there would be no long-run mistakes due to myopia. However, this policy comes with a disadvantage that is likely to be substantial: it would cause too little consumption (QA ) in the short run. (QC is the most efficient short-run consumption level.) Using traditional economic logic, one could ask whether the efficiency losses from the short-run misallocation with high excess capacity (shown as the shaded area in Figure 2.1) would be offset by the gains from better consumer decisions having long-run consequences. If so, then it would be better (on efficiency grounds) to make PE the current price. This scenario illustrates how the existence of imperfections in consumer decision making can affect pricing recommendations.[17]

The above example does not imply that an appropriate response to imperfect consumer decision making is to price at long-run marginal cost. As mentioned, it is not the least bit clear that the long-run gains would outweigh the short-run losses. Even if they did, there are other alternatives that retain pricing at short-run marginal-cost and that are likely to be more efficient. Consider whether the technological regulations with which we began this example combined with the use of the price PA currently might not be a better policy package than simply using PE for both current and future prices. The answer is probably yes. The policy of regulating technology avoids the short-run misallocations caused by making the current price equal to PE . However, it will yield somewhat smaller long-run gains.

[16] That is, an attempt to "inform" consumers by, say, including the future price information in a current mailing does not work for the general reasons discussed earlier: many consumers will not read the information; others will not trust it or will forget it; and still others will ignore it because they do not make decisions by making present-value calculations as explained in economics textbooks.

[17] As an empirical matter, it is probably true that even long-run marginal cost is substantially lower than the current prices faced by California consumers. See Chapters 4 and 6 in this volume.

The regulatory policy will prevent many long-run mistakes that myopic consumers would make, e.g., the purchase of energy-hogging types of regulated appliances and buildings by consumers who underestimate their operating costs. However, not all long-run consumer decisions can be regulated, so some long-run errors would persist. Furthermore, a new type of consumer mistake is caused by the technological regulation. Some nonmyopic consumers might wish to purchase the banned appliances considered inefficient by the regulators, and thus the regulations would cause these consumers to be made worse off. Should this latter group be large, the technological regulations could actually worsen the long-run decisions on balance (compared with no technological regulations, other things equal). Even if this latter group is small, some long-run consumer decisions will be faulty under the regulatory policy. On the other hand, the policy of making current price PE leads to no long-run errors. Nevertheless, the substantial short-run advantage of the technology-regulating approach is likely to outweigh its long-run disadvantage. Thus in the absence of convincing empirical information to the contrary, the standard recommendation to price in accordance with short-run marginal costs will be maintained in this analysis.

The discussion of this section has emphasized the importance of understanding actual consumer decision making in order to link public policies to their energy-consumption and efficiency consequences. The issue of actual consumer behavior and the clarity of price signals will arise again in the discussion of what it means to implement pricing at short-run marginal cost in the form of an actual complex rate structure.

V. REVENUE ALLOCATION

The rate design decisions made in the general rate cases start after the marginal costs have been estimated and the total allowed revenue to the utility decided. One interesting and important aspect of these prior decisions as well as of those to follow is that, as mentioned earlier, to make them the CPUC (like most state commissions) works with a fixed estimate of expected sales. This means that no matter how the rest of the rate structure is decided, it must have the characteristic that the final rates applied to the fixed sales estimate add up to the total allowed revenue. It also means that the final rates applied to the fixed sales estimate for each customer class must sum to the revenue allocation for that customer class. This constraint of a fixed sales estimate seems to ignore basic economics: quantity purchased will depend on the price.

The basic rationale for the constraint is to simplify the decision process. If quantity estimates were allowed to vary with specific rate propos-

als, then all parties to the case would have to have estimates of the price responsiveness of each customer class to each of the rates that it faced (e.g., peak time, midpeak and off-peak price elasticities of SCE's large industrial customers with automatic powershift, and estimates for the same elasticities for those large industrial customers without automatic powershifting, and the price elasticity of the powershift option itself). We have already mentioned that this information, for the most part, does not exist. This would leave the CPUC in the position of having to pick from among the large array of estimates and guesses offered by the different parties to the case, with very little knowledge to form a basis for its decision.

Similarly, the fixed marginal-cost estimates seem to defy economic logic: marginal costs will depend on the quantities of energy bought under a specific rate structure. Yet the economic errors that arise from both of these simplifying assumptions are probably small. Because the demand for energy is highly inelastic in the short run and the marginal-cost curves are likely to be relatively flat over the small range of plausible short-run quantity variations, the simplifying assumptions should not cause large differences between the estimates and actual quantities and marginal costs.[18] Furthermore, if one envisions an iterative adjustment process of the sales forecast from one rate case to the next, earlier forecast errors can be corrected over time.[19]

How should the CPUC proceed in making its revenue allocation decision? If we turn to economic theory for normative guidance, we may be struck at first by the inattention to this decision. Normative economic theory is, for the most part, concerned with the derivation of the most efficient prices given the total revenue constraint. Use of the most efficient prices implies the revenue raised from each customer class; no further decisions are necessary.

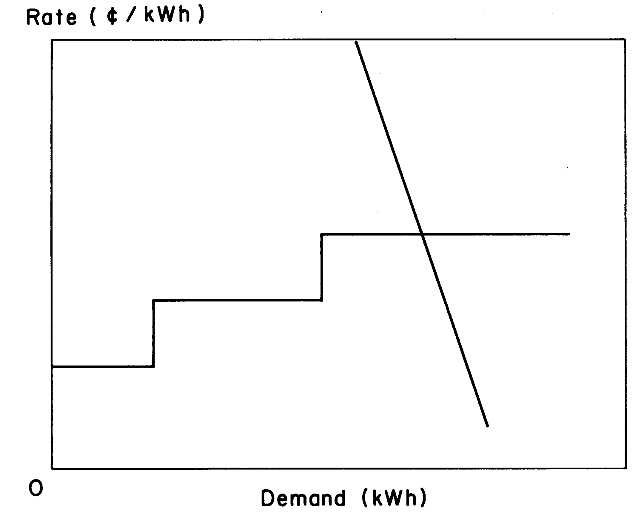

Three different approaches to calculating the most efficient prices are found in the economic literature: optimal nonlinear pricing, optimal uniform pricing, and the two-part tariff. Collectively, these approaches are generally referred to as second-best pricing principles. They are called second-best in recognition that the best pricing principle— pricing each customer class at its marginal cost—is infeasible because it would violate the overall profit constraint.

[18] Although rapid changes in fuel costs can occur and result in substantial marginal-cost changes, they are handled through the offset clauses mentioned earlier. Our interest here is whether any errors in quantity forecasts can themselves be the cause of substantial errors in marginal-cost estimates.

[19] See Manski (1979) and Willig and Bailey (1979) for analysis of adjustment rules to use as a response to limited empirical information.

For example, in the 1985 SCE general rate case, marginal costs were estimated as substantially greater than average costs.[20] The estimated revenue produced by marginal-cost pricing would have been $5.34 billion, whereas the allowed revenue was only $4.80 billion and included allowance for a 16% rate of return on common equity capital. Marginal-cost pricing would have led to an overall rate of return on equity capital of 39%![21]

A brief review of the three different methods in light of the organizational and behavioral constraints I have previously identified will help to identify promising approaches. Historically, the principles for optimal uniform pricing under a profit constraint were developed first, and we begin with consideration of its potential for practical application to rate design.[22] Uniform pricing is this context means that the price per unit to a customer is the same regardless of the quantity of units purchased (i.e., there are no block rates).

Optimal Uniform Pricing

No Utility Applications. To my knowledge, no utility or its regulatory commission has ever attempted explicit use of the principles for optimal uniform pricing. These principles, often referred to as Ramsey pricing and the inverse elasticity rule, require knowledge of the elasticities of demand for each product to be priced. They do not themselves provide guidance on what products should be priced separately (nor do any of the other methods I discuss)[23] If we accept for the most part that utilities will continue to establish separate markets for residential, commercial, industrial, and agricultural customers and will have multiple products within each class (e.g., rates that vary by time of use, connection charges, etc.), then quite detailed knowledge of the elasticities is required for application of the rules for optimal uniform pricing.

I have already mentioned that utilities and their regulatory commissions do not generally have the necessary information about the elasticities specific to their customer markets. Furthermore, there may be legal

[20] Other chapters in this book suggest that California is about to enter an extended era where the marginal costs of electricity production are below average costs.

[21] The total SCE rate base was $5.13 billion apportioned 45% to common stock equity, 10% to preferred stock, and 45% to debt. The net revenue allowed SCE was $652 billion, of which $370 billion was the return to common equity. The extra revenues from marginal-cost pricing would increase this return to $910 billion or 39.4% of common equity. See California Public Utilities Commission (1984), Appendix B, p. 39.

[22] The first statement of these principles is Ramsey (1927).

[23] If the sole objective is economic efficiency, then one segments the market (i.e., sets a separate price) to minimize any deadweight loss caused by the profit constraint. Deadweight loss is a measure of the magnitude of the efficiency decrease. For an exposition of such measures, see Friedman (1984), Chapters 5 and 7. In special cases, the second-best prices may result in no deadweight loss.

constraints on this type of pricing. The U.S. Postal Service explicitly used these principles in the early 1970s, but this use was struck down as discriminatory in the U.S. Court of Appeals for the District of Columbia Circuit (Tye, 1983). Thus the obstacles to the use of this method are considerable.

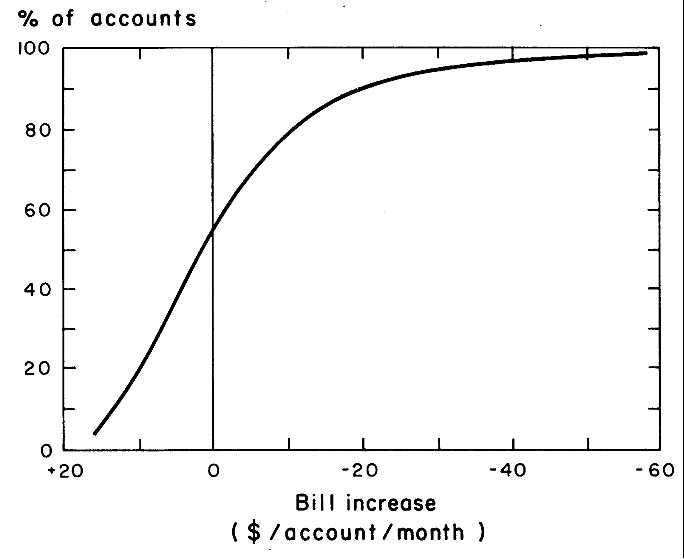

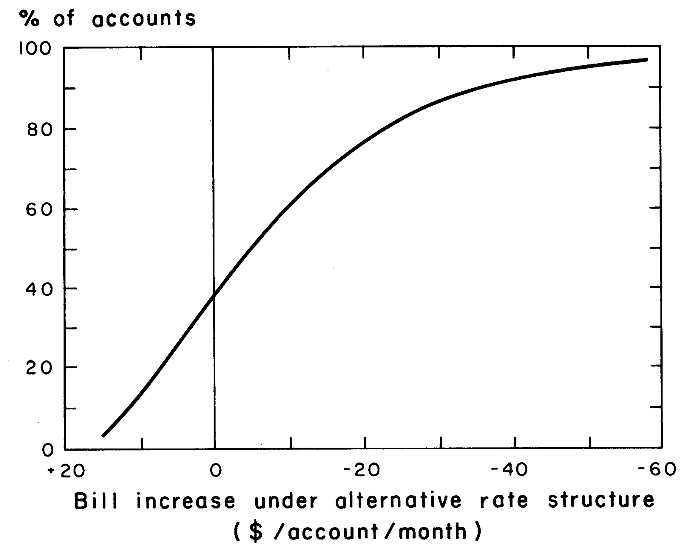

The EPMC Method as an Approximation. Nevertheless, some work has been done in an attempt to devise an easily implementable decision routine that approximates the optimal uniform prices. Hausker (1985), for example, has shown that under certain conditions likely to apply to the allocation problem across customer classes, setting prices for each customer class at an equal percentage of class marginal costs (a rule that is very simple to implement) gives a solution close to the efficiency level of the optimal uniform prices.[24] A particularly interesting aspect of Hausker's work, for our purposes, is that the CPUC actually does calculate the class revenue allocations that would result from using the equal percentage of marginal cost (EPMC) method. In the case of the San Diego Gas & Electric Company, the CPUC adopted this allocation. But when the same calculations were made for PG&E and SCE, the CPUC did not like the results. In the latter two cases, the results would have been to increase substantially the energy bills of residential households. To quote directly from the SCE decision: "As in the case of PG&E, we are concerned that a significant and disproportionate increase in electric bills would result for Edison's residential customers if we were to adopt a full EPMC revenue allocation at this time…. For these reasons, we will adopt a 95% SAPC [system average percentage change, based on historical rates]—5% EPMC revenue allocation method" (California Public Utilities Commission, 1984, pp. 270-271).

CPUC Reluctance to Rely on EPMC. Curiously, the CPUC went on to assert that "this is consistent with our policy . . . of moving towards a full EPMC revenue allocation method" (California Public Utilities Commission, 1984, pp. 270-271). It is clear, however, that the CPUC is substantially more interested in protecting the residential class from rate increases than it is in achieving efficient allocations. There can be multiple

[24] The important condition, stated as a rule of thumb, is that the price elasticity of demand for any particular class be leas than twice the price elasticity for any other customer class. However, establishing the efficiency level of an actual rate structure is more complex than assumed in the calculation. The "price" per customer class used is actually not a price. It is the weighted average of the different lower-level prices that are yet to be set (e.g., peak, midpeak, and off-peak prices faced by industrial customers). Actual efficiency depends on the specific prices used in the rate structure, and is not simply a weighted average of them. This point is illustrated later on in the text.

explanations for this behavior: the political clout of the residential class compared with that of commercial or industrial customers, a genuine feeling on the part of the CPUC that equity requires residential customers to be subsidized at the expense of other customers, or a belief that rate stability is important per se. Let us comment briefly on these different motives.

Residential customers possibly exert more effective pressure on the CPUC than do business customers; however, not at the staff level. In both the PG&E and SCE cases, the CPUC staff recommended class allocations much closer to the EPMC allocations than those the commissioners ordered. Thus the rationale of the commissioners themselves (and their aides) must explain the decision.